- Topic1/3

6k Popularity

160k Popularity

15k Popularity

40k Popularity

100k Popularity

- Pin

- Hey Square fam! How many Alpha points have you racked up lately?

Did you get your airdrop? We’ve also got extra perks for you on Gate Square!

🎁 Show off your Alpha points gains, and you’ll get a shot at a $200U Mystery Box reward!

🥇 1 user with the highest points screenshot → $100U Mystery Box

✨ Top 5 sharers with quality posts → $20U Mystery Box each

📍【How to Join】

1️⃣ Make a post with the hashtag #ShowMyAlphaPoints#

2️⃣ Share a screenshot of your Alpha points, plus a one-liner: “I earned ____ with Gate Alpha. So worth it!”

👉 Bonus: Share your tips for earning points, redemption experienc

- 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

[Exchange] US Dollar/Yen Dependent on Trump Administration - Part 1 | Yoshida Tsune's Forex Daily | Moneyクリ MoneyX Securities Investment Information and Media Useful for Money

The Hedge Fund That Shifted from Selling Yen to Buying Yen

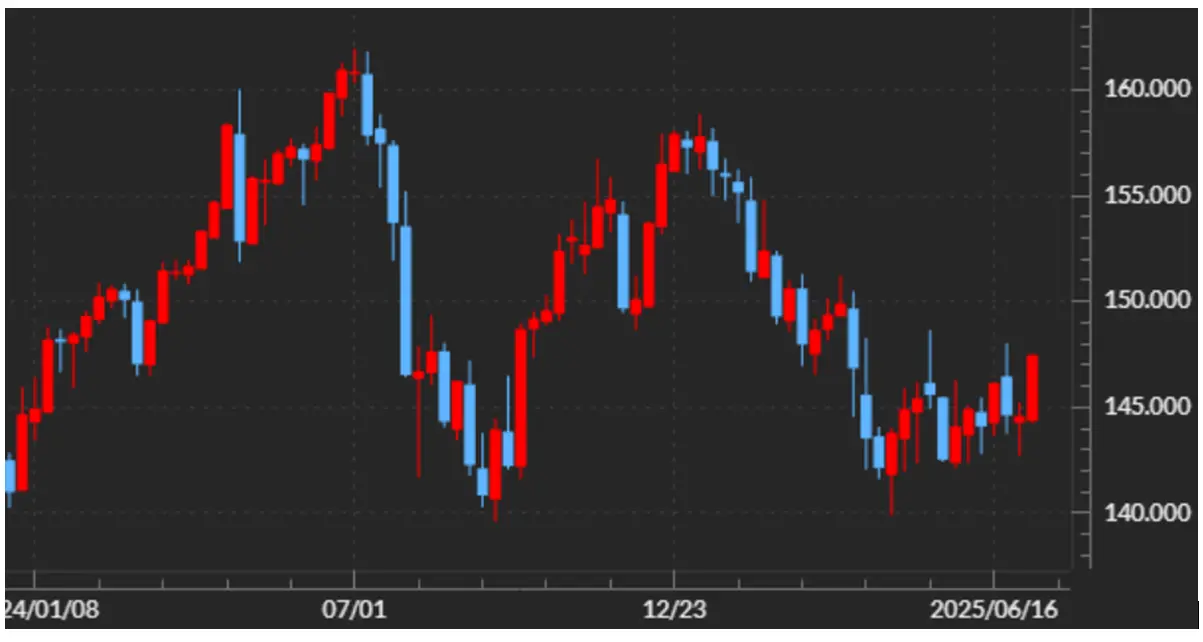

The USD/JPY, which rose to 161 yen in July 2024, had climbed back to 158 yen before the Trump administration started, but then dropped significantly, falling below 140 yen at one point in April (see Chart 1). In this way, the market transitioned from a strong dollar and weak yen to a weak dollar and strong yen, with hedge funds playing an important role.

[Figure 1] Weekly chart of USD/JPY (from January 2024) Source: MoneyX Trader FX

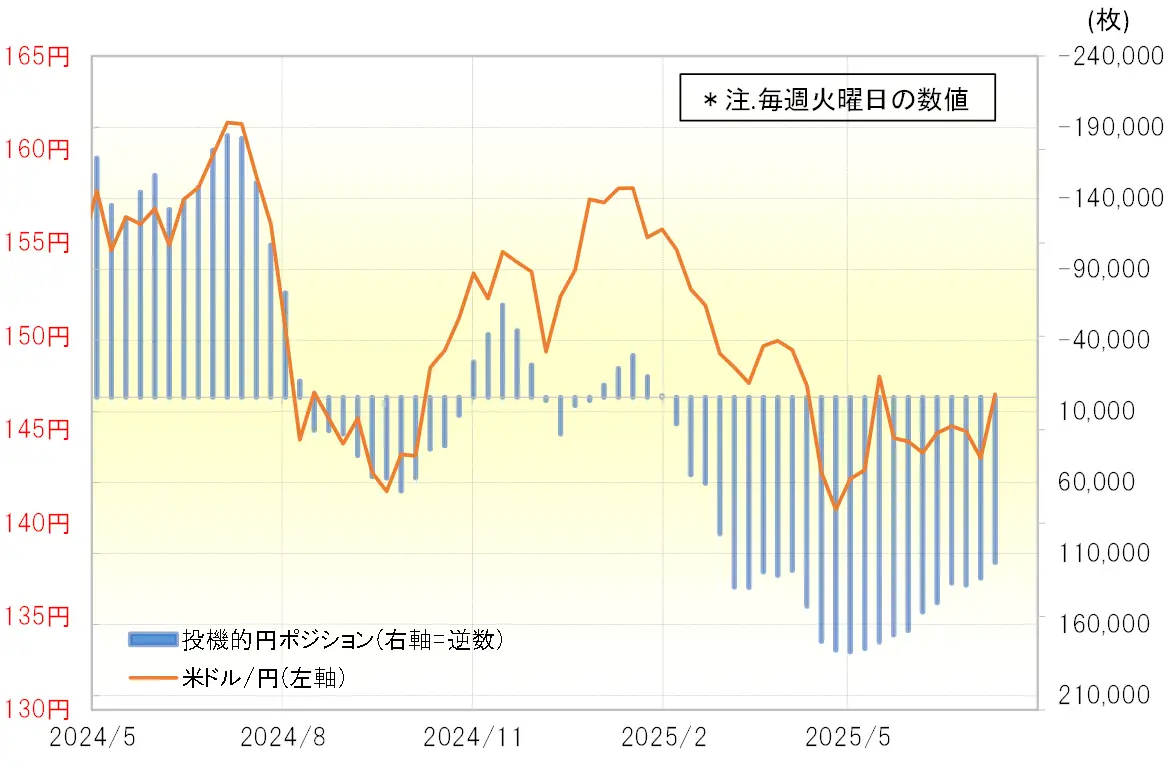

The speculative yen position of hedge funds reflected in the CFTC (Commodity Futures Trading Commission) statistics expanded to 180,000 contracts, nearly matching the largest scale ever recorded, during the phase when the USD/JPY rose to 161 yen in July 2024 (see Chart 2). In other words, it is believed that hedge funds played a leading role in aggressive USD buying and yen selling during the historically weak yen level of 161 yen.

Source: MoneyX Trader FX

The speculative yen position of hedge funds reflected in the CFTC (Commodity Futures Trading Commission) statistics expanded to 180,000 contracts, nearly matching the largest scale ever recorded, during the phase when the USD/JPY rose to 161 yen in July 2024 (see Chart 2). In other words, it is believed that hedge funds played a leading role in aggressive USD buying and yen selling during the historically weak yen level of 161 yen.

[Figure 2] CFTC Statistics of Speculative Yen Positions and USD/JPY (From May 2024) Source: Created by Monex Securities from Refinitiv data.

However, that Hedging F became cautious about buying US dollars and selling yen when it was determined that the Trump administration would make a comeback in the US presidential election in November 2024. Eventually, by shifting to actively selling US dollars and buying yen, it led to a decline in the US dollar and an increase in yen.

Source: Created by Monex Securities from Refinitiv data.

However, that Hedging F became cautious about buying US dollars and selling yen when it was determined that the Trump administration would make a comeback in the US presidential election in November 2024. Eventually, by shifting to actively selling US dollars and buying yen, it led to a decline in the US dollar and an increase in yen.

The US Justification for the Unreasonable Expansion of Yen Buying Induced by Yen Appreciation from the Perspective of Interest Rate Differentials

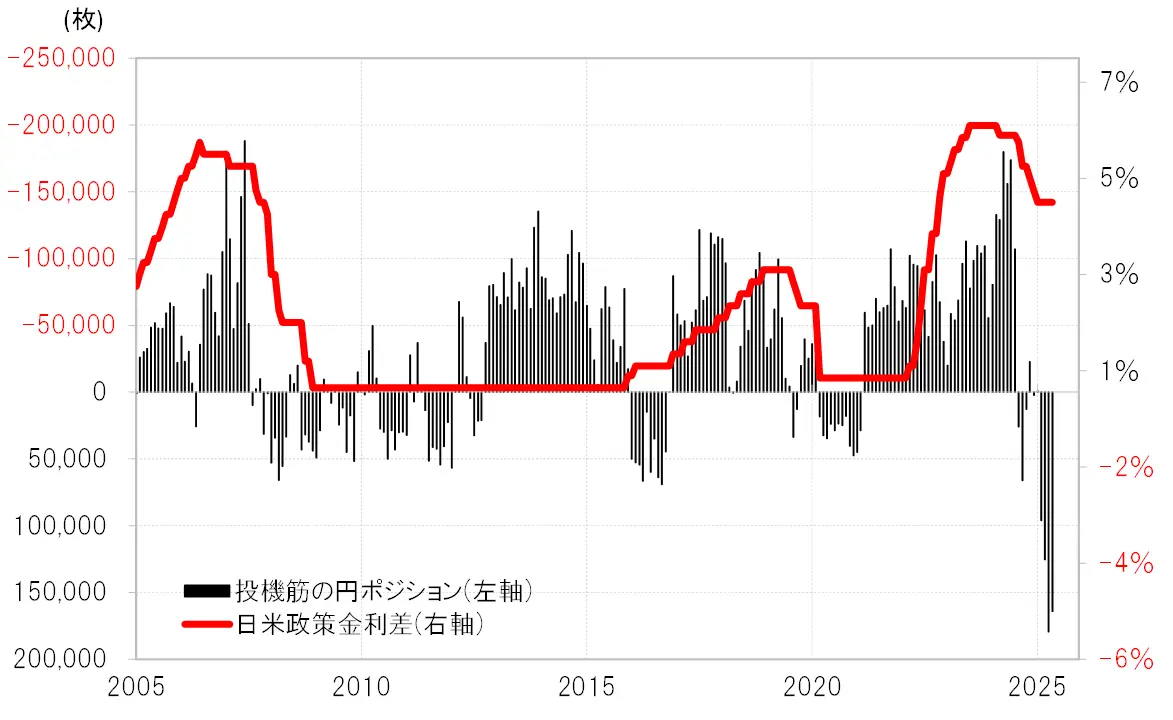

Why did Hedge F significantly shift its trading strategy from selling yen to buying yen with the advent of the Trump administration? The aggressive shift towards selling yen leading up to July 2024 was rational given the substantial US-Japan interest rate differential (with the US dollar being advantageous and the yen being disadvantageous) (see Chart 3). The US-Japan interest rate differential subsequently narrowed as the US moved to cut interest rates while Japan moved to raise them. Even so, the aggressive buying of yen, which was still disadvantageous when viewed from the perspective of the absolute substantial interest rate differential, was deemed irrational; yet, Hedge F moved towards an unprecedented expansion of this irrational yen buying.

[Figure 3] CFTC statistics of speculative yen positions and the Japan-U.S. policy interest rate differential (2005 onward) Source: Created by Monex Securities based on data from Refinitiv.

The justification for the unreasonable buying of yen from the perspective of interest rate differentials was the rise in the yen exchange rate, which means a weaker US dollar and a stronger yen. It seems that Treasury Secretary Mnuchin, who was in charge of currency policy during the Trump administration, was moving towards a policy that would lead to a weaker US dollar and a stronger yen. (To be continued in the second part)

Source: Created by Monex Securities based on data from Refinitiv.

The justification for the unreasonable buying of yen from the perspective of interest rate differentials was the rise in the yen exchange rate, which means a weaker US dollar and a stronger yen. It seems that Treasury Secretary Mnuchin, who was in charge of currency policy during the Trump administration, was moving towards a policy that would lead to a weaker US dollar and a stronger yen. (To be continued in the second part)