- Topic1/3

5k Popularity

158k Popularity

13k Popularity

26k Popularity

100k Popularity

- Pin

- Hey Square fam! How many Alpha points have you racked up lately?

Did you get your airdrop? We’ve also got extra perks for you on Gate Square!

🎁 Show off your Alpha points gains, and you’ll get a shot at a $200U Mystery Box reward!

🥇 1 user with the highest points screenshot → $100U Mystery Box

✨ Top 5 sharers with quality posts → $20U Mystery Box each

📍【How to Join】

1️⃣ Make a post with the hashtag #ShowMyAlphaPoints#

2️⃣ Share a screenshot of your Alpha points, plus a one-liner: “I earned ____ with Gate Alpha. So worth it!”

👉 Bonus: Share your tips for earning points, redemption experienc

- 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

[U.S. Stocks: Stock Discovery] Earnings Surprises: Cadence Design Systems [CDNS], benefiting from the "AI Supercycle" | U.S. Stocks, Industry Trends and Stock Commentary | Moneyクリ Money Partners Securities Investment Information and Media for Financial Assistance

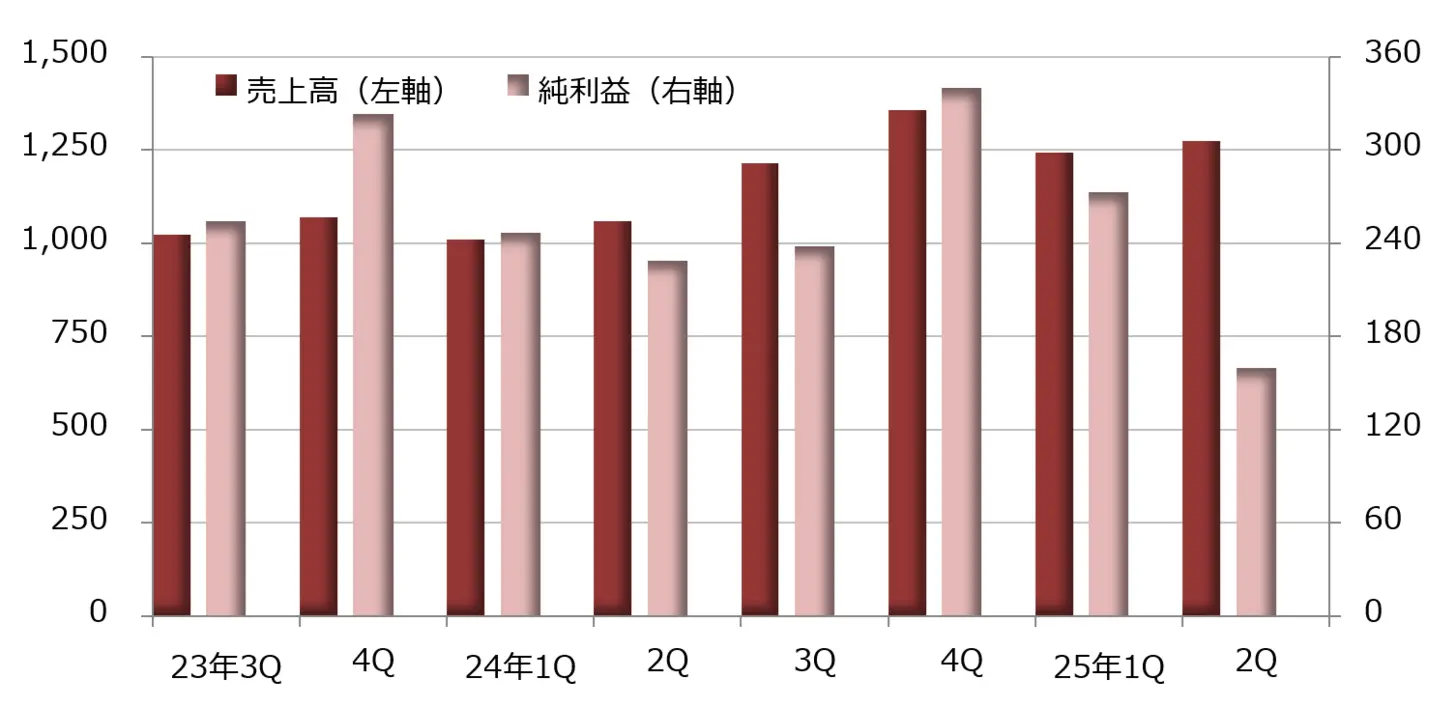

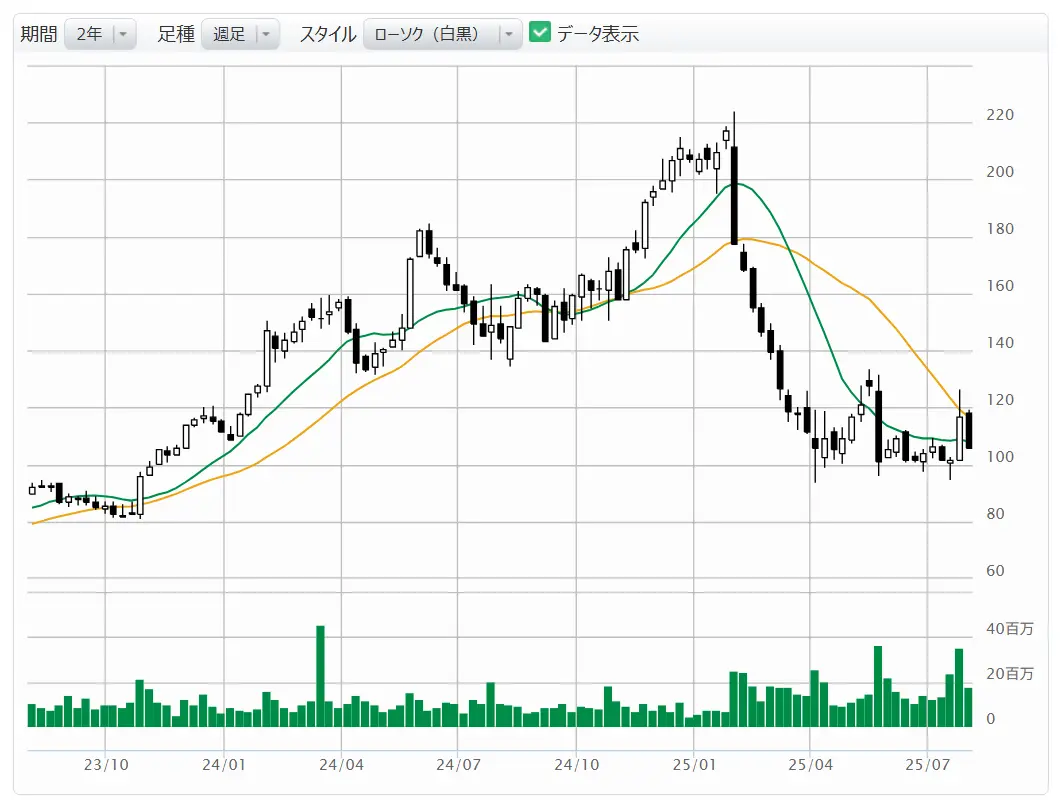

Cadence Design Systems [CDNS] Reports 20% Revenue Growth Driven by AI-Related Demand

Cadence Design Systems [CDNS], a company developing EDA tools that automate the design of integrated circuits and electronic devices, announced that its financial results for the April to June 2025 period showed a revenue of $1.275 billion, a 20% increase compared to the same period last year, while net profit decreased by 30% to $165 million. The non-GAAP EPS (earnings per share) was $1.65, exceeding the market forecast of $1.55 compiled by LSEG (London Stock Exchange Group) by 6.1%.

The demand for generative artificial intelligence (AI) has boosted sales, achieving a 20% increase in revenue. Although the increase in cost of goods sold and maintenance expenses, combined with the accounting of a contingent liability-related loss of $129 million, impacted net profit, the non-GAAP net profit, excluding stock-based compensation expenses and contingent liability-related losses, has grown by 28% to $450 million.

Anilud Debugan, the Chief Executive Officer (CEO), explains that the company's competitive strength and wide product lineup allow it to "lead in the accelerating wave of the AI supercycle (period of rapid demand expansion), from building AI infrastructure to new frontiers such as physical AI for autonomous systems."

In the guidance provided during the earnings announcement, the sales forecast for the fiscal year ending December 2025 is projected to be between $5.21 billion and $5.27 billion, which is an upward revision from the previous guidance of $5.15 billion to $5.23 billion given in April this year. The expected EPS on a GAAP basis is revised down to $3.97 to $4.07, from the previous guidance of $4.21 to $4.31 provided in April, while the non-GAAP EPS is projected to be between $6.85 and $6.95, up from $6.73 to $6.83 in April.

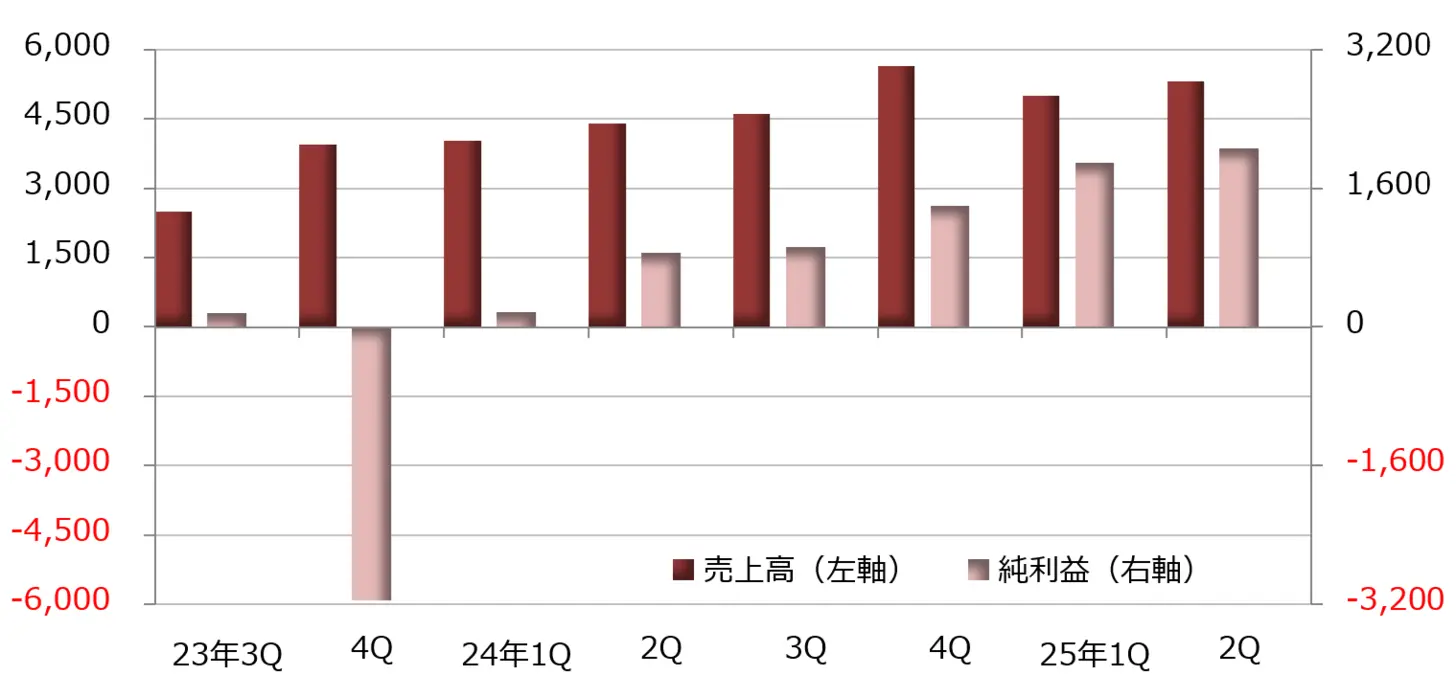

[Figure 1] Cadence Design Systems [CDNS]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in December

Source: Created by DZH Financial Research from LSEG

*The end of the term is in December

[Chart 2] Cadence Design Systems [CDNS]: Weekly Chart (Moving Average Lines Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of August 1, 2025)

Source: Monex Securities website (as of August 1, 2025)

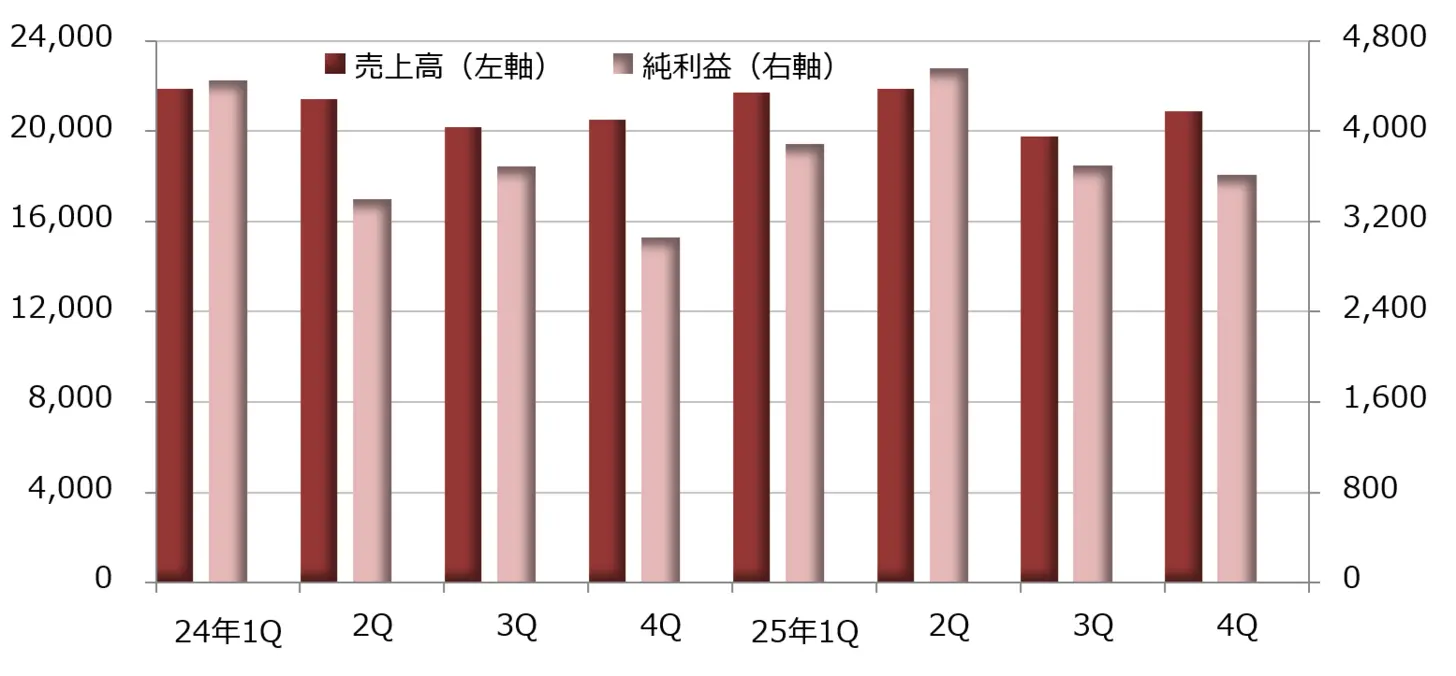

Procter & Gamble [PG], 15% Increase in Profit Due to Cost Control

Procter & Gamble [PG] announced that its financial results for the April to June 2025 period showed revenue of $20.889 billion, a 2% increase compared to the same period last year, and a net profit of $3.615 billion, a 15% increase. The EPS (earnings per share) was $1.48, exceeding the market expectation of $1.42 compiled by LSEG by 4.2%.

The growth of the cost of goods sold exceeded the revenue growth rate, leading to a deterioration in profitability. However, by reducing selling and administrative expenses by 6% to $5.93 billion, the operating profit margin has increased.

By business segment, the detergent and household goods division performed well with sales increasing by 2% to $7.385 billion and net profit increasing by 11% to $1.375 billion. The baby and women's sanitary products division saw sales increase by 2% to $5.093 billion, with net profit increasing by 12% to $948 million. The beauty division's sales remained flat at $3.733 billion, but net profit increased by 4% to $557 million, showing some stagnation. However, the healthcare and grooming divisions, including shaving products, achieved profit increases of 14% and 19% respectively, boosting overall net profit.

The full-year financial results for June 2025 showed a revenue increase of 0.3% year-on-year to $84.284 billion, a net profit increase of 7% to $15.974 billion, and a core EPS increase of 4% to $6.83. In addition to the effect of a 3% reduction in selling and administrative expenses to $22.669 billion, the net profit has increased due to the rebound from the recording of impairment provisions of $1.341 billion in the previous year.

The guidance forecasts that the full-year sales for June 2026 will increase by 1-5% compared to the previous year's results. The 1% increase is based on expected foreign exchange gains and capital gains, while the actual revenue growth rate is projected to be between 0-4%. On the other hand, the forecast for core EPS is an increase of 0-4%, ranging from $6.83 to $7.09.

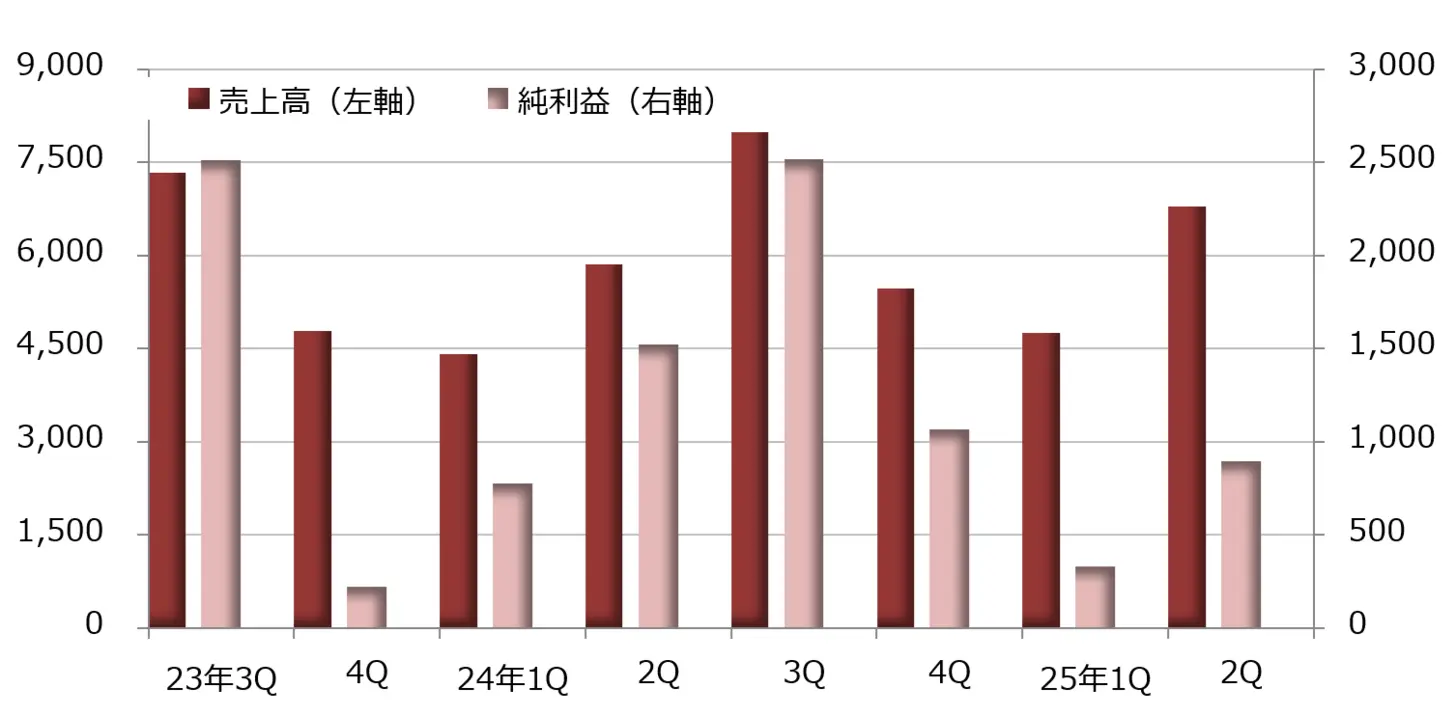

[Table 3] Procter & Gamble [PG]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in June.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in June.

[Chart 4] Procter & Gamble [PG]: Weekly Chart (Moving Averages Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of August 1, 2025)

Source: Monex Securities website (as of August 1, 2025)

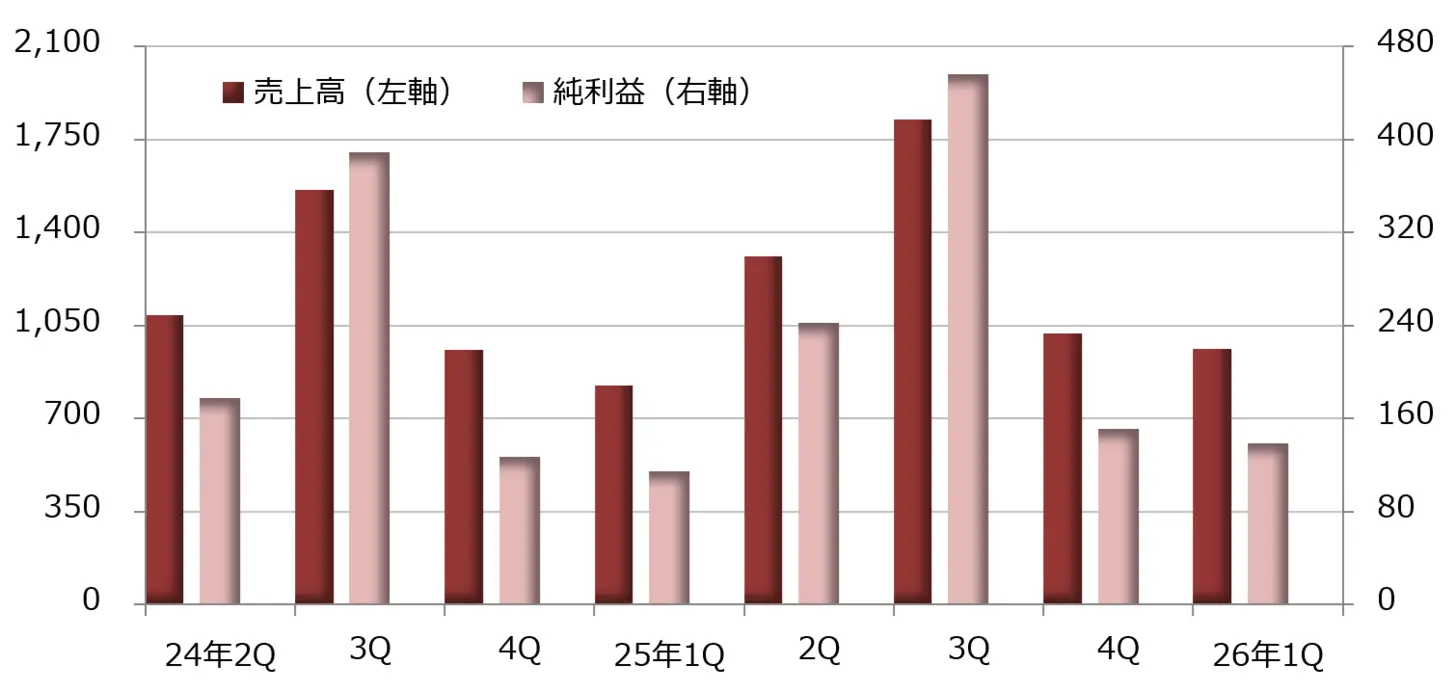

Deckers Outdoor [DECK] drives with a 20% increase in the 'HOKA' brand

Deckers Outdoor, which develops the footwear brand DECK, announced that its financial results for the April to June 2025 quarter showed a revenue of $965 million, a 17% increase compared to the same period last year, and a net profit of $139 million, a 20% increase. The EPS (earnings per share) was $0.93, exceeding the market expectation of $0.68 compiled by LSEG by 36.0%.

Sales increased by double digits, but the cost of goods sold rose by 20%, surpassing the revenue growth rate, leading to a decline in the gross profit margin from 56.9% in the same period last year to 55.8%. On the other hand, selling and administrative expenses remained at $373 million, an increase of 11%, while operating profit grew by 24% to $165 million.

The main footwear brands are UGG, HOKA, Teva, Sanuk, Koolaburra, and AHNU.

In terms of sales by brand, HOKA saw a 20% increase to $653 million, while UGG experienced a 19% increase to $265 million, performing well. In contrast, other brands were limited to a 19% decrease, totaling $46 million. CEO Stefano Caroti stated, "HOKA and UGG exceeded expectations," adding, "While uncertainty remains in the trade environment, trust in the brands is unwavering."

In the guidance during the earnings announcement, we expect revenue for the July-September 2025 period to be between $1.38 billion and $1.42 billion, with EPS estimated between $1.50 and $1.55. The results for the same period last year (July-September 2024) were a revenue of $1.311 billion and EPS of $1.59.

[Figure 5] Deckers Outdoor [DECK]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in March.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in March.

[Chart 6] Deckers Outdoor [DECK]: Weekly Chart (Moving Average Lines Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of August 1, 2025)

Source: Monex Securities website (as of August 1, 2025)

Newmont [NEM] Sees Profits Surge 2.4 Times with Rising Average Gold Prices

Newmont [NEM], engaged in gold mining and refining, announced that its financial results for the April to June 2025 period showed a 21% increase in revenue compared to the same period last year, totaling $5.317 billion, and a net profit that increased 2.4 times to $2.061 billion. The adjusted EPS (earnings per share) was $1.43, surpassing the market forecast of $1.18 compiled by LSEG by 21.6%.

Gold production, including equity-method applied mines, decreased by 4% on a consolidated basis to 1,478,000 ounces, while the average realized price of gold (per ounce) rose by 41% to $3,320, improving profitability. As sales increased, costs and expenses remained at $2.249 billion, a 33% reduction, leading to wider profit margins.

Adjusted net income, excluding the fair value fluctuations of investment projects and corporate taxes from net profit, increased by 91% to $1.594 billion, while adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) rose by 52% to $2.997 billion.

In terms of products, the presence of gold is significant, with sales increasing by 26% to $4.582 billion, while the cost of sales decreased by 6% to $1.677 billion, resulting in wider profit margins. Sales of other products are all declining, with copper down 5% to $360 million, silver down 9% to $191 million, zinc down 5% to $141 million, and lead down 2% to $43 million.

The guidance provided by the management set the gold production target for the full year ending December 2025 at 5.9 million ounces, maintaining the guidance presented during the announcement of the financial results for the January-March 2025 quarter. The actual production was 3.015 million ounces, resulting in an achievement rate of 51.1% against the full-year target.

[Figure 7] Newmont [NEM]: Performance Trend (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is December.

Source: Created by DZH Financial Research from LSEG

*The end of the term is December.

[Chart 8] Newmont [NEM]: Weekly Chart (Moving Averages Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of August 1, 2025)

Source: Monex Securities website (as of August 1, 2025)

Booking Holdings [BKNG] reports a 26% increase in adjusted net income

The financial results for the April-June 2025 period announced by online travel agency Booking Holdings [BKNG] showed a revenue of $6.798 billion, a 16% increase year-on-year, while net profit decreased by 41% to $895 million. The adjusted EPS (earnings per share) was $55.40, surpassing the market expectation of $50.22 compiled by LSEG by 10.3%.

The recording of foreign exchange losses and other expenses amounted to 962 million dollars (compared to other income of 37 million dollars in the same period last year), which is a factor for reduced profits. Adjusted net profit, excluding such factors, reached 1.807 billion dollars, an increase of 26%.

Revenue has been steadily increasing, particularly with users making online payments during travel bookings, resulting in a merchant-type income for Booking Holdings that rose by 29% to $4.457 billion. On the other hand, agency-type income from receiving commissions on accommodation and flight bookings has remained at $2.044 billion, a decrease of 5%. Advertising revenue has also shown steady growth, increasing by 10% to $297 million.

In the April to June 2025 period, the total number of room nights increased by 8% to 308 million, and the total amount of bookings reached $46.7 billion, an increase of 13%. CEO Glenn Fogel stated, "The cases of booking two or more travel methods are growing healthily."

The guidance expects that the total number of rooms for the July to September 2025 period will increase by 3.5% to 5.5% compared to the same period last year, and the total amount of reservations is expected to increase by 8% to 10%. Revenue is projected to increase by 7% to 9%, and adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) is expected to reach between $3.9 billion and $4.0 billion, an increase of 6% to 9%.

For the full year of December 2025, we expect revenue growth to be at a low double-digit level, with adjusted EBITDA growth anticipated to be in the mid-10% range.

[Table 9] Booking Holdings [BKNG]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

[Chart 10] Booking Holdings [BKNG]: Weekly Chart (Moving Average Lines Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of August 1, 2025)

Source: Monex Securities website (as of August 1, 2025)