⚡ Institutional Adoption of Blockchain Accelerates

Current Trend:

Traditional financial institutions such as State Street, JPMorgan, and Goldman Sachs are actively adopting blockchain technology.

They are launching digital asset platforms to tokenize financial products and enhance operational efficiency.

📉 Market Implications: Digitization of Traditional Finance

Adoption Signals:

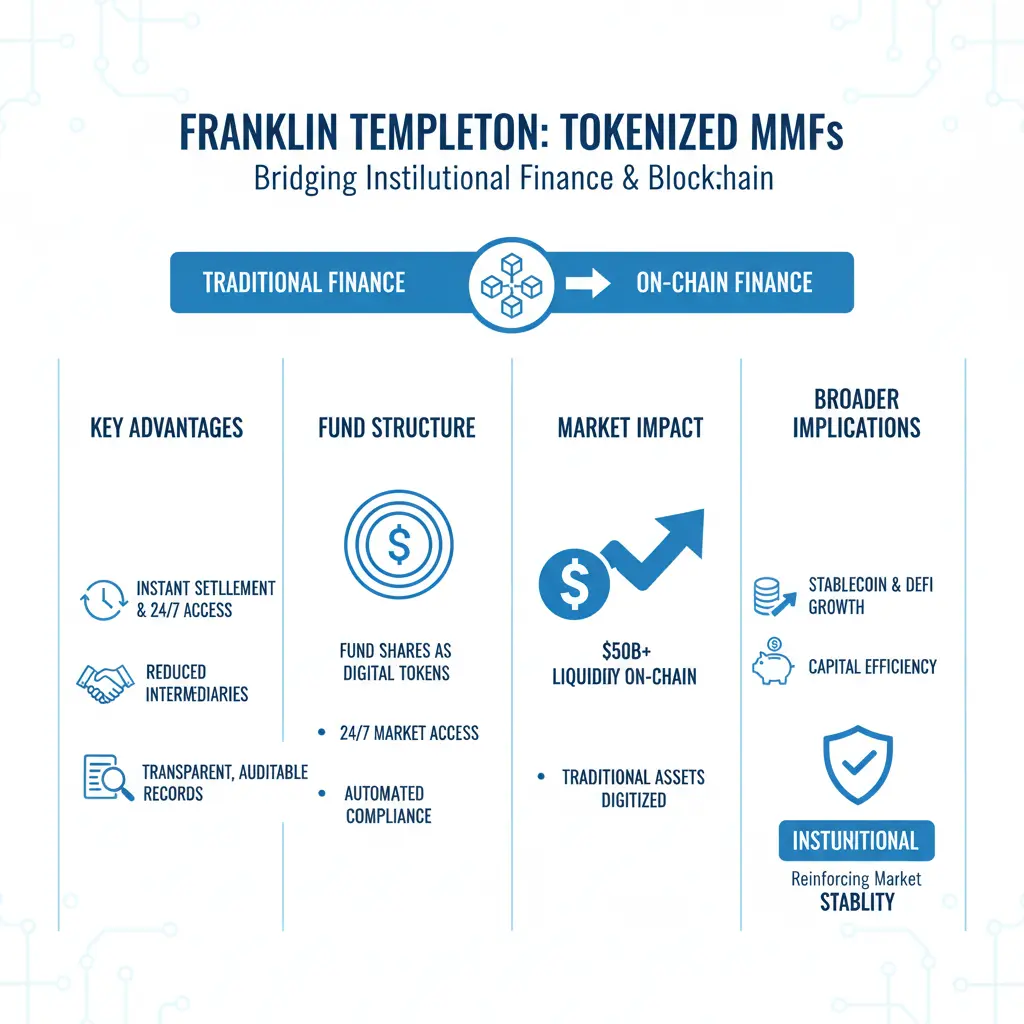

Blockchain integration allows real-time settlement and increased transparency.

Tokenization enables fractional ownership of assets, improving liquidity and circulation efficiency.

Financial institutions are experimenting with digital bonds, tokenized equities, and other structured products.

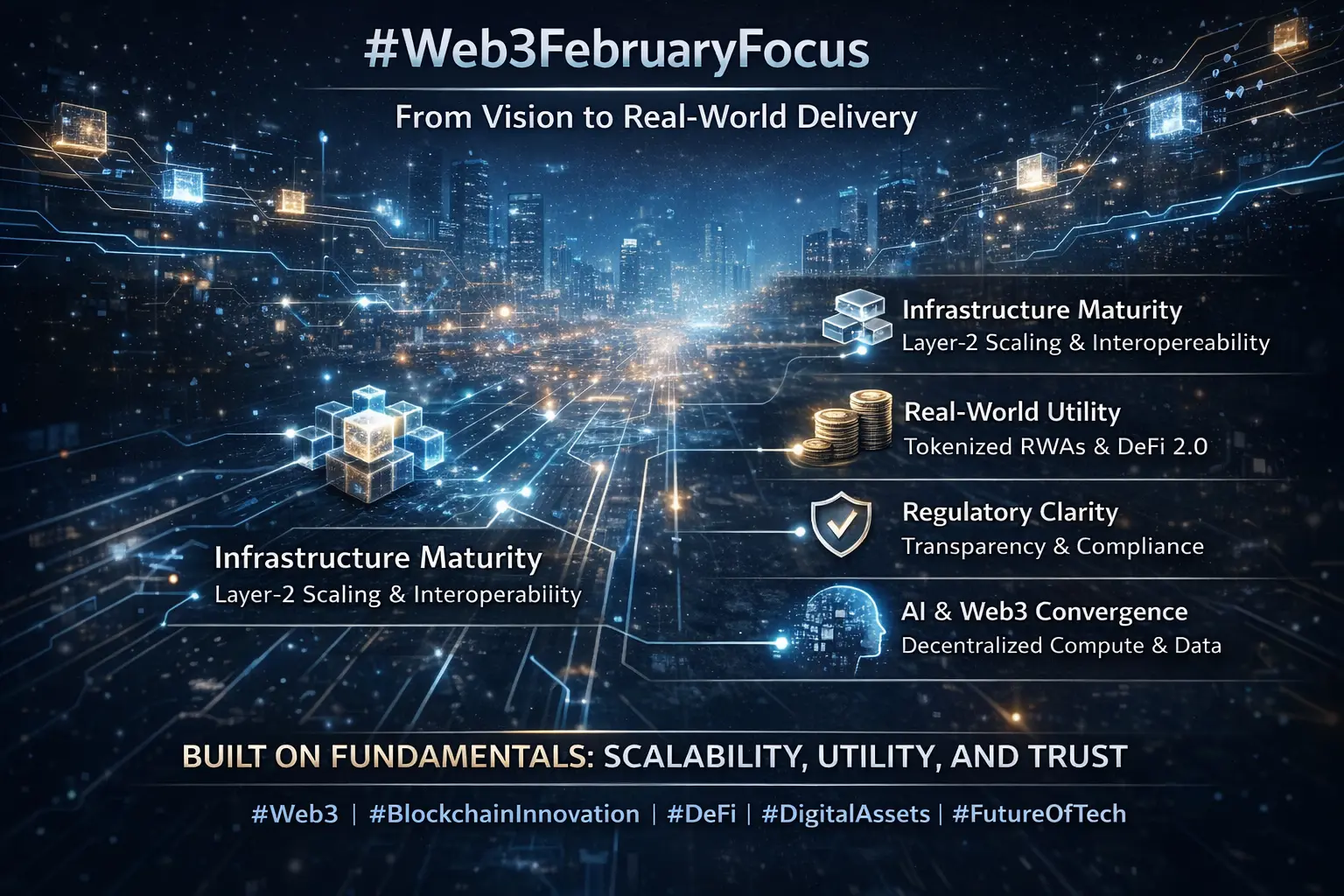

Insight: This trend indicates a gradual merging of traditional finance and digital finance, laying the foundation for faster, more seamless transactions across markets.

🔎 Why Institutions Are Moving to Blockchain

Efficiency Gains: Distributed ledger technology reduces intermediaries and transaction delays.

Enhanced Transparency: Immutable records increase trust and regulatory compliance.

Liquidity and Accessibility: Tokenized assets allow for fractional participation and global access.

Future-Proofing: Institutions are positioning themselves for the digital financial ecosystem of tomorrow.

💡 Strategic Takeaways

Monitor Institutional Platforms: Early adoption by top-tier banks often signals broader market trends.

Focus on High-Quality Digital Assets: Assets supported by institutional infrastructure may see higher credibility and stability.

Watch for Integration Opportunities: Tokenized products may become core parts of trading, lending, and settlement systems.

Risk Management: Regulatory frameworks are evolving; stay informed on legal and compliance developments.

📈 Long-Term Outlook

Institutional blockchain adoption will likely accelerate digitization across traditional finance, making transactions faster, cheaper, and more accessible.

Tokenization and digital assets are gradually becoming mainstream financial instruments, not just experimental tools.

Investors and market participants should consider the impact on liquidity, product accessibility, and systemic efficiency.

Summary Table

Institution Adoption: State Street, JPMorgan, Goldman Sachs integrating blockchain

Purpose: Digital asset platforms, tokenization of traditional products

Impact on Market: Faster circulation, improved efficiency, increased liquidity

Transparency & Compliance: Enhanced via distributed ledger technology

Long-Term Outlook: Broader digitization of financial transactions

⚠️ Risk Warning

Investing or participating in digital asset markets carries significant risk:

Regulations and adoption rates are evolving.

Tokenized assets may be volatile and subject to legal or operational constraints.

Only participate with capital you can afford to risk.

Stay informed on compliance, infrastructure, and market developments.

#TraditionalFinanceAcceleratesTokenization

Current Trend:

Traditional financial institutions such as State Street, JPMorgan, and Goldman Sachs are actively adopting blockchain technology.

They are launching digital asset platforms to tokenize financial products and enhance operational efficiency.

📉 Market Implications: Digitization of Traditional Finance

Adoption Signals:

Blockchain integration allows real-time settlement and increased transparency.

Tokenization enables fractional ownership of assets, improving liquidity and circulation efficiency.

Financial institutions are experimenting with digital bonds, tokenized equities, and other structured products.

Insight: This trend indicates a gradual merging of traditional finance and digital finance, laying the foundation for faster, more seamless transactions across markets.

🔎 Why Institutions Are Moving to Blockchain

Efficiency Gains: Distributed ledger technology reduces intermediaries and transaction delays.

Enhanced Transparency: Immutable records increase trust and regulatory compliance.

Liquidity and Accessibility: Tokenized assets allow for fractional participation and global access.

Future-Proofing: Institutions are positioning themselves for the digital financial ecosystem of tomorrow.

💡 Strategic Takeaways

Monitor Institutional Platforms: Early adoption by top-tier banks often signals broader market trends.

Focus on High-Quality Digital Assets: Assets supported by institutional infrastructure may see higher credibility and stability.

Watch for Integration Opportunities: Tokenized products may become core parts of trading, lending, and settlement systems.

Risk Management: Regulatory frameworks are evolving; stay informed on legal and compliance developments.

📈 Long-Term Outlook

Institutional blockchain adoption will likely accelerate digitization across traditional finance, making transactions faster, cheaper, and more accessible.

Tokenization and digital assets are gradually becoming mainstream financial instruments, not just experimental tools.

Investors and market participants should consider the impact on liquidity, product accessibility, and systemic efficiency.

Summary Table

Institution Adoption: State Street, JPMorgan, Goldman Sachs integrating blockchain

Purpose: Digital asset platforms, tokenization of traditional products

Impact on Market: Faster circulation, improved efficiency, increased liquidity

Transparency & Compliance: Enhanced via distributed ledger technology

Long-Term Outlook: Broader digitization of financial transactions

⚠️ Risk Warning

Investing or participating in digital asset markets carries significant risk:

Regulations and adoption rates are evolving.

Tokenized assets may be volatile and subject to legal or operational constraints.

Only participate with capital you can afford to risk.

Stay informed on compliance, infrastructure, and market developments.

#TraditionalFinanceAcceleratesTokenization