# BItcoin

6.63M

Mosfick

JUST IN: Stablecoin Market Cap Hits All-Time High as $2 Billion Floods Exchanges.

The sidelines are officially emptying. In the last 6 hours, on-chain data recorded a massive $2 billion inflow of USDT and USDC into centralized exchange wallets. This liquidity injection arrives precisely as Bitcoin stabilizes above $91,500, signaling that large capital allocators are finished de-risking from the recent geopolitical scare and are positioning for deployment.

This matters because it represents "potential energy."

Unlike open interest, which indicates leverage, stablecoin inflows represent raw spot

The sidelines are officially emptying. In the last 6 hours, on-chain data recorded a massive $2 billion inflow of USDT and USDC into centralized exchange wallets. This liquidity injection arrives precisely as Bitcoin stabilizes above $91,500, signaling that large capital allocators are finished de-risking from the recent geopolitical scare and are positioning for deployment.

This matters because it represents "potential energy."

Unlike open interest, which indicates leverage, stablecoin inflows represent raw spot

BTC2,54%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#FedRateDecisionApproaches 🚨

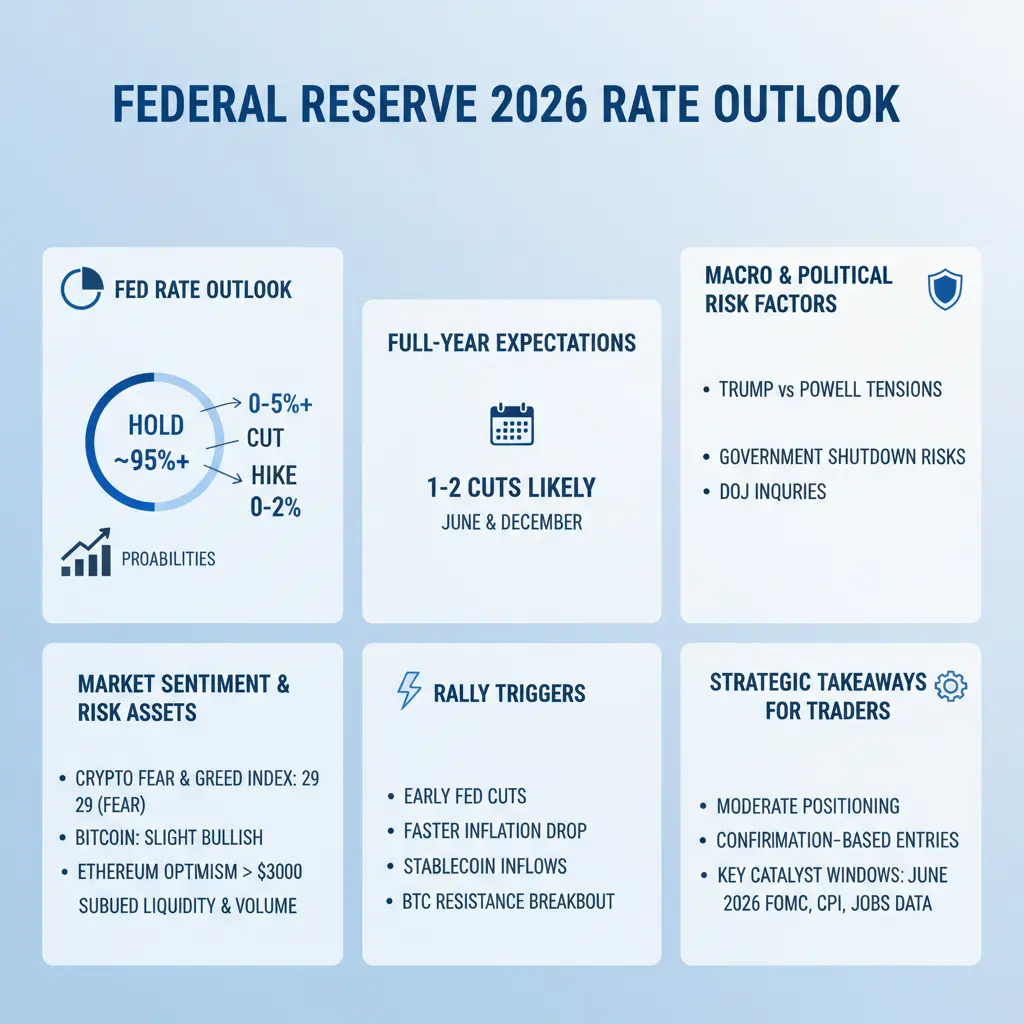

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

- Reward

- 5

- 8

- Repost

- Share

CryptoChampion :

:

DYOR 🤓View More

#CryptoMarketWatch #CryptoMarketWatch 📊🚀

Price action is heating up, but direction isn’t obvious yet. Bitcoin is hovering around important support zones while capital continues to rotate selectively across altcoins.

What’s driving today’s uncertainty isn’t charts alone — it’s macro pressure: • Upcoming Fed policy decisions are keeping traders cautious

• Rising geopolitical stress in the Middle East is adding risk premium

• Regulatory developments are influencing sentiment across crypto markets

In environments like this, liquidity decides the winners. Short-term moves can be sharp and mislead

Price action is heating up, but direction isn’t obvious yet. Bitcoin is hovering around important support zones while capital continues to rotate selectively across altcoins.

What’s driving today’s uncertainty isn’t charts alone — it’s macro pressure: • Upcoming Fed policy decisions are keeping traders cautious

• Rising geopolitical stress in the Middle East is adding risk premium

• Regulatory developments are influencing sentiment across crypto markets

In environments like this, liquidity decides the winners. Short-term moves can be sharp and mislead

- Reward

- 8

- 11

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

💰Capital flow from Silver to $BTC ?

Analysts note that historically, the BTC/Silver exchange rate reached its minimum 13 months after the peak, showing a drop of 75-85% 📉

At the moment, it's the twelfth month, and the collapse is already at 78%.

According to this dynamic, a capital flow from Silver to BTC could start in the first half of 2026.

#BTC #Bitcoin #Silver $BTC

Analysts note that historically, the BTC/Silver exchange rate reached its minimum 13 months after the peak, showing a drop of 75-85% 📉

At the moment, it's the twelfth month, and the collapse is already at 78%.

According to this dynamic, a capital flow from Silver to BTC could start in the first half of 2026.

#BTC #Bitcoin #Silver $BTC

BTC2,54%

- Reward

- 9

- 6

- Repost

- Share

Discovery :

:

Watching Closely 🔍️View More

🚨 #CryptoMarketWatch | Market Update – Jan 28, 2026 🚨

Crypto market is sending mixed but interesting signals 👀

Bitcoin is consolidating, altcoins are exploding, and gold is stealing the safe-haven spotlight.

📊 Today’s Key Prices • BTC: ~$89,000 — consolidation phase, underperforming vs gold

• ETH: ~$3,000 — stable with slow strength

• DOGE: ~$0.89 — momentum rising after Nasdaq ETF listing

• RIVER: ~$1.25 — 50x in one month, pure speculative heat

• Gold: ~$5,210 — breakout confirms strong safe-haven demand

🔁 Bitcoin vs Gold Short term mein gold ne BTC ko outperform kiya hai due to geopoli

Crypto market is sending mixed but interesting signals 👀

Bitcoin is consolidating, altcoins are exploding, and gold is stealing the safe-haven spotlight.

📊 Today’s Key Prices • BTC: ~$89,000 — consolidation phase, underperforming vs gold

• ETH: ~$3,000 — stable with slow strength

• DOGE: ~$0.89 — momentum rising after Nasdaq ETF listing

• RIVER: ~$1.25 — 50x in one month, pure speculative heat

• Gold: ~$5,210 — breakout confirms strong safe-haven demand

🔁 Bitcoin vs Gold Short term mein gold ne BTC ko outperform kiya hai due to geopoli

- Reward

- 1

- 1

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊#CryptoMarketWatch 📊🚀

Markets are moving fast, and the crypto ecosystem is showing mixed signals today. BTC is testing key support zones while altcoins rotate with emerging trends.

Macro factors are influencing every move:

• Fed rate decisions approaching (#FedRateDecisionApproaches)

• Middle East tensions (#MiddleEastTensionsEscalate)

• Regulatory news shaping sentiment (#CryptoRegulationNewProgress)

Liquidity is key — short-term spikes can be unpredictable, but disciplined positioning wins in the long term.

Smart traders focus on:

• Support & resistance levels

• Volume trends

• High-impact

Markets are moving fast, and the crypto ecosystem is showing mixed signals today. BTC is testing key support zones while altcoins rotate with emerging trends.

Macro factors are influencing every move:

• Fed rate decisions approaching (#FedRateDecisionApproaches)

• Middle East tensions (#MiddleEastTensionsEscalate)

• Regulatory news shaping sentiment (#CryptoRegulationNewProgress)

Liquidity is key — short-term spikes can be unpredictable, but disciplined positioning wins in the long term.

Smart traders focus on:

• Support & resistance levels

• Volume trends

• High-impact

- Reward

- 12

- 13

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

🚨 #CryptoRegulationNewProgress 🚨

Crypto regulation ab uncertainty se nikal kar clarity & enforcement ke phase mein enter kar chuki hai.

Governments worldwide licensing, AML, taxation aur stablecoin oversight ko formal bana rahi hain — jo market ko stronger, safer aur more institutional bana raha hai.

🌍 Global Shift • Europe: Strict KYC/AML, anonymous accounts ka end

• USA: Institutional adoption + Bitcoin strategic focus

• Asia: Licensing, taxation aur regulated trading

• Pakistan: PVARA, PCC, stablecoin partnerships & Digital Rupee (CBDC) pilot

📈 Market Impact Regulation ka matlab suppres

Crypto regulation ab uncertainty se nikal kar clarity & enforcement ke phase mein enter kar chuki hai.

Governments worldwide licensing, AML, taxation aur stablecoin oversight ko formal bana rahi hain — jo market ko stronger, safer aur more institutional bana raha hai.

🌍 Global Shift • Europe: Strict KYC/AML, anonymous accounts ka end

• USA: Institutional adoption + Bitcoin strategic focus

• Asia: Licensing, taxation aur regulated trading

• Pakistan: PVARA, PCC, stablecoin partnerships & Digital Rupee (CBDC) pilot

📈 Market Impact Regulation ka matlab suppres

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

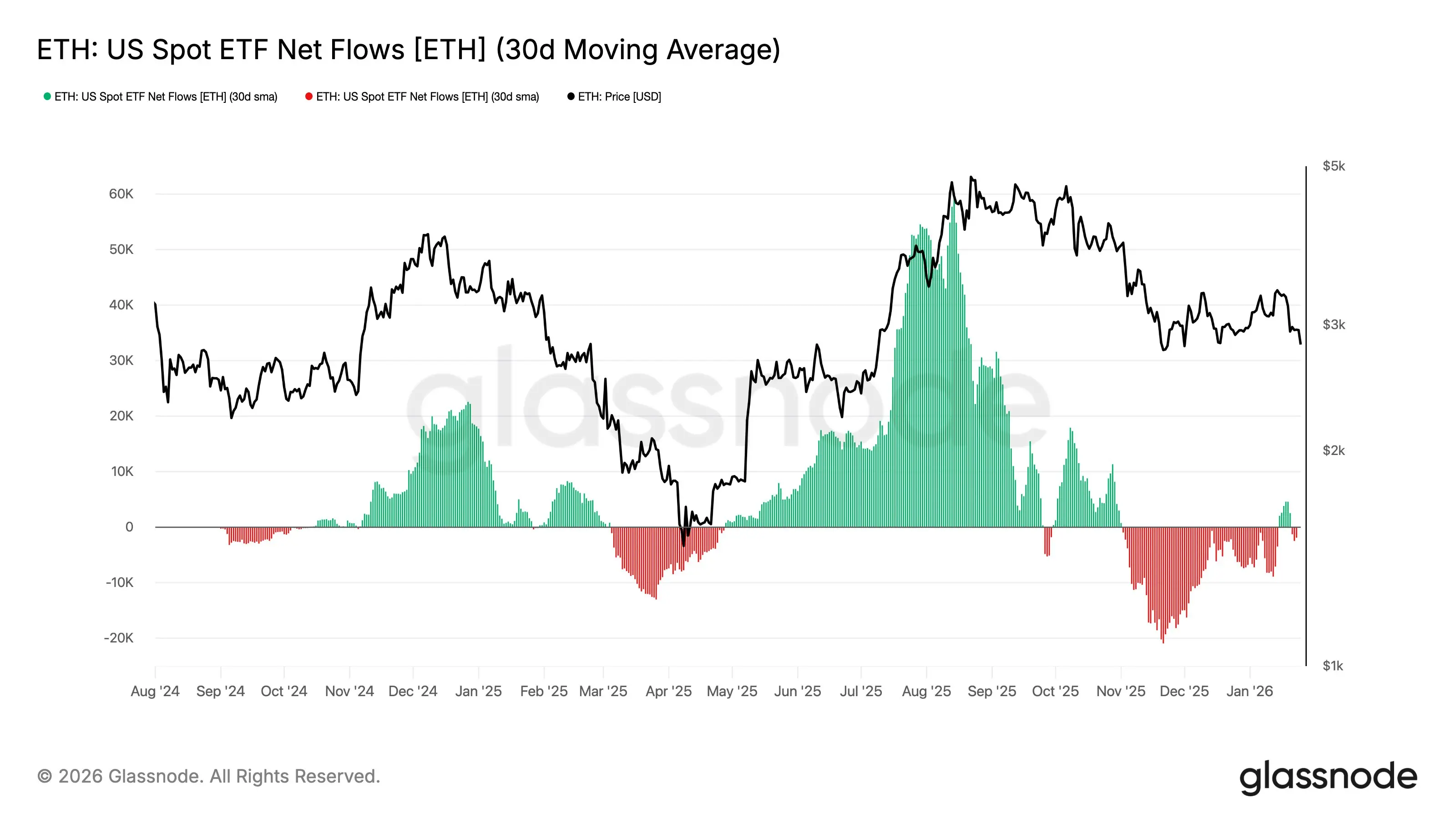

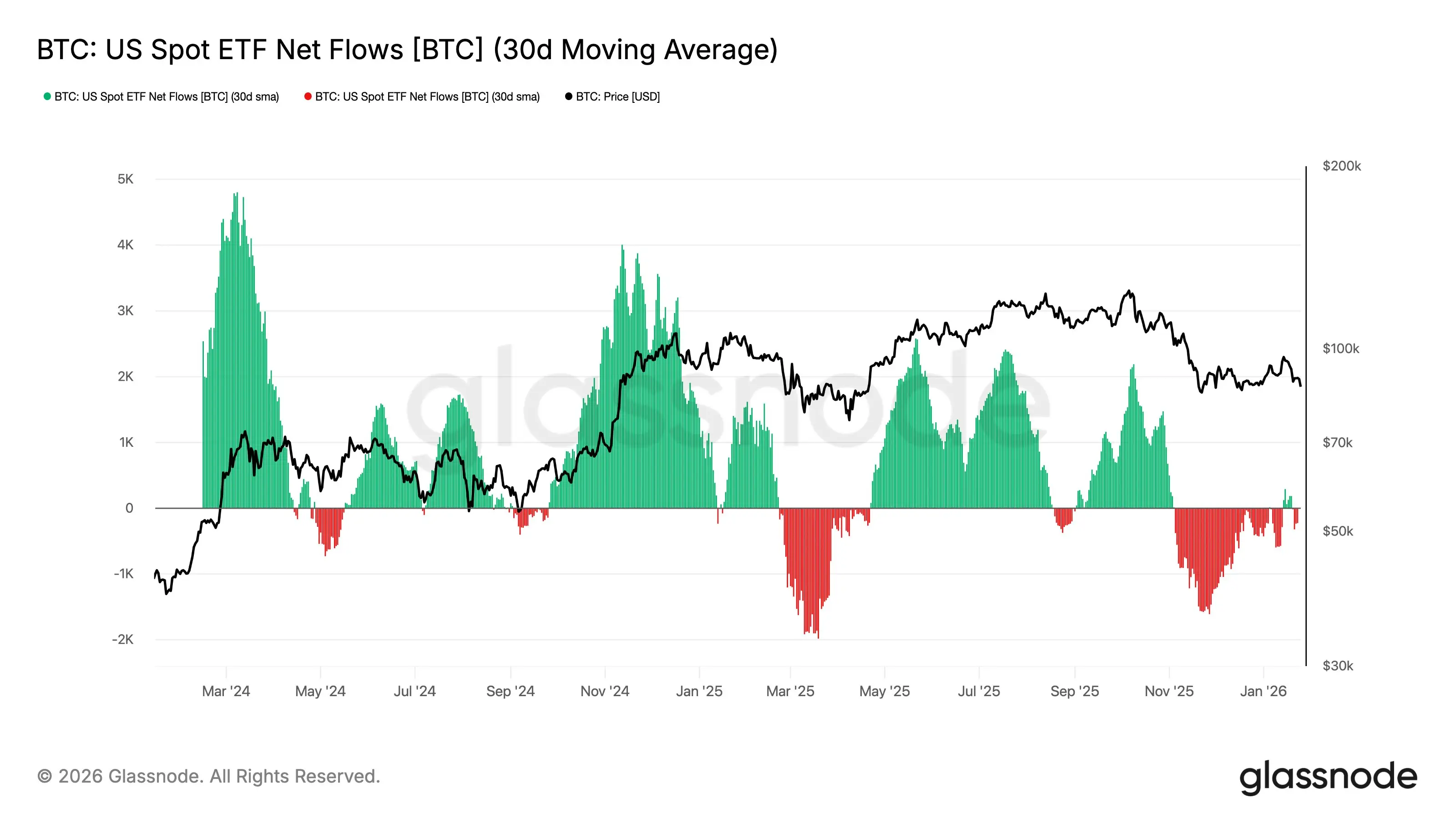

ETF Flow Divergence Highlights Structural Differences Between #Bitcoin and #Ethereum Demand

The 30-day moving average of US spot ETF net flows reveals a clear divergence between Bitcoin and Ethereum, offering insight into how institutional demand is evolving across the two assets. While both benefited from ETF-driven inflows during the mid-2025 risk-on phase, the persistence and price impact of those flows differ materially.

Bitcoin ETF flows show a more cyclical but resilient pattern. Periods of strong inflows tend to coincide with sustained price appreciation, and even during outflow phases,

The 30-day moving average of US spot ETF net flows reveals a clear divergence between Bitcoin and Ethereum, offering insight into how institutional demand is evolving across the two assets. While both benefited from ETF-driven inflows during the mid-2025 risk-on phase, the persistence and price impact of those flows differ materially.

Bitcoin ETF flows show a more cyclical but resilient pattern. Periods of strong inflows tend to coincide with sustained price appreciation, and even during outflow phases,

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

Good luck everyone View More

#BTC行情分析 | Bitcoin Market Outlook 🔍

Bitcoin (BTC) is currently trading in a high-volatility consolidation phase, reflecting strong market indecision near a critical psychological zone.

📊 Market Structure

BTC is hovering around the $88,000 – $92,000 range, indicating a classic range-bound market after an aggressive prior move. Buyers are defending key support, while sellers remain active near resistance.

🔑 Key Levels to Watch

Major Support: $86,000 – $88,000

A strong demand zone. A breakdown below this area could trigger short-term corrective pressure.

Immediate Resistance: $90,000 – $92,000

Bitcoin (BTC) is currently trading in a high-volatility consolidation phase, reflecting strong market indecision near a critical psychological zone.

📊 Market Structure

BTC is hovering around the $88,000 – $92,000 range, indicating a classic range-bound market after an aggressive prior move. Buyers are defending key support, while sellers remain active near resistance.

🔑 Key Levels to Watch

Major Support: $86,000 – $88,000

A strong demand zone. A breakdown below this area could trigger short-term corrective pressure.

Immediate Resistance: $90,000 – $92,000

BTC2,54%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

11.4K Popularity

73.8K Popularity

29.36K Popularity

10.21K Popularity

10.35K Popularity

9.25K Popularity

8.33K Popularity

8.06K Popularity

74.31K Popularity

21.44K Popularity

82.44K Popularity

23.36K Popularity

50.12K Popularity

43.67K Popularity

179.17K Popularity

News

View MoreBarclays: Euro becomes the main "anti-dollar" trading target, as the dollar approaches a four-year low

4 m

USDC Treasury在以太坊销毁9515万枚USDC

9 m

Data: 151.58 BTC transferred out from multiple anonymous addresses, worth approximately $13.67 million

25 m

Opinion: Trump may announce the new Federal Reserve Chair tonight

25 m

Uniswap: Token auction feature will be launched on the web version on February 2nd

28 m

Pin