CoincrazeCentral

No content yet

CoincrazeCentral

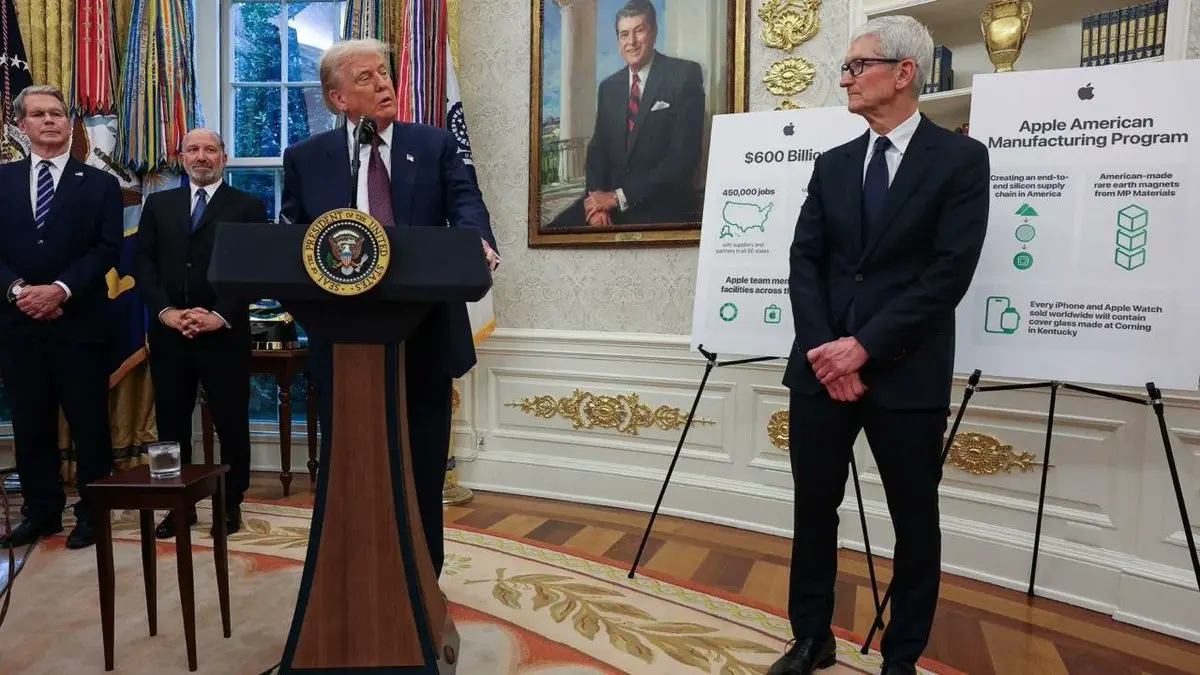

Apple committing $600B to reshoring U.S. production is more than just a headline—it’s a signal of a seismic geopolitical and economic shift.

You’re watching the world’s most valuable company bet on supply chain sovereignty, in sync with a White House that’s using tariffs not to punish—but to realign. This is Apple laying the groundwork for a chip-to-glass-to-FaceID ecosystem entirely built on American soil.

Forget slogans. This is how “Made in America” actually becomes real again—through semiconductors in Arizona, rare earths in Texas, and manufacturing in Kentucky and New York.

For crypto fol

You’re watching the world’s most valuable company bet on supply chain sovereignty, in sync with a White House that’s using tariffs not to punish—but to realign. This is Apple laying the groundwork for a chip-to-glass-to-FaceID ecosystem entirely built on American soil.

Forget slogans. This is how “Made in America” actually becomes real again—through semiconductors in Arizona, rare earths in Texas, and manufacturing in Kentucky and New York.

For crypto fol

- Reward

- like

- Comment

- Share

Just heard VP JD Vance double down on the Trump admin’s support for crypto — and honestly, this is the clearest stance we've seen from the White House in years.

🟢 Owns Bitcoin

🟢 Understands its role as “digital gold/cash”

🟢 Believes innovation shouldn’t be blocked — it should be tested by the market

Letting crypto prove itself without being choked by regulation is exactly the kind of leadership this space needs.

You don't have to love every coin or protocol — but suppressing an entire financial frontier is how you lose global relevance.

America's next edge won't come from more red tape. It

🟢 Owns Bitcoin

🟢 Understands its role as “digital gold/cash”

🟢 Believes innovation shouldn’t be blocked — it should be tested by the market

Letting crypto prove itself without being choked by regulation is exactly the kind of leadership this space needs.

You don't have to love every coin or protocol — but suppressing an entire financial frontier is how you lose global relevance.

America's next edge won't come from more red tape. It

- Reward

- like

- Comment

- Share

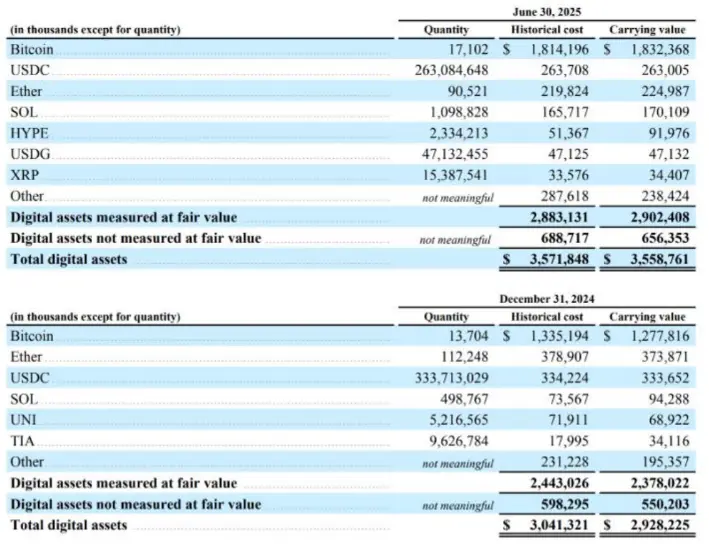

Galaxy just flipped from a $295M loss to a $30M profit — and quietly added 4,272 BTC to their books.

They now hold 17,102 BTC (~$1.95B), alongside ETH, USDC, SOL, and XRP — total digital assets: $3.56B.

This isn’t just a rebound.

It’s a signal that BTC isn’t dead capital anymore — it’s working capital for global firms with crypto-native balance sheets.

Galaxy isn’t betting on Bitcoin.

They’re operating on it.

#GalaxyDigital # Bitcoin #BTC # CryptoTreasury #DigitalAssets # Finance #MacroCrypto # Q2Earnings

They now hold 17,102 BTC (~$1.95B), alongside ETH, USDC, SOL, and XRP — total digital assets: $3.56B.

This isn’t just a rebound.

It’s a signal that BTC isn’t dead capital anymore — it’s working capital for global firms with crypto-native balance sheets.

Galaxy isn’t betting on Bitcoin.

They’re operating on it.

#GalaxyDigital # Bitcoin #BTC # CryptoTreasury #DigitalAssets # Finance #MacroCrypto # Q2Earnings

- Reward

- 1

- 1

- Share

Sekayla28 :

:

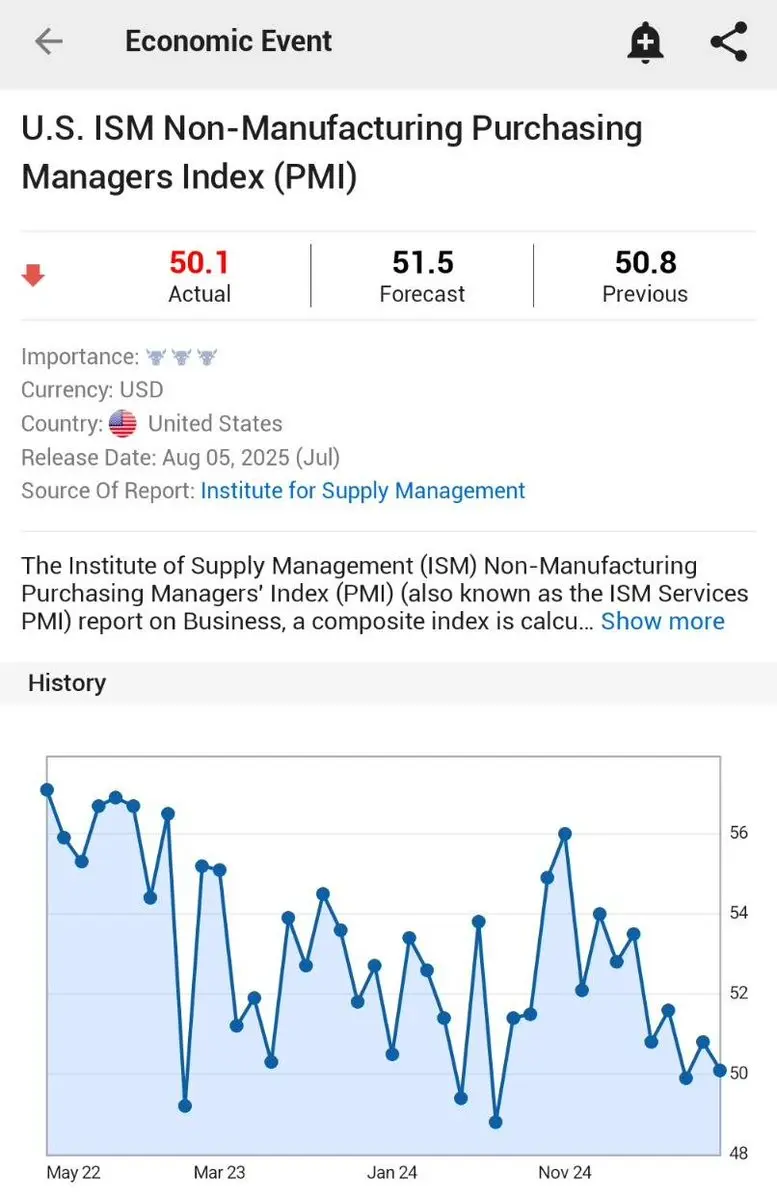

It's good when there's a profit. But the scale of the numbers is astounding.U.S. service sector just barely avoided contraction — ISM at 50.1 vs 51.5 expected.

But prices? Up. Way up. Inflation in services is re-accelerating even as demand stalls.

This is the stagflation setup economists fear.

Now layer in Trump’s tariff threat:

150–250% on pharmaceuticals. Chips next.

You’ve got supply-side inflation, weak growth, and political shocks… all at once.

In this kind of environment, crypto isn’t risk-on — it’s optionality.

It’s what you hold when policy gets erratic and currency trust gets tested.

#Macro # Stagflation #Inflation # Tariffs #Bitcoin # CryptoFinance #ISM # Trump

But prices? Up. Way up. Inflation in services is re-accelerating even as demand stalls.

This is the stagflation setup economists fear.

Now layer in Trump’s tariff threat:

150–250% on pharmaceuticals. Chips next.

You’ve got supply-side inflation, weak growth, and political shocks… all at once.

In this kind of environment, crypto isn’t risk-on — it’s optionality.

It’s what you hold when policy gets erratic and currency trust gets tested.

#Macro # Stagflation #Inflation # Tariffs #Bitcoin # CryptoFinance #ISM # Trump

- Reward

- like

- Comment

- Share

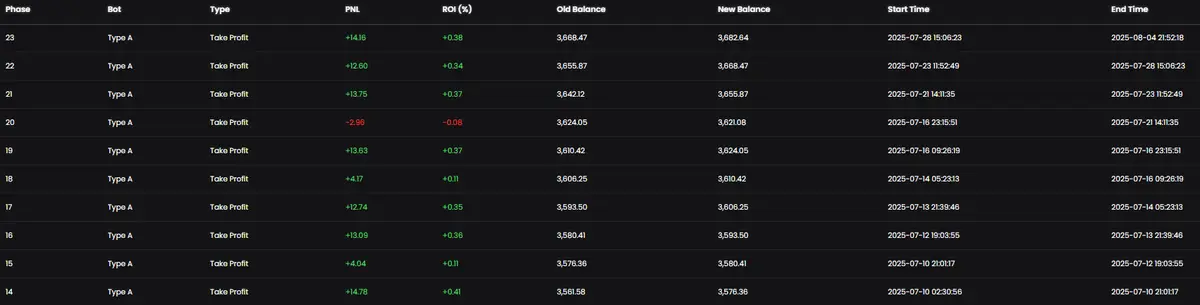

📊 Bot Performance Report

📍 UID: 2471460x | Exchange: @Gate_io

📆 Phase 14 → 23

🗓 Period: 2025-07-10 → 2025-08-04

📌 Trade Summary:

• ✅ Profitable Trades: 9 / 10

• ❌ Losing Trades: 1 (Phase 20)

• 💰 Net Profit: +102.87 USDT

• 💵 Balance Growth:

from $3,561.58 → $3,682.64

• 📊 Max ROI: +0.41% (Phase 14)

• 📉 Drawdown: -2.96 USDT (Phase 20)

The bot performed with strong consistency, with 9/10 successful trades and a quick recovery from its single loss. ROI stayed stable throughout, maintaining a healthy upward trend.

📈 Let performance lead. Let automation scale.

#AITrading # CryptoBot #Perf

📍 UID: 2471460x | Exchange: @Gate_io

📆 Phase 14 → 23

🗓 Period: 2025-07-10 → 2025-08-04

📌 Trade Summary:

• ✅ Profitable Trades: 9 / 10

• ❌ Losing Trades: 1 (Phase 20)

• 💰 Net Profit: +102.87 USDT

• 💵 Balance Growth:

from $3,561.58 → $3,682.64

• 📊 Max ROI: +0.41% (Phase 14)

• 📉 Drawdown: -2.96 USDT (Phase 20)

The bot performed with strong consistency, with 9/10 successful trades and a quick recovery from its single loss. ROI stayed stable throughout, maintaining a healthy upward trend.

📈 Let performance lead. Let automation scale.

#AITrading # CryptoBot #Perf

- Reward

- like

- Comment

- Share

Metaplanet just added another 463 BTC.

That’s 17,595 BTC now on their balance sheet — quietly becoming one of the largest corporate holders in the world.

They’re not speculating.

They’re executing a capital strategy built on conviction.

While most public companies debate “digital transformation,” Metaplanet is turning Bitcoin into a treasury operating system.

This isn’t just accumulation. It’s infrastructure.

#Bitcoin # Metaplanet #BTC # CorporateTreasury #Macro # DigitalAssets #CryptoFinance

That’s 17,595 BTC now on their balance sheet — quietly becoming one of the largest corporate holders in the world.

They’re not speculating.

They’re executing a capital strategy built on conviction.

While most public companies debate “digital transformation,” Metaplanet is turning Bitcoin into a treasury operating system.

This isn’t just accumulation. It’s infrastructure.

#Bitcoin # Metaplanet #BTC # CorporateTreasury #Macro # DigitalAssets #CryptoFinance

- Reward

- like

- Comment

- Share

🗓 MACROECONOMIC CALENDAR

⏰WEEK 2 OF AUGUST

➡️ This week doesn’t have many major news events, but don’t forget to take note of the days with scheduled news releases. Whether big or small, these events can still trigger certain market movements!

⭕️ Current probability of a Fed rate cut on September 18 (according to CME):

+ No change: 22.3%

+ 25bps cut: 77.7%

⏰WEEK 2 OF AUGUST

➡️ This week doesn’t have many major news events, but don’t forget to take note of the days with scheduled news releases. Whether big or small, these events can still trigger certain market movements!

⭕️ Current probability of a Fed rate cut on September 18 (according to CME):

+ No change: 22.3%

+ 25bps cut: 77.7%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

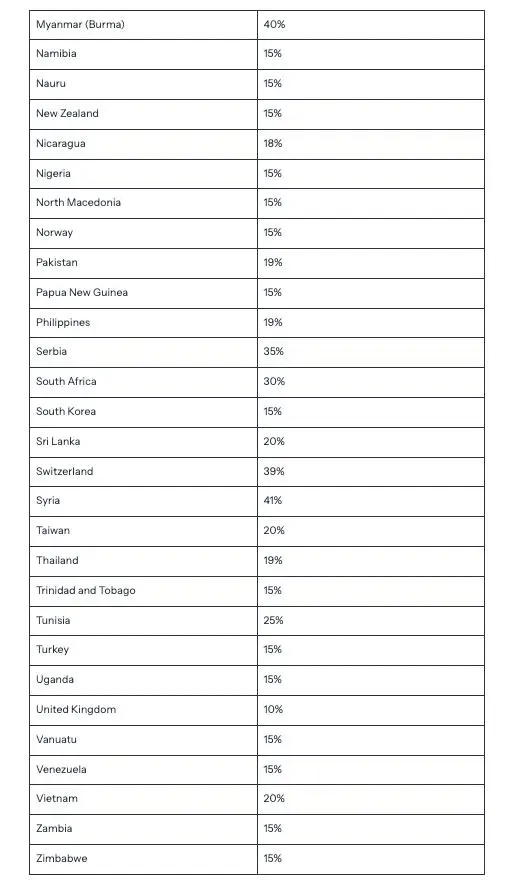

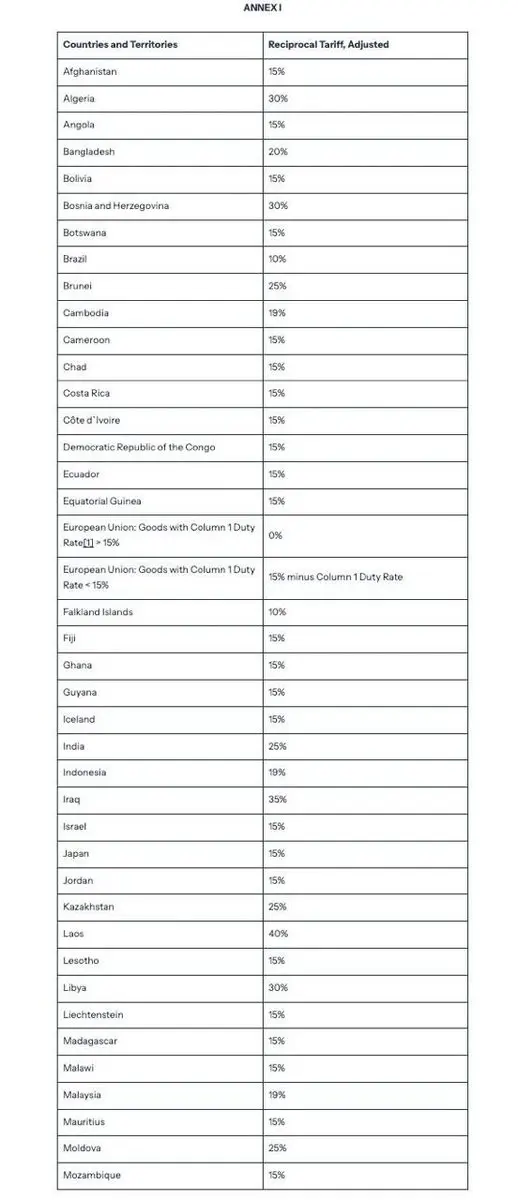

Trump just raised tariffs on Canada to 35%.

More hikes are coming — targeting countries across Asia, Europe, even Latin America.

This isn’t about trade efficiency anymore.

It’s about leverage, retaliation, and showing who controls the terms.

But here’s the thing: global supply chains can reroute.

Capital flows? Much harder.

That’s why open, borderless financial infrastructure — like crypto — matters more than ever.

Because when goods get taxed and payments get gated, programmable money becomes geopolitical neutrality.

#Tariffs # TradePolicy #Crypto # ProgrammableMoney #MacroFinance # Trump #Globa

More hikes are coming — targeting countries across Asia, Europe, even Latin America.

This isn’t about trade efficiency anymore.

It’s about leverage, retaliation, and showing who controls the terms.

But here’s the thing: global supply chains can reroute.

Capital flows? Much harder.

That’s why open, borderless financial infrastructure — like crypto — matters more than ever.

Because when goods get taxed and payments get gated, programmable money becomes geopolitical neutrality.

#Tariffs # TradePolicy #Crypto # ProgrammableMoney #MacroFinance # Trump #Globa

- Reward

- like

- Comment

- Share

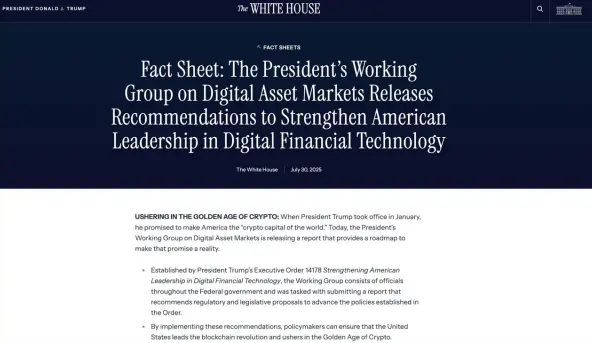

The White House just released the most aggressive crypto-forward roadmap in U.S. history.

It ends regulation-by-enforcement.

Creates safe harbor + sandbox rules.

Puts stablecoins under federal law.

And explicitly bans CBDCs.

Whether you love Trump or not, this is how a government embraces innovation:

• DeFi integrated into TradFi

• Banks greenlit for crypto services

• Clarity for staking, wrapping, self-custody

• No more weaponizing banking access (goodbye Choke Point 2.0)

America’s making a play to lead the Golden Age of Crypto — not just regulate it.

This isn’t just policy. It’s positioning.

It ends regulation-by-enforcement.

Creates safe harbor + sandbox rules.

Puts stablecoins under federal law.

And explicitly bans CBDCs.

Whether you love Trump or not, this is how a government embraces innovation:

• DeFi integrated into TradFi

• Banks greenlit for crypto services

• Clarity for staking, wrapping, self-custody

• No more weaponizing banking access (goodbye Choke Point 2.0)

America’s making a play to lead the Golden Age of Crypto — not just regulate it.

This isn’t just policy. It’s positioning.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

Heads up, everyone! The Fed will announce its interest rate decision at 1 AM (UTC+7) tonight.

According to CME FedWatch, nearly 97% of investors expect rates to stay unchanged, while only 3% anticipate a small hike.

Even BlackRock leans toward no change.

🔥 What’s your prediction? Are you with the majority — or expecting a surprise move?

According to CME FedWatch, nearly 97% of investors expect rates to stay unchanged, while only 3% anticipate a small hike.

Even BlackRock leans toward no change.

🔥 What’s your prediction? Are you with the majority — or expecting a surprise move?

MOVE2.02%

- Reward

- like

- Comment

- Share

🚨 Something new and exclusive is coming your way

@CoinCrazeCen × @Gate_io this week 🚀

There are exciting signs of a Special Reward Drop

Looks like something big is slowly unfolding...

⏳Stay tuned! @CoinCrazeKR

#Coincraze# #Gate# #CryptoEvent# #Rewarddrop#

@CoinCrazeCen × @Gate_io this week 🚀

There are exciting signs of a Special Reward Drop

Looks like something big is slowly unfolding...

⏳Stay tuned! @CoinCrazeKR

#Coincraze# #Gate# #CryptoEvent# #Rewarddrop#

LOOKS-2.73%

- Reward

- like

- Comment

- Share

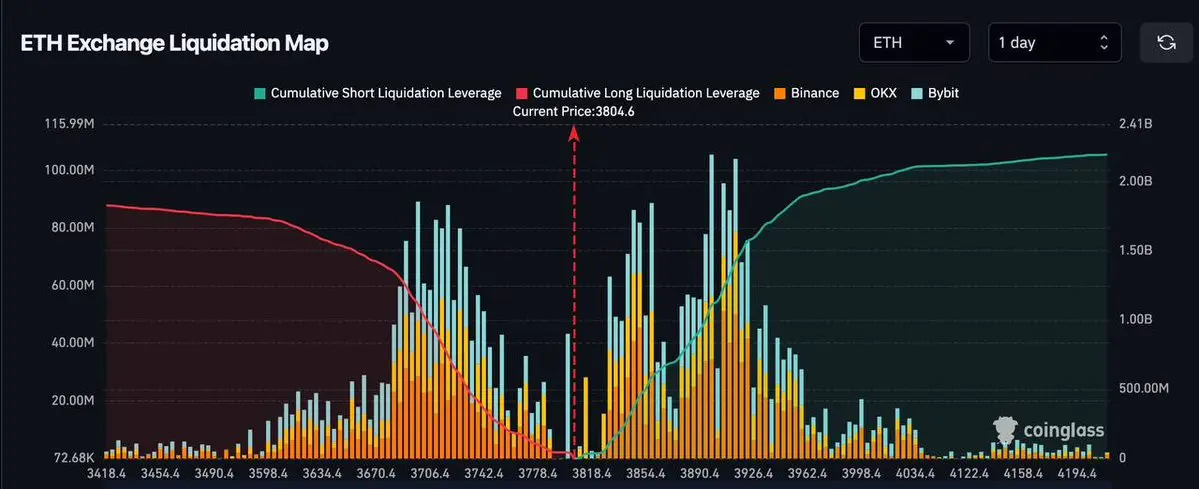

🔥 $2 billion in short positions will be liquidated if $ETH returns to the $4,000

On the flip side, over $1.6 billion in long positions will be wiped out if ETH breaks below $3,630.

ETH is currently at $3,800, exactly $200 away from both liquidation zones.

Which side will get liquidated first?

#coincraze # ccc #btcprice # Newsnight #newscrypto # cryptocurrency #discuss # Coincrazebot #tradingbot

On the flip side, over $1.6 billion in long positions will be wiped out if ETH breaks below $3,630.

ETH is currently at $3,800, exactly $200 away from both liquidation zones.

Which side will get liquidated first?

#coincraze # ccc #btcprice # Newsnight #newscrypto # cryptocurrency #discuss # Coincrazebot #tradingbot

- Reward

- like

- Comment

- Share

The court just upheld Trump’s move to kill the $800 de minimis exemption. No more duty-free Chinese imports to the U.S.

This changes the game for fast fashion, e-comm startups, and any business built on just-in-time global shipping.

It’s not just about Shein and Temu. It’s about the end of cheap, direct-to-door cross-border commerce as we know it.

When compliance gets this expensive, companies (and AI agents) will start choosing open financial infrastructure.

Crypto doesn’t dodge tariffs — but it removes permissioned rails from the equation.

Trade barriers are back. Programmable money just bec

This changes the game for fast fashion, e-comm startups, and any business built on just-in-time global shipping.

It’s not just about Shein and Temu. It’s about the end of cheap, direct-to-door cross-border commerce as we know it.

When compliance gets this expensive, companies (and AI agents) will start choosing open financial infrastructure.

Crypto doesn’t dodge tariffs — but it removes permissioned rails from the equation.

Trade barriers are back. Programmable money just bec

- Reward

- like

- Comment

- Share

🚨 U.S. Treasury just raised its Q3 borrowing estimate to $1.007 trillion — up $453B from April’s forecast.

Why?

Lower starting cash and weaker-than-expected net inflows.

Add another $590B expected in Q4, and we’re looking at $1.6T+ in new debt just in the back half of 2025.

In contrast, Q2 borrowing was just $65B — dramatically undershooting forecasts thanks to tight cash management.

What does this mean?

The U.S. is entering a phase of rapid re-leveraging into year-end.

Higher issuance = upward pressure on yields.

And for crypto markets? Liquidity dynamics will matter more than rate guidance.

Why?

Lower starting cash and weaker-than-expected net inflows.

Add another $590B expected in Q4, and we’re looking at $1.6T+ in new debt just in the back half of 2025.

In contrast, Q2 borrowing was just $65B — dramatically undershooting forecasts thanks to tight cash management.

What does this mean?

The U.S. is entering a phase of rapid re-leveraging into year-end.

Higher issuance = upward pressure on yields.

And for crypto markets? Liquidity dynamics will matter more than rate guidance.

- Reward

- like

- Comment

- Share

JPMorgan is charging fintechs like Plaid for API access.

Why? 1.89B data requests in June — but only 13% came from real users. The rest? Automated pings, background refreshes, API noise.

This isn’t just about fees. It’s a sign:

Legacy banking infrastructure wasn’t built for real-time, permissionless finance. Especially not for AI or automation.

Crypto rails, on the other hand, don’t care if your transaction comes from a user, a bot, or a smart contract.

It’s open, direct, and doesn’t need Plaid in the middle.

If AI is the front end of money, crypto is the only backend that actually fits.

#JPMo

Why? 1.89B data requests in June — but only 13% came from real users. The rest? Automated pings, background refreshes, API noise.

This isn’t just about fees. It’s a sign:

Legacy banking infrastructure wasn’t built for real-time, permissionless finance. Especially not for AI or automation.

Crypto rails, on the other hand, don’t care if your transaction comes from a user, a bot, or a smart contract.

It’s open, direct, and doesn’t need Plaid in the middle.

If AI is the front end of money, crypto is the only backend that actually fits.

#JPMo

- Reward

- like

- Comment

- Share

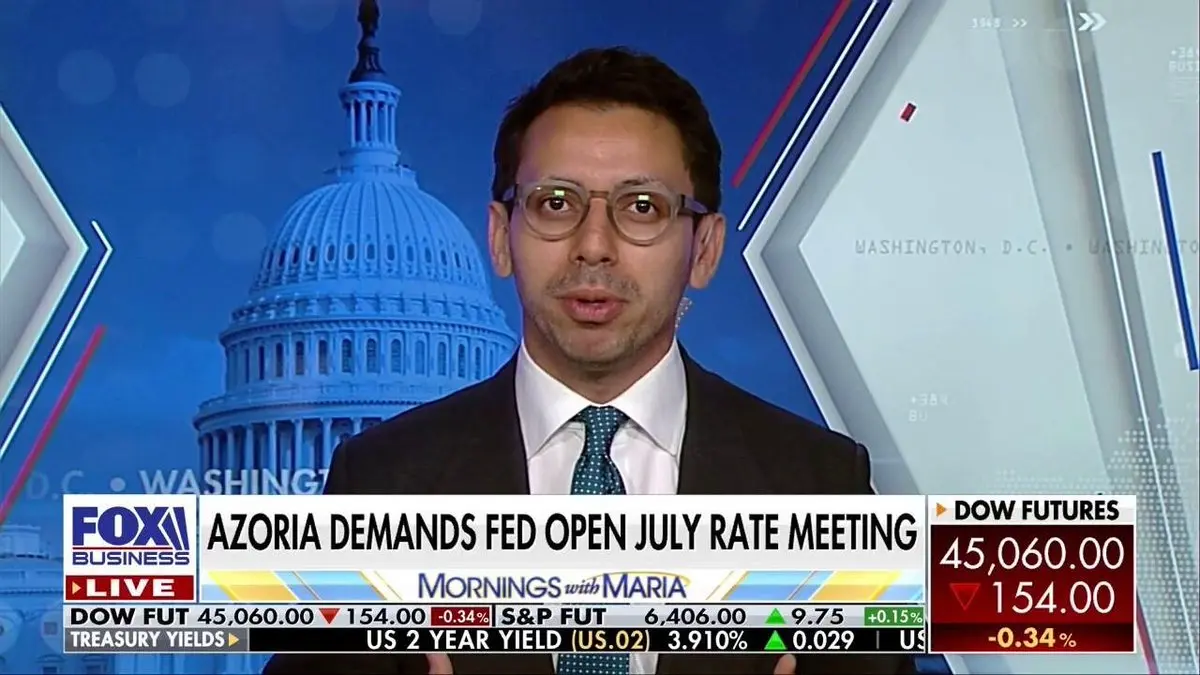

A federal judge just ruled the Fed doesn’t have to open its FOMC meetings to the public.

No surprise there — but it highlights the deeper issue:

We’re in a world where trillion-dollar decisions are made behind closed doors… and markets are expected to just interpret tone.

In crypto, everything’s on-chain.

In TradFi, everything’s off-record — until it’s not.

If the Fed wants trust, it doesn’t need to livestream meetings.

But it does need to catch up to an era where transparency isn’t a luxury — it’s infrastructure.

#FOMC # Fed #Transparency # CryptoVsTradFi #MonetaryPolicy # Bitcoin #MacroFinance

No surprise there — but it highlights the deeper issue:

We’re in a world where trillion-dollar decisions are made behind closed doors… and markets are expected to just interpret tone.

In crypto, everything’s on-chain.

In TradFi, everything’s off-record — until it’s not.

If the Fed wants trust, it doesn’t need to livestream meetings.

But it does need to catch up to an era where transparency isn’t a luxury — it’s infrastructure.

#FOMC # Fed #Transparency # CryptoVsTradFi #MonetaryPolicy # Bitcoin #MacroFinance

- Reward

- like

- Comment

- Share