Ripple’s Yield Push Puts XRP Back in Institutional Focus

Ripple's efforts are rejuvenating interest in XRP, which has recently dipped but shows potential for recovery. With price hovering near $2, XRP could rise to $2.48 if bullish momentum builds, attracting institutional investments.

XRP0.15%

CryptoDaily·4m ago

Top Altcoins Traders Are Monitoring While the Market Remains in Fear

Table of Contents

2. Solana Eyes Potential Breakout as Price Nears Key Resistance Level

4. Uniswap (UNI) Eyes Potential Rebound Despite Recent Slump

6. Ethena's Price Struggle: Can It Bounce Back?

8. Conclusion

Despite nervous market vibes, savvy traders keep their

CryptoDaily·9m ago

Yearn Finance Legacy Contract Exploit Raises $300K Concern

A deprecated iEarn contract lost $300K after an exploit, with stolen funds swapped to 103 ETH held at a known address.

Yearn confirmed v2 Vaults and active contracts were unaffected, limiting impact to outdated systems deployed before Vaults.

The incident underscores legacy DeFi risks

CryptoFrontNews·13m ago

Altcoin Market Flashes Rare Buy Signal – 3 Coins Set for a Breakout Run

LINK shows rising demand from RWA growth and may target 30–40 dollars soon.

AVAX gains institutional attention and holds strong support with breakout potential toward 25–30 dollars.

SOL forms a bullish base and may reach 300 dollars after breaking resistance.

The altcoin market now

CryptoNewsLand·23m ago

Is the Bitcoin selling pressure about to end? K33: Long-term holders are exiting, entering the final stage, and institutional demand in 2026 holds a hidden turning point

Crypto research and brokerage firm K33 Research pointed out that after two years of large-scale selling, Bitcoin long-term holders (LTH) are approaching a saturation point of selling pressure. As early investors' profit-taking pressure gradually diminishes, on-chain selling pressure is expected to ease significantly, potentially bringing a market turnaround.

(Background: Glassnode: Bitcoin weak volatility, is a major wave coming?)

(Additional context: 2025 Bitcoin forecast collective crash, why are institutions all wrong?)

Crypto research and brokerage firm K33 Research released a new report on December 16, stating that Bitcoin long-term holders (LTH) have nearly exhausted their selling pressure after two years of large-scale selling. As early investors' profit-taking pressure gradually diminishes, on-chain sell

動區BlockTempo·24m ago

$1.9T Norway Wealth Fund Backs Metaplanet’s Bitcoin Expansion

Key Takeaways:

Norway’s $1.9 trillion sovereign wealth fund has backed all of Metaplanet’s proposals tied to Bitcoin-related capital expansion.

The vote supports share issuance and capital changes that strengthen Metaplanet’s balance sheet and Bitcoin strategy.

The move highlights how large

BTC0.33%

CryptoNinjas·41m ago

Datagram Launches Closed Beta of Decentralized, No-Logs VPN Network

The VPN maintains the robustness and privacy benefits of a distributed network while offering superior performance on par with centralized providers by doing away with relay chains and multilayer encryption layers.

Instead of relying on trust, Datagram VPN uses architectural limitations to

DGRAM-13.39%

TheNewsCrypto·51m ago

Securitize announces the launch of an "on-chain" stock trading marketplace in Q1 next year: real listed company equity will be tokenized on the blockchain, and users can also participate in DeFi interactions.

Asset tokenization platform Securitize announces that it will launch a product called "Stocks on Securitize" in the first quarter of 2026. The company claims this is the world's first fully compliant, fully on-chain trading platform for real listed company stocks, aiming to bring traditional financial markets closer to Web3 infrastructure, allowing investors to directly own and trade shares of truly public listed companies via blockchain.

(Background: What are the future and risks of financial asset tokenization? An in-depth analysis of RWA in a 73-page report by global securities regulators)

(Additional background: Huili Securities partners with Securitize Japan to issue tokenized securities! Allowing retail investors to participate in Sony's film "The Island")

Asset tokenization platform Securitize announced today (17) via the X platform that it will launch in 20

動區BlockTempo·59m ago

The on-chain game of the payment giants: The battle for the $40 trillion settlement layer

The payments industry may seem "old," but it has always been the earliest and most easily restructured part of the financial system through technology.

While the market is still debating whether "cryptocurrency is an asset," two major payment giants—Visa and Mastercard—have reached a consensus on a more fundamental engineering issue: Is there a more efficient settlement layer that can be embedded into the existing payment system instead of starting from scratch?

The answer is stablecoins.

Recently, Visa announced the opening of USDC settlement to banks in the United States via Solana; previously, Mastercard partnered with Ripple to test RLUSD-based transaction settlement on XRPL.

This is not just a short-term pilot but a clear signal that the global payment infrastructure is beginning to migrate toward a new generation of settlement layers.

Visa: Making stablecoins into a "settlement"

USDC0.02%

金色财经_·1h ago

Morning Minute: A Big Day for Stablecoins

Decrypt's Art, Fashion, and Entertainment Hub.

Discover SCENE

Morning Minute is a daily newsletter written by Tyler Warner . The analysis and opinions expressed are his own and do not necessarily reflect those of Decrypt. Subscribe to the Morning Minute on Substack .

GM!

Today's top news:

Decrypt·1h ago

Tether launches Pearpass, a peer-to-peer password manager that does not use cloud servers

Tether has officially launched PearPass, a peer-to-peer password management application focused on privacy and security. Unlike traditional password managers that rely on centralized cloud servers, PearPass operates entirely without cloud infrastructure.

TapChiBitcoin·1h ago

ICE invests 2 billion, valuation of 8 billion USD. How does Polymarket justify this valuation?

Intercontinental Exchange (ICE) announces an investment of up to $2 billion in Polymarket, valuing the company at $8 billion. This is the largest private equity investment from traditional Wall Street and will position Polymarket as a global distributor of event-driven data, potentially launching the POLY token. The investment marks a turning point for Polymarket and its founders, as ICE plans to boost revenue through data services while exploring the path to productize information.

金色财经_·1h ago

In-depth Analysis of Aave Internal Conflict: The Power Struggle Between Protocol and Frontend

Author: Chloe, ChainCatcher

Recently, the controversy between Aave DAO and Aave Labs has been exposed. The former is responsible for governance protocols, while the latter develops Aave products.

The focus of this dispute is the fee issue arising from the recent announcement of deep integration with CoW Swap. An Aave DAO member using the pseudonym EzR3aL pointed out that Aave Labs recently integrated CoW Swap services, originally intended to optimize user trading paths, but on-chain data shows that the fees generated from this integration no longer flow into the DAO, but directly into Labs' private address. At the current rate, approximately $10 million will flow out of the DAO treasury in one year.

EzR3aL raised concerns to the community: why was there no prior consultation with the DAO regarding the fees?

金色财经_·1h ago

JPMorgan "Escapes" from the Federal Reserve's $350 billion assault on US Treasuries

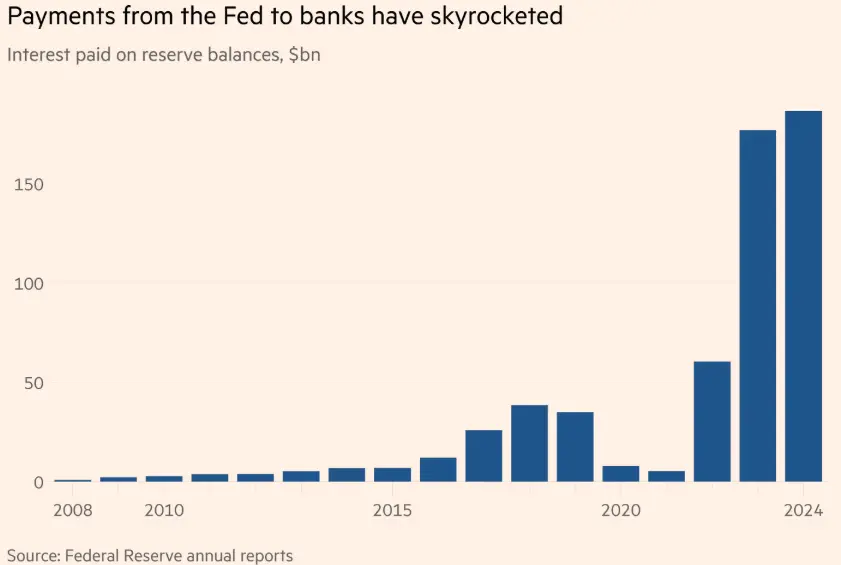

JPMorgan Chase has withdrawn nearly $350 billion in cash from its Federal Reserve account since 2023 and has allocated most of it into U.S. government bonds. This move is a defensive strategy the bank has adopted to counter the threat of rate cuts that could erode its profits.

According to data compiled by industry tracking agency BankRegData, as of the third quarter of this year, this bank, with assets exceeding $4 trillion, has seen its balance at the Federal Reserve plummet from $409 billion at the end of 2023 to just $63 billion.

During the same period, the bank increased its holdings of U.S. Treasury bonds from $231 billion to $450 billion. This operation allowed it to lock in higher yields in advance to prepare for Federal Reserve rate cuts.

These fund transfers reflect how this largest U.S. bank is preparing for the end of a period of easy profits. During that period, the bank will

金色财经_·1h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28