#ETHTrendWatch

In the early days of 2026, as the crypto market leaves behind the volatility of the past and enters a more institutional and technologically mature phase, Ethereum (#ETH) is at the very heart of this transformation.

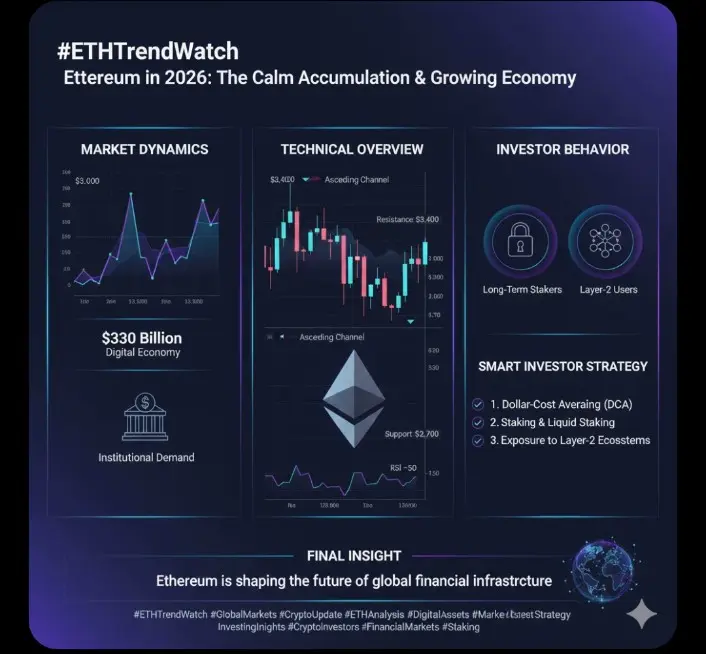

1. Market Analysis: Ethereum Enters a "Valuation" Period

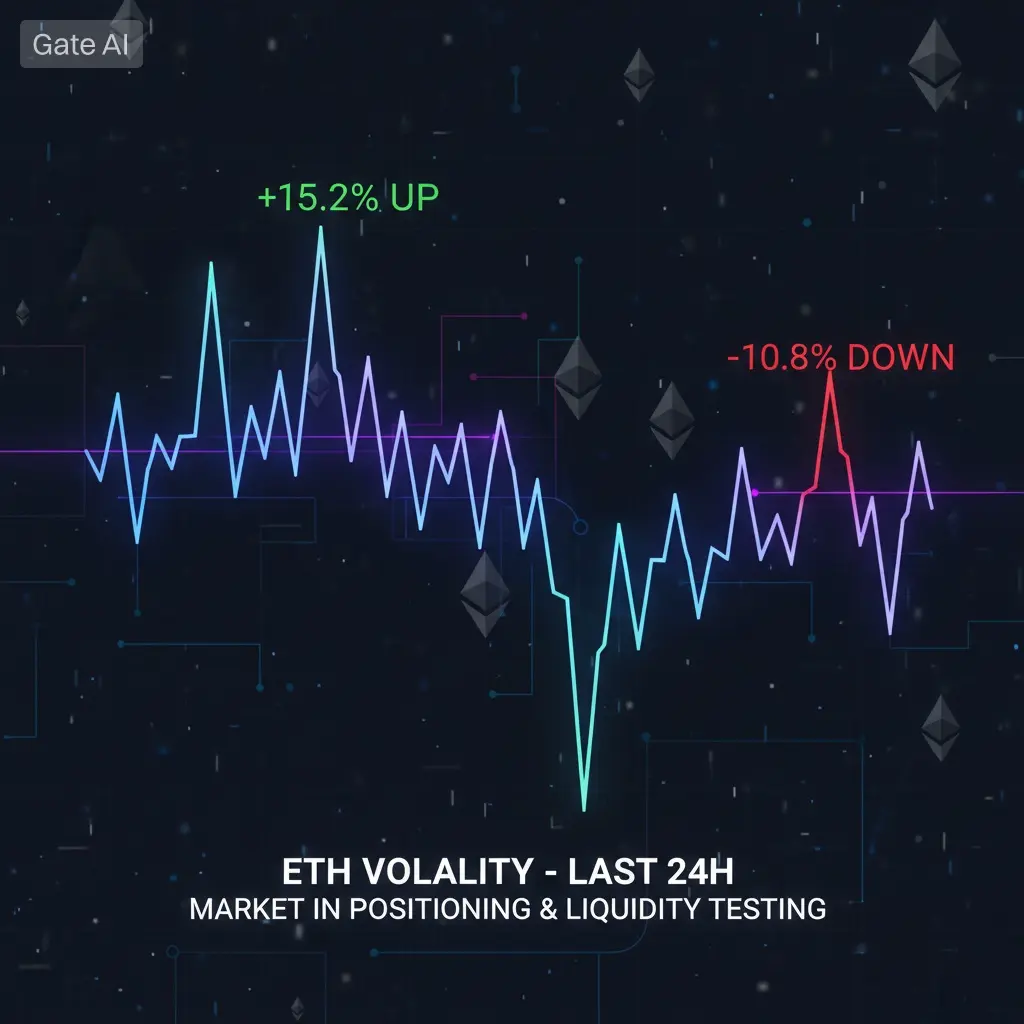

The speculative price movements of 2024 and 2025 have given way to an on-chain economy-based valuation in 2026.

Current Price Status: As of January 2026, ETH is experiencing an accumulation process in the $3,000 - $3,400 range. The correction following the all-time high of $4,950 seen in August of last year ha

In the early days of 2026, as the crypto market leaves behind the volatility of the past and enters a more institutional and technologically mature phase, Ethereum (#ETH) is at the very heart of this transformation.

1. Market Analysis: Ethereum Enters a "Valuation" Period

The speculative price movements of 2024 and 2025 have given way to an on-chain economy-based valuation in 2026.

Current Price Status: As of January 2026, ETH is experiencing an accumulation process in the $3,000 - $3,400 range. The correction following the all-time high of $4,950 seen in August of last year ha