# ETHUnderPressure

6.25K

ETH is under price pressure while upgrades and Layer-2 activity continue. How do you position ETH when price and fundamentals diverge?

xxx40xxx

#ETHUnderPressure

📊 ETH/USDT Technical Overview — Structured Market Analysis

🧭 Market Summary

ETH has shown a strong recovery over the past 24 hours, supported by rising price action and increasing trading volume. Technically, the market structure remains bullish in the short term. However, overbought indicators and proximity to a key resistance zone suggest an elevated risk of short-term profit-taking and potential pullbacks.

📈 Price & Volume Snapshot

Metric

Value

Current Price

2,384.46 USDT

24H Low / High

2,157.31 / 2,397.05 USDT

24H Price Change

+3.39%

24H Trading Volume

764,397,335 USD

📊 ETH/USDT Technical Overview — Structured Market Analysis

🧭 Market Summary

ETH has shown a strong recovery over the past 24 hours, supported by rising price action and increasing trading volume. Technically, the market structure remains bullish in the short term. However, overbought indicators and proximity to a key resistance zone suggest an elevated risk of short-term profit-taking and potential pullbacks.

📈 Price & Volume Snapshot

Metric

Value

Current Price

2,384.46 USDT

24H Low / High

2,157.31 / 2,397.05 USDT

24H Price Change

+3.39%

24H Trading Volume

764,397,335 USD

ETH2,02%

- Reward

- like

- Comment

- Repost

- Share

#ETHUnderPressure captures the narrative around recent challenges within the Ethereum ecosystem, one of the world’s largest blockchain networks by market capitalization and the leading smart contract platform powering decentralized applications, DeFi, and NFTs.

This hashtag highlights moments when Ethereum’s price, network activity, developer momentum, or macroeconomic pressures combine to create bearish sentiment or heightened risk awareness among investors, traders, and stakeholders.

Unique Market Position

Ethereum is not just a digital asset; it is a foundational layer for thousands of dece

This hashtag highlights moments when Ethereum’s price, network activity, developer momentum, or macroeconomic pressures combine to create bearish sentiment or heightened risk awareness among investors, traders, and stakeholders.

Unique Market Position

Ethereum is not just a digital asset; it is a foundational layer for thousands of dece

ETH2,02%

- Reward

- 2

- Comment

- Repost

- Share

🚨 ETH Price Under Pressure, But Fundamentals Remain Strong

Current Price: $2,286.86

Daily Change: -$142.05 (-5.85%)

Intraday High / Low: $2,429.09 / $2,163.14

📉 Price vs. Fundamentals: The Divergence

Ethereum is showing short-term price weakness while network fundamentals continue to grow:

Price Signals:

ETH is consolidating below key resistance levels.

Short-term sentiment is cautious, with traders hesitant to push prices higher.

Fundamentals:

On-chain activity and active addresses are rising steadily.

Layer-2 solutions (Arbitrum, Optimism, Base) are processing tens of millions of transacti

Current Price: $2,286.86

Daily Change: -$142.05 (-5.85%)

Intraday High / Low: $2,429.09 / $2,163.14

📉 Price vs. Fundamentals: The Divergence

Ethereum is showing short-term price weakness while network fundamentals continue to grow:

Price Signals:

ETH is consolidating below key resistance levels.

Short-term sentiment is cautious, with traders hesitant to push prices higher.

Fundamentals:

On-chain activity and active addresses are rising steadily.

Layer-2 solutions (Arbitrum, Optimism, Base) are processing tens of millions of transacti

ETH2,02%

- Reward

- 11

- 9

- Repost

- Share

DragonFlyOfficial :

:

ETH price may feel weak now, but if you look at the fundamentals—Layer-2 growth, network upgrades, and increasing institutional interest—the long-term picture is strong. 🟢 Patience and smart accumulation could be the key right now. What’s your strategy for these dips?View More

🚨 ETH Price Under Pressure, But Fundamentals Remain Strong

Current Price: $2,286.86

Daily Change: -$142.05 (-5.85%)

Intraday High / Low: $2,429.09 / $2,163.14

📉 Price vs. Fundamentals: The Divergence

Ethereum is showing short-term price weakness while network fundamentals continue to grow:

Price Signals:

ETH is consolidating below key resistance levels.

Short-term sentiment is cautious, with traders hesitant to push prices higher.

Fundamentals:

On-chain activity and active addresses are rising steadily.

Layer-2 solutions (Arbitrum, Optimism, Base) are processing tens of millions of transacti

Current Price: $2,286.86

Daily Change: -$142.05 (-5.85%)

Intraday High / Low: $2,429.09 / $2,163.14

📉 Price vs. Fundamentals: The Divergence

Ethereum is showing short-term price weakness while network fundamentals continue to grow:

Price Signals:

ETH is consolidating below key resistance levels.

Short-term sentiment is cautious, with traders hesitant to push prices higher.

Fundamentals:

On-chain activity and active addresses are rising steadily.

Layer-2 solutions (Arbitrum, Optimism, Base) are processing tens of millions of transacti

ETH2,02%

- Reward

- 1

- 1

- Repost

- Share

repanzal :

:

Happy New Year! 🤑#ETHUnderPressure

ETH Under Pressure: Navigating Price Divergence Amid Upgrades and Layer-2 Growth

Ethereum is currently experiencing price pressure, even as the network continues to see significant upgrades and strong activity on Layer-2 solutions. This divergence between short-term price action and long-term fundamentals raises an important question for traders and investors: how should ETH be positioned when technical weakness appears while the ecosystem’s structural narrative remains intact? From my perspective, the situation demands a nuanced strategy that balances risk management, funda

ETH Under Pressure: Navigating Price Divergence Amid Upgrades and Layer-2 Growth

Ethereum is currently experiencing price pressure, even as the network continues to see significant upgrades and strong activity on Layer-2 solutions. This divergence between short-term price action and long-term fundamentals raises an important question for traders and investors: how should ETH be positioned when technical weakness appears while the ecosystem’s structural narrative remains intact? From my perspective, the situation demands a nuanced strategy that balances risk management, funda

- Reward

- 4

- 8

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#ETHUnderPressure captures the narrative around recent challenges within the Ethereum ecosystem, one of the world’s largest blockchain networks by market capitalization and the leading smart contract platform powering decentralized applications, DeFi, and NFTs.

This hashtag highlights moments when Ethereum’s price, network activity, developer momentum, or macroeconomic pressures combine to create bearish sentiment or heightened risk awareness among investors, traders, and stakeholders.

Unique Market Position

Ethereum is not just a digital asset; it is a foundational layer for thousands of dece

This hashtag highlights moments when Ethereum’s price, network activity, developer momentum, or macroeconomic pressures combine to create bearish sentiment or heightened risk awareness among investors, traders, and stakeholders.

Unique Market Position

Ethereum is not just a digital asset; it is a foundational layer for thousands of dece

ETH2,02%

- Reward

- 7

- 11

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#ETHUnderPressure Capital rotation is one of the most misunderstood forces in the crypto market. It is not capital leaving the ecosystem, but capital changing its location based on risk, yield, and narrative strength. At the moment, the market is experiencing a multi-layered rotation that explains much of the current pressure, especially on Ethereum, while quietly laying the groundwork for the next expansion phase.

The first major shift is a renewed flight toward quality yield. As global rates stabilize, speculative capital is moving away from low-utility assets and into networks that offer su

The first major shift is a renewed flight toward quality yield. As global rates stabilize, speculative capital is moving away from low-utility assets and into networks that offer su

- Reward

- 3

- 1

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊#ETHUnderPressure

Ethereum is currently trading under noticeable pressure, making #ETHUnderPressure a key topic across crypto markets today. After a period of relative stability, ETH has started to face increasing resistance as broader market uncertainty and cautious risk sentiment weigh on price action. This pressure is not driven by a single factor but rather a combination of macro influences, Bitcoin’s consolidation, and internal Ethereum-specific dynamics. As the second-largest cryptocurrency by market capitalization, Ethereum’s behavior often reflects the overall health of the altcoin ma

Ethereum is currently trading under noticeable pressure, making #ETHUnderPressure a key topic across crypto markets today. After a period of relative stability, ETH has started to face increasing resistance as broader market uncertainty and cautious risk sentiment weigh on price action. This pressure is not driven by a single factor but rather a combination of macro influences, Bitcoin’s consolidation, and internal Ethereum-specific dynamics. As the second-largest cryptocurrency by market capitalization, Ethereum’s behavior often reflects the overall health of the altcoin ma

- Reward

- 3

- 7

- Repost

- Share

Falcon_Official :

:

1000x VIbes 🤑View More

#ETHUnderPressure

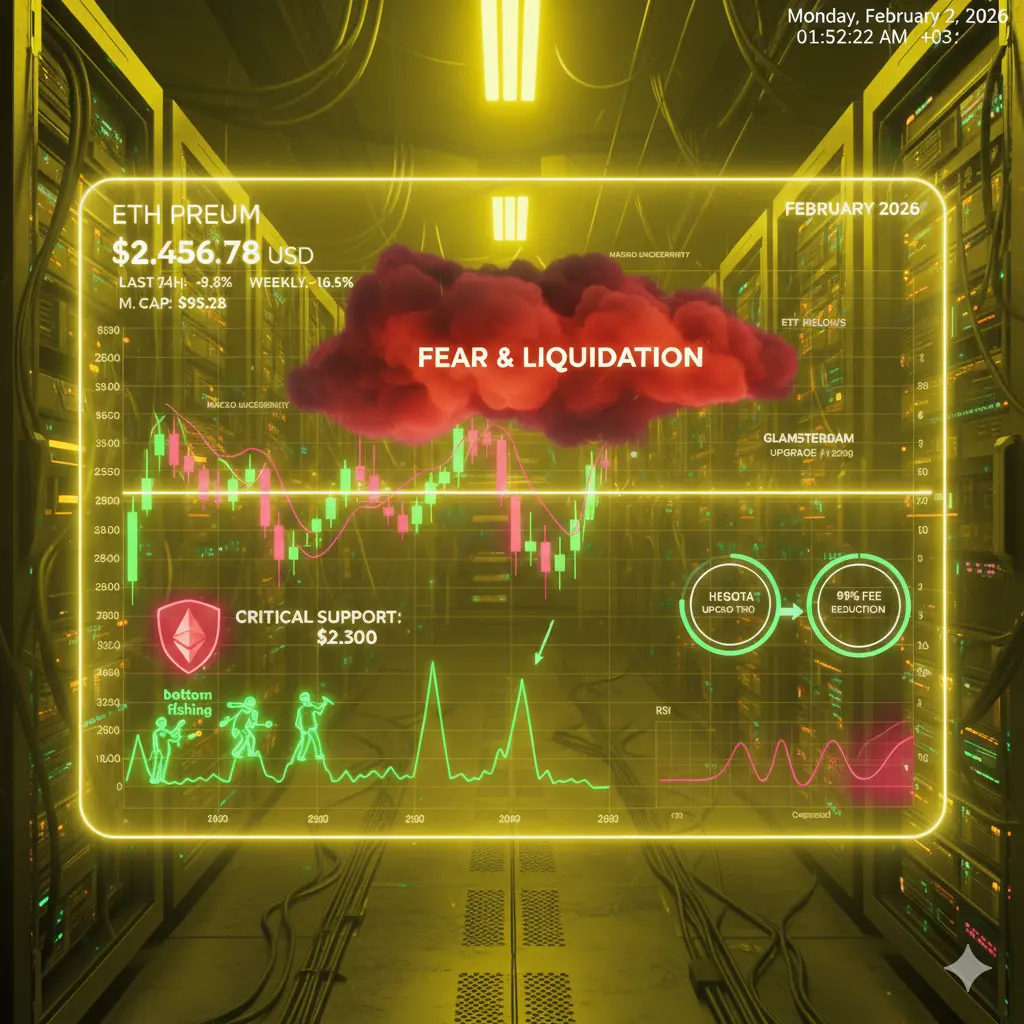

Ethereum’s Turning Point in February 2026: Innovations, Price Pressures, and Future Vision

As the second-largest asset in the cryptocurrency world, Ethereum (ETH) continues to dominate the headlines in early 2026 with a blend of technical breakthroughs and market volatility. As of February 2, 2026, the price of ETH is fluctuating within the $2,400 - $2,500 range, having experienced a value loss of approximately 9-10% in the last 24 hours. While this decline was triggered by a broader reduction in risk appetite across the crypto markets, Ethereum’s long-term potential remains

Ethereum’s Turning Point in February 2026: Innovations, Price Pressures, and Future Vision

As the second-largest asset in the cryptocurrency world, Ethereum (ETH) continues to dominate the headlines in early 2026 with a blend of technical breakthroughs and market volatility. As of February 2, 2026, the price of ETH is fluctuating within the $2,400 - $2,500 range, having experienced a value loss of approximately 9-10% in the last 24 hours. While this decline was triggered by a broader reduction in risk appetite across the crypto markets, Ethereum’s long-term potential remains

- Reward

- 42

- 31

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#CapitalRotation

Capital rotation is the movement of liquidity from one sector of the crypto market to another. Currently, we are seeing a three-stage shift that is putting unique pressure on the market:

1. The Flight to "Quality" Yield

As global interest rates stabilize in early 2026, capital is rotating out of high-risk, low-utility "meme" coins and back into Yield-Bearing Assets. Because Ethereum offers native staking rewards (projected to be more stable following the Glamsterdam upgrade), institutional desks are rotating their stablecoin reserves back into ETH to capture the 3-4% "real" y

Capital rotation is the movement of liquidity from one sector of the crypto market to another. Currently, we are seeing a three-stage shift that is putting unique pressure on the market:

1. The Flight to "Quality" Yield

As global interest rates stabilize in early 2026, capital is rotating out of high-risk, low-utility "meme" coins and back into Yield-Bearing Assets. Because Ethereum offers native staking rewards (projected to be more stable following the Glamsterdam upgrade), institutional desks are rotating their stablecoin reserves back into ETH to capture the 3-4% "real" y

- Reward

- 6

- 6

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

380.36K Popularity

9.47K Popularity

9.09K Popularity

5.07K Popularity

3.45K Popularity

6.25K Popularity

3.46K Popularity

4.08K Popularity

2.19K Popularity

43 Popularity

54.65K Popularity

69.68K Popularity

20.66K Popularity

26.96K Popularity

201.72K Popularity

News

View MoreData: The only group currently continuing to buy is the mega whales holding over 1,000 BTC. Retail investors holding less than 10 BTC have been continuously selling for a month.

4 m

Sky Protocol used a total of 8.5 million USDS to repurchase 130 million SKY in January.

10 m

India plans to explore cross-border use of digital rupees to reduce payment costs and improve trade settlement efficiency

12 m

Virtuals introduces the 60 Days framework, supporting a 60-day testing period and a reversible tokenization mechanism to enhance user flexibility and security.

15 m

Goldman Sachs: Ethereum's fundamentals are strong, with the average daily new addresses in January far surpassing the "DeFi Summer" period

15 m

Pin