# IranTradeSanctions

7.32K

Trump says the U.S. will impose a 25% tariff on countries trading with Iran. Do you think this will be enforced or political pressure remians? Could it escalate geopolitics and impact financial and crypto markets?

Discovery

#IranTradeSanctions

The "Domino Effect" in Global Trade: 2026 Iran Sanctions

As of the first weeks of 2026, the pressure on Iran has reached unprecedented levels. This time, the issue is not just about "what is being sold to Tehran," but rather "who is sitting at the table with Tehran."

1. Trump’s "25% Tariff": A Global Warning

In January 2026, U.S. President Donald Trump shook the foundations of the trade world with a radical social media announcement: "Any country doing business with Iran will face a 25% additional customs tariff on their exports to the United States."

The Impact: This move

The "Domino Effect" in Global Trade: 2026 Iran Sanctions

As of the first weeks of 2026, the pressure on Iran has reached unprecedented levels. This time, the issue is not just about "what is being sold to Tehran," but rather "who is sitting at the table with Tehran."

1. Trump’s "25% Tariff": A Global Warning

In January 2026, U.S. President Donald Trump shook the foundations of the trade world with a radical social media announcement: "Any country doing business with Iran will face a 25% additional customs tariff on their exports to the United States."

The Impact: This move

- Reward

- 63

- 64

- Repost

- Share

snowflakee :

:

Happy New Year! 🤑View More

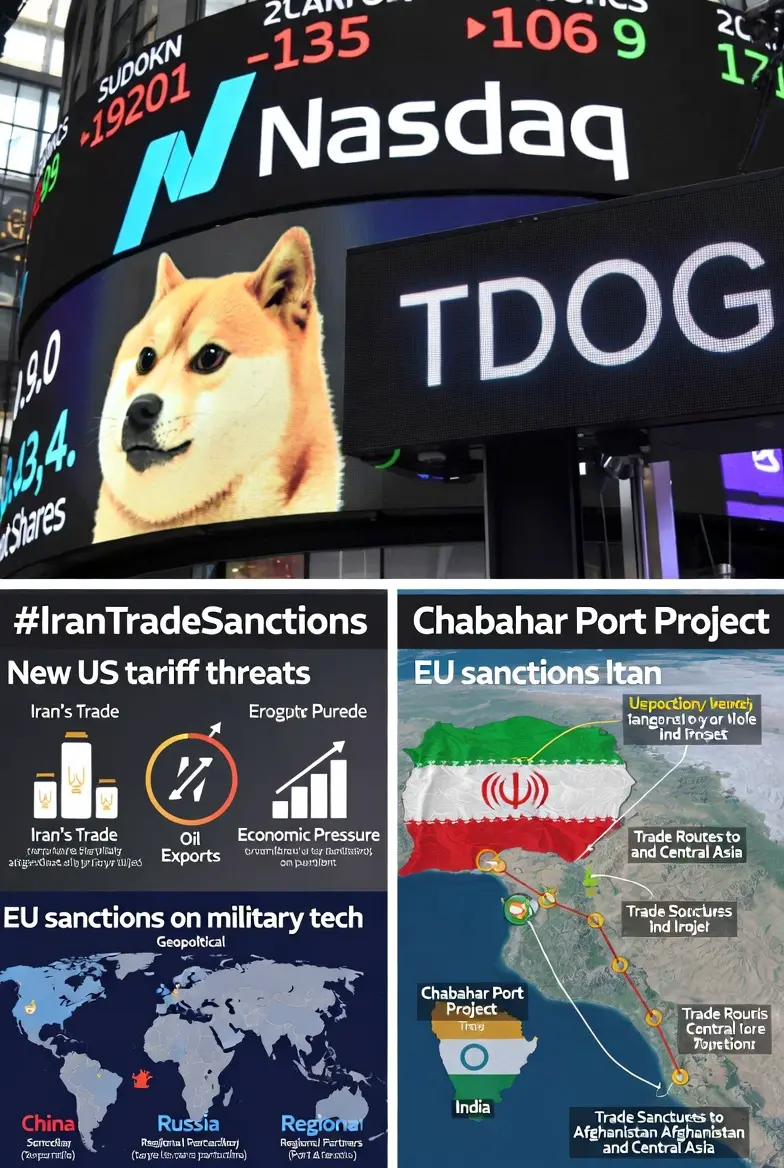

#IranTradeSanctions In 2025–2026, trade sanctions on Iran have once again become a central focus of international politics and global markets, driven by long‑standing tensions between Tehran and the United States, European powers, and the United Nations. Sanctions are economic and financial penalties designed to pressure Iran over its nuclear program, human rights issues, and regional behavior. In recent weeks, these sanctions have taken on new dimensions with unexpected tariff threats from the United States and renewed global enforcement mechanisms that are reshaping Iran’s economic landscape

- Reward

- 7

- 15

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#IranTradeSanctions

Global markets and geopolitical discussions are once again centered on Iran trade sanctions, as economic pressure remains one of the most powerful tools shaping international relations in the modern world. The hashtag #IranTradeSanctions reflects the ongoing restrictions placed on Iran’s trade, financial systems, and energy exports, which continue to influence not only the country’s domestic economy but also regional stability and global market dynamics. Sanctions are no longer viewed merely as political statements; they have evolved into strategic mechanisms that can resh

Global markets and geopolitical discussions are once again centered on Iran trade sanctions, as economic pressure remains one of the most powerful tools shaping international relations in the modern world. The hashtag #IranTradeSanctions reflects the ongoing restrictions placed on Iran’s trade, financial systems, and energy exports, which continue to influence not only the country’s domestic economy but also regional stability and global market dynamics. Sanctions are no longer viewed merely as political statements; they have evolved into strategic mechanisms that can resh

- Reward

- 2

- 7

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

#IranTradeSanctions

U.S. Imposes 25% Tariffs on Countries Trading with Iran: Geopolitical Tensions and Market Implications

The Trump administration has announced plans to impose a 25% tariff on countries that maintain trade with Iran, signaling a potential escalation in global trade and geopolitical tensions. This move is intended to pressure countries into limiting economic engagement with Iran, particularly in sectors like energy, manufacturing, and technology.

While the announcement is bold, questions remain about enforcement, compliance, and real-world economic impact. Markets are already

U.S. Imposes 25% Tariffs on Countries Trading with Iran: Geopolitical Tensions and Market Implications

The Trump administration has announced plans to impose a 25% tariff on countries that maintain trade with Iran, signaling a potential escalation in global trade and geopolitical tensions. This move is intended to pressure countries into limiting economic engagement with Iran, particularly in sectors like energy, manufacturing, and technology.

While the announcement is bold, questions remain about enforcement, compliance, and real-world economic impact. Markets are already

BTC0,45%

- Reward

- 10

- 18

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

#IranTradeSanctions

💥 IranTradeSanctions U.S. Threatens 25% Tariffs on Iran Trading Partners: Macro Shockwaves, Geopolitical Escalation, and Crypto Implications

The announcement that the United States may impose a 25% tariff on countries trading with Iran is far from a standard trade headline. This is a potential structural shock to global trade, geopolitics, and financial markets, one that requires serious attention from traders, allocators, and crypto participants alike. Even if full enforcement is uncertain, the market’s perception of risk alone can create volatility across equities, comm

💥 IranTradeSanctions U.S. Threatens 25% Tariffs on Iran Trading Partners: Macro Shockwaves, Geopolitical Escalation, and Crypto Implications

The announcement that the United States may impose a 25% tariff on countries trading with Iran is far from a standard trade headline. This is a potential structural shock to global trade, geopolitics, and financial markets, one that requires serious attention from traders, allocators, and crypto participants alike. Even if full enforcement is uncertain, the market’s perception of risk alone can create volatility across equities, comm

- Reward

- 8

- 8

- Repost

- Share

CryptoChampion :

:

Buy To Earn 💎View More

#IranTradeSanctions

1) What’s Happening Now

New US Tariff Threat Linked to Iran

The United States government has threatened a 25 % tariff on any country doing business with Iran, a broad measure aimed at isolating Tehran economically by forcing other nations to choose between trading with Iran or keeping full access to the US market. This threat has drawn strong criticism from China and Russia, which oppose interference and argue such measures harm global trade and stability.

European Union Moves Toward New Sanctions

The European Commission is planning additional sanctions on Iran’s exports

1) What’s Happening Now

New US Tariff Threat Linked to Iran

The United States government has threatened a 25 % tariff on any country doing business with Iran, a broad measure aimed at isolating Tehran economically by forcing other nations to choose between trading with Iran or keeping full access to the US market. This threat has drawn strong criticism from China and Russia, which oppose interference and argue such measures harm global trade and stability.

European Union Moves Toward New Sanctions

The European Commission is planning additional sanctions on Iran’s exports

- Reward

- 8

- 7

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

Global Alert: Iran Trade Sanctions Update 🌐⚖️

The international community is tightening trade restrictions on Iran, impacting multiple sectors from energy to tech. VIP traders and global investors need to stay informed to navigate risks and opportunities.

🔹 Key Details:

1️⃣ New Sanctions Scope:

Targeting energy exports, petrochemicals, and banking transactions

Stricter oversight on financial institutions facilitating Iran trade

2️⃣ Affected Markets:

Crude oil and gas trading

Key metals and commodities linked to Iran

International shipping and logistics involving Iran

3️⃣ Investor/VIP Implica

The international community is tightening trade restrictions on Iran, impacting multiple sectors from energy to tech. VIP traders and global investors need to stay informed to navigate risks and opportunities.

🔹 Key Details:

1️⃣ New Sanctions Scope:

Targeting energy exports, petrochemicals, and banking transactions

Stricter oversight on financial institutions facilitating Iran trade

2️⃣ Affected Markets:

Crude oil and gas trading

Key metals and commodities linked to Iran

International shipping and logistics involving Iran

3️⃣ Investor/VIP Implica

- Reward

- 6

- 9

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

#IranTradeSanctions In 2025–2026, trade sanctions on Iran have once again become a central focus of international politics and global markets, driven by long‑standing tensions between Tehran and the United States, European powers, and the United Nations. Sanctions are economic and financial penalties designed to pressure Iran over its nuclear program, human rights issues, and regional behavior. In recent weeks, these sanctions have taken on new dimensions with unexpected tariff threats from the United States and renewed global enforcement mechanisms that are reshaping Iran’s economic landscape

- Reward

- 5

- 6

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#IranTradeSanctions

Recent developments regarding trade sanctions on Iran have significant implications for global markets, commodities, and geopolitical stability. Investors and traders are closely monitoring these shifts to assess their potential impact on energy markets, currency flows, and regional trade.

1. Overview of the Sanctions

The sanctions target specific sectors of Iran’s economy, including energy exports, banking, and international trade channels.

These measures are aimed at pressuring compliance with international regulations while influencing regional economic dynamics.

2. Mar

Recent developments regarding trade sanctions on Iran have significant implications for global markets, commodities, and geopolitical stability. Investors and traders are closely monitoring these shifts to assess their potential impact on energy markets, currency flows, and regional trade.

1. Overview of the Sanctions

The sanctions target specific sectors of Iran’s economy, including energy exports, banking, and international trade channels.

These measures are aimed at pressuring compliance with international regulations while influencing regional economic dynamics.

2. Mar

- Reward

- 10

- 11

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#IranTradeSanctions

#IranTradeSanctions

Iran trade sanctions are increasing global uncertainty by pressuring oil supply, raising inflation risks, and weakening market confidence. This may trigger a 15%–40% rise in trading volume, 20%–50% higher volatility, and 5%–10% short-term liquidity tightening in financial and crypto markets. Bitcoin could move 1%–4%, while altcoins may swing 3%–8% due to speculative activity, strengthening crypto’s hedge narrative.

#IranTradeSanctions

Iran trade sanctions are increasing global uncertainty by pressuring oil supply, raising inflation risks, and weakening market confidence. This may trigger a 15%–40% rise in trading volume, 20%–50% higher volatility, and 5%–10% short-term liquidity tightening in financial and crypto markets. Bitcoin could move 1%–4%, while altcoins may swing 3%–8% due to speculative activity, strengthening crypto’s hedge narrative.

BTC0,45%

- Reward

- 3

- 4

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

32.93K Popularity

16.5K Popularity

11.12K Popularity

3.8K Popularity

7.63K Popularity

7.87K Popularity

7.32K Popularity

73.89K Popularity

35.66K Popularity

19.81K Popularity

5.39K Popularity

108.94K Popularity

251.67K Popularity

20.16K Popularity

161.58K Popularity

News

View MoreMoonbirds live event announced to be on January 28th TGE

1 m

Data: 479.21 BTC transferred from an anonymous address, then routed through a relay and sent to another anonymous address

31 m

Data: Ax6Yh73Y5exFQXepUcTdbvEErbzgRjun2xPBiJyDAQXU received 123,300 SOL, worth approximately $157 million.

1 h

Data: 200 BTC transferred from an anonymous address, worth approximately $17.9 million

1 h

Data: 4,900 ETH transferred out from K3 Capital, worth approximately $14.43 million

1 h

Pin