📊 Dragon Fly Official Perspective: February’s Web3 calendar is stacked with milestones — from scaling upgrades to major ecosystem launches and cross‑chain integrations. These events could signal rotation within sectors that matter most for adoption and real usage.

💭 What I’m thinking / How I’m watching / Astra view:

Dragon Fly Official has been tracking DeFi capital flows, L2 throughput increases, and early gamefi / NFT utility adoption metrics — these tend to correlate with real structural growth rather than mere hype. 🔍

Observations: Historical cycles show that projects with stronger fundamentals and network activity outperform during macro strength.

My take: While some narratives may attract short bursts of social attention, the ones with sustained on‑chain engagement and developer momentum could offer more lasting participation.

🧠 Sector & Narrative Breakdown

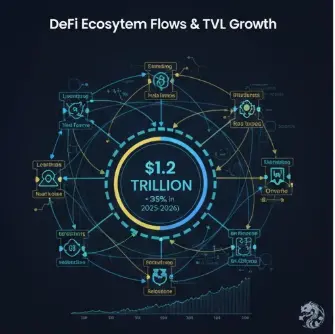

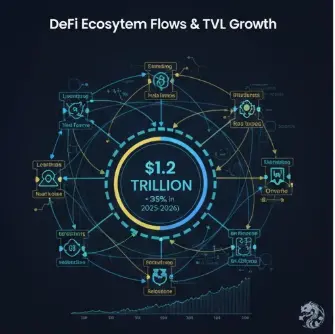

1) DeFi — Value Capture & Sustainable Liquidity

• Monitor TVL growth, stablecoin movement, and liquidity incentives.

• Layer‑2 rollups boosting transaction efficiency often lead to higher DeFi engagement.

→ Dragon Fly Official sees that liquidity migration toward optimized chains may define February’s performance tiers.

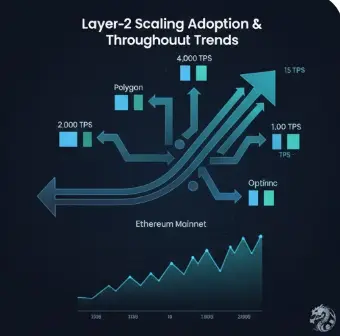

2) Layer‑2 Scaling & Ecosystem Adoption

• Look at usage statistics, bridge flows, and rollup throughput.

• Networks that solve cost + speed issues without central bottlenecks gain structural credibility.

→ This is a narrative where Dragon Fly Official analysis suggests adoption metrics matter more than hype.

3) NFT Utilities & Interoperability

• Beyond collectibles — check membership models, token utilities, and cross‑chain collectibles.

• Interoperability layers that facilitate asset movement across ecosystems can unlock fresh liquidity.

📈 Macro Context & Narrative Weight

• BTC and ETH behavior sets the backdrop — consolidation supports risk appetite but with tighter liquidity than prior cycles.

• Event catalysts (protocol upgrades, mainnet launches, governance milestones) often trigger sector rotation.

• Narrative strength is increasingly tied to real usage metrics — active wallets, retention rates, and developer activity — not just social buzz.

⚡ Suggested Approach:

• Track quantifiable adoption signals — TVL, throughput, unique addresses, developer activity.

• Prioritize sectors with positive structural indicators over pure social momentum.

• Combine short‑term insights with medium‑term narrative strength for better risk‑reward setups.

⚠️ Risk Disclaimer:

Crypto markets are highly volatile and speculative. Always manage risk and position sizing according to your strategy and tolerance.

#Web3FebruaryFocus

💭 What I’m thinking / How I’m watching / Astra view:

Dragon Fly Official has been tracking DeFi capital flows, L2 throughput increases, and early gamefi / NFT utility adoption metrics — these tend to correlate with real structural growth rather than mere hype. 🔍

Observations: Historical cycles show that projects with stronger fundamentals and network activity outperform during macro strength.

My take: While some narratives may attract short bursts of social attention, the ones with sustained on‑chain engagement and developer momentum could offer more lasting participation.

🧠 Sector & Narrative Breakdown

1) DeFi — Value Capture & Sustainable Liquidity

• Monitor TVL growth, stablecoin movement, and liquidity incentives.

• Layer‑2 rollups boosting transaction efficiency often lead to higher DeFi engagement.

→ Dragon Fly Official sees that liquidity migration toward optimized chains may define February’s performance tiers.

2) Layer‑2 Scaling & Ecosystem Adoption

• Look at usage statistics, bridge flows, and rollup throughput.

• Networks that solve cost + speed issues without central bottlenecks gain structural credibility.

→ This is a narrative where Dragon Fly Official analysis suggests adoption metrics matter more than hype.

3) NFT Utilities & Interoperability

• Beyond collectibles — check membership models, token utilities, and cross‑chain collectibles.

• Interoperability layers that facilitate asset movement across ecosystems can unlock fresh liquidity.

📈 Macro Context & Narrative Weight

• BTC and ETH behavior sets the backdrop — consolidation supports risk appetite but with tighter liquidity than prior cycles.

• Event catalysts (protocol upgrades, mainnet launches, governance milestones) often trigger sector rotation.

• Narrative strength is increasingly tied to real usage metrics — active wallets, retention rates, and developer activity — not just social buzz.

⚡ Suggested Approach:

• Track quantifiable adoption signals — TVL, throughput, unique addresses, developer activity.

• Prioritize sectors with positive structural indicators over pure social momentum.

• Combine short‑term insights with medium‑term narrative strength for better risk‑reward setups.

⚠️ Risk Disclaimer:

Crypto markets are highly volatile and speculative. Always manage risk and position sizing according to your strategy and tolerance.

#Web3FebruaryFocus