Post content & earn content mining yield

placeholder

Neesa04

📈 December ETH Price Prediction Challenge

With expectations of a Fed rate cut heating up this December, Ethereum (ETH) sentiment is turning bullish again! 🚀 We’re launching a prediction challenge — spot the trend, call the market, and win rewards! 💰

🎁 Rewards:

- 5 winners will be randomly selected from all correct predictions

- Each winner receives 10 USDT

📅 Deadline:

- December 11, 12:00 (UTC+8)

✍️ How to Participate:

1. Post your ETH price prediction on Gate Square

2. Clearly state a price range (e.g., $3,200–$3,400, range must be < $200)

3. Include the hashtag #ETHDecPrediction

💡 Post

With expectations of a Fed rate cut heating up this December, Ethereum (ETH) sentiment is turning bullish again! 🚀 We’re launching a prediction challenge — spot the trend, call the market, and win rewards! 💰

🎁 Rewards:

- 5 winners will be randomly selected from all correct predictions

- Each winner receives 10 USDT

📅 Deadline:

- December 11, 12:00 (UTC+8)

✍️ How to Participate:

1. Post your ETH price prediction on Gate Square

2. Clearly state a price range (e.g., $3,200–$3,400, range must be < $200)

3. Include the hashtag #ETHDecPrediction

💡 Post

ETH-0.59%

- Reward

- like

- Comment

- Repost

- Share

📉 Whole Market Bleeding… Even With a Rate-Cut Bet at 93%

$BNB , $BTC , $ETH , #sol , #XRP — everything is printing red today, even though Polymarket traders are pricing in a massive 93% chance of a 25 bps rate cut this December, just 5 days before FOMC.

So why the dump?

Because when expectations are this high, the market starts front-running the event — and that creates pockets of heavy volatility. Smart money positions early… retail usually reacts late.

A rate cut should be bullish, but the path to it is never smooth.

This is the phase where liquidity hunts, fake bounces, and sudden flushes

$BNB , $BTC , $ETH , #sol , #XRP — everything is printing red today, even though Polymarket traders are pricing in a massive 93% chance of a 25 bps rate cut this December, just 5 days before FOMC.

So why the dump?

Because when expectations are this high, the market starts front-running the event — and that creates pockets of heavy volatility. Smart money positions early… retail usually reacts late.

A rate cut should be bullish, but the path to it is never smooth.

This is the phase where liquidity hunts, fake bounces, and sudden flushes

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

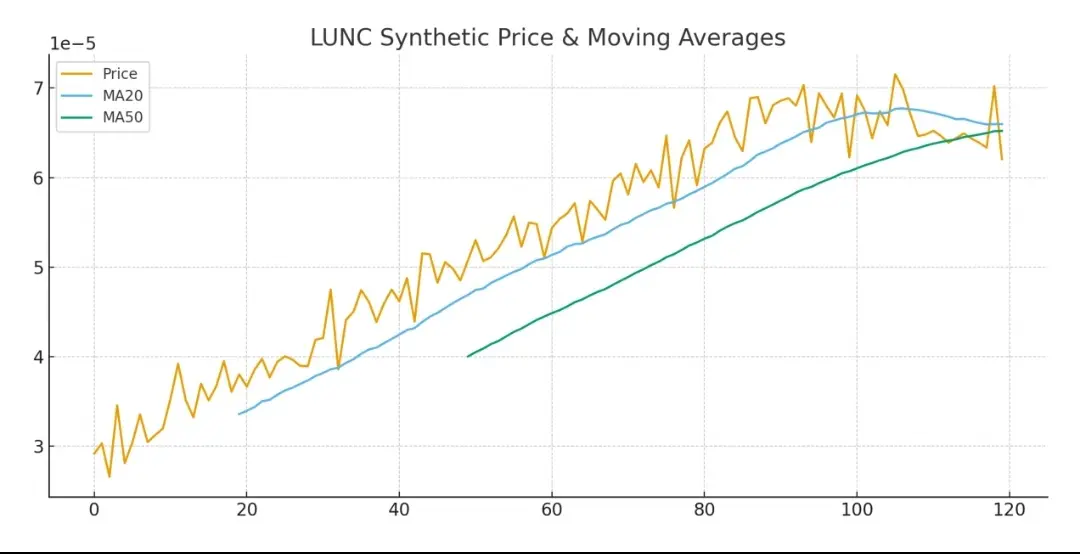

$LUNC LUNC Market Update (1H Overview)

LUNC has been showing strong momentum with a solid climb, followed by a healthy pullback. Price is still moving above key MA zones, showing buyers are active even after the dip. As long as LUNC holds above its recent support levels, the uptrend structure stays intact.

Short-Term View (1H):

• Price is cooling down after a sharp rise, forming a natural correction.

• Holding above MA20 keeps the momentum alive.

• A push back above the recent swing high could open room for another breakout.

Mid-Term View (4H):

Using wider tools like MA and Bollinger Bands,

LUNC has been showing strong momentum with a solid climb, followed by a healthy pullback. Price is still moving above key MA zones, showing buyers are active even after the dip. As long as LUNC holds above its recent support levels, the uptrend structure stays intact.

Short-Term View (1H):

• Price is cooling down after a sharp rise, forming a natural correction.

• Holding above MA20 keeps the momentum alive.

• A push back above the recent swing high could open room for another breakout.

Mid-Term View (4H):

Using wider tools like MA and Bollinger Bands,

LUNC-4.39%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Injective The Financial Engine That Wants To Rebuild How Markets Work

Injective is a Layer 1 blockchain created with a very specific mission, to be the core financial engine for an open digital economy where trading, derivatives and capital markets live directly on chain instead of being trapped behind slow, opaque and centralized systems, and when I connect what official documentation, research reports and independent overviews say about it, I’m not just looking at another general purpose chain, I am seeing a network that defines itself as the blockchain built for finance, with pre built modu

Injective is a Layer 1 blockchain created with a very specific mission, to be the core financial engine for an open digital economy where trading, derivatives and capital markets live directly on chain instead of being trapped behind slow, opaque and centralized systems, and when I connect what official documentation, research reports and independent overviews say about it, I’m not just looking at another general purpose chain, I am seeing a network that defines itself as the blockchain built for finance, with pre built modu

INJ0.96%

- Reward

- 1

- 2

- Repost

- Share

Discovery :

:

Watching Closely 🔍View More

𝗪𝗵𝘆 𝗖𝗮𝗻 𝗬𝗼𝘂 𝗕𝘂𝘆 𝗧𝗵𝗲 𝗕𝗼𝘁𝘁𝗼𝗺 𝗕𝘂𝘁 𝗖𝗮𝗻 𝗡𝗼𝘁 𝗦𝗲𝗹𝗹 𝗧𝗵𝗲 𝗧𝗼𝗽?

You spot a potential low cap coin. You buy $1,000 at the bottom. A few weeks later, it goes up 100x. Your account shows $100,000. You feel like a genius. You place an order to sell everything to lock in your profit. But the price crashes 50% immediately, or your order is stuck and doesn’t fill. You only get a fraction of that $100,000.

Why?

🔸 The Nature of Price and Liquidity:

Market Price is the price of the last executed trade. It is a surface number.

Liquidity is the ability to convert asset

You spot a potential low cap coin. You buy $1,000 at the bottom. A few weeks later, it goes up 100x. Your account shows $100,000. You feel like a genius. You place an order to sell everything to lock in your profit. But the price crashes 50% immediately, or your order is stuck and doesn’t fill. You only get a fraction of that $100,000.

Why?

🔸 The Nature of Price and Liquidity:

Market Price is the price of the last executed trade. It is a surface number.

Liquidity is the ability to convert asset

BTC-1.03%

- Reward

- 4

- 4

- Repost

- Share

Discovery :

:

Watching Closely 🔍View More

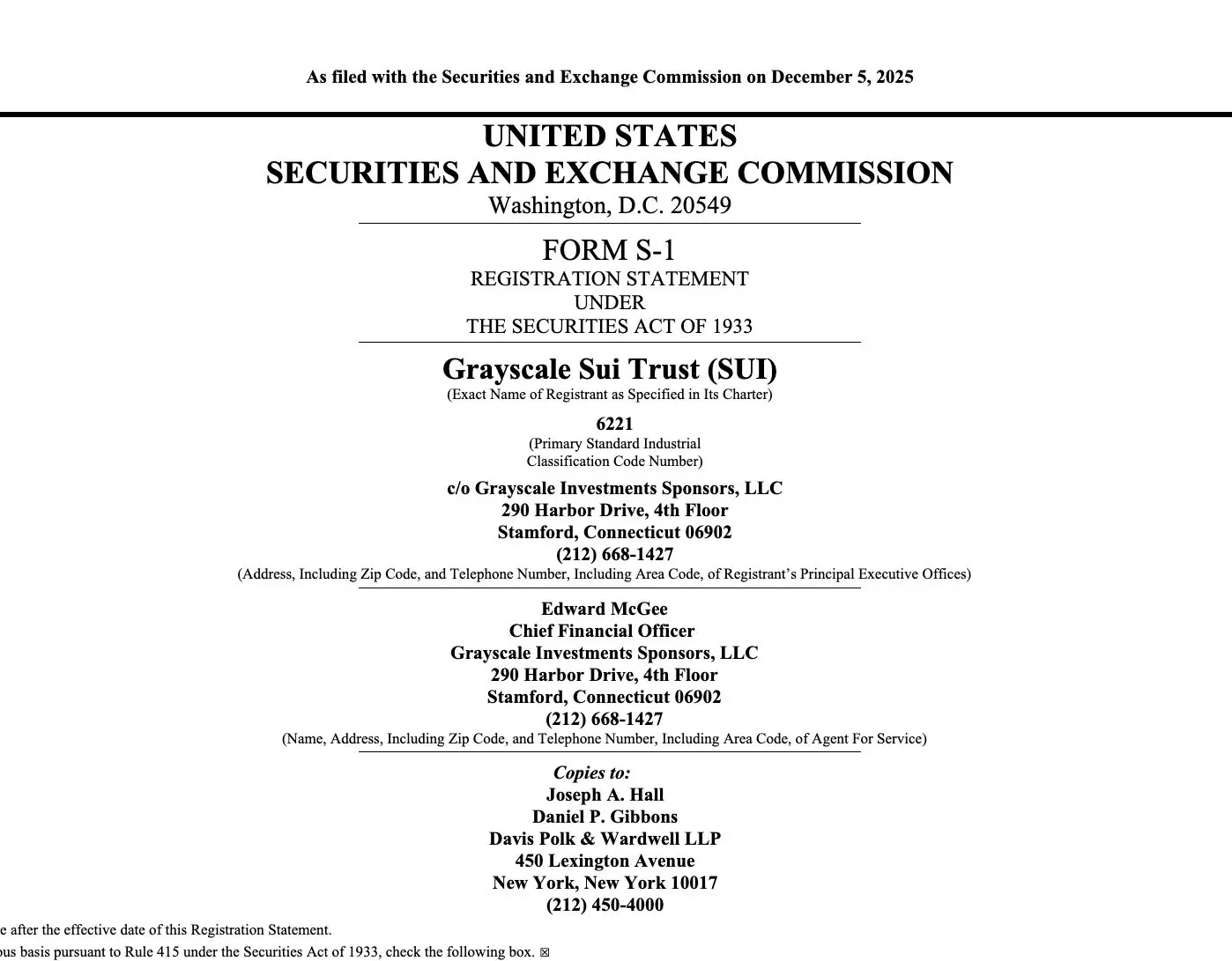

GRAYSCALE FILES S-1 FOR $SUI TRUST

The “Grayscale Sui Trust,” is a spot-style ETF designed to provide direct exposure to the $SUI token.

Grayscale's goal is to mirror SUI’s market performance, minus fees, giving long-term investors a regulated, hassle-free way to hold SUI without managing the asset directly.

The move comes right after 21Shares launched its SUI-based ETF on Nasdaq. The race for SuiNetwork investment products is on.

The “Grayscale Sui Trust,” is a spot-style ETF designed to provide direct exposure to the $SUI token.

Grayscale's goal is to mirror SUI’s market performance, minus fees, giving long-term investors a regulated, hassle-free way to hold SUI without managing the asset directly.

The move comes right after 21Shares launched its SUI-based ETF on Nasdaq. The race for SuiNetwork investment products is on.

SUI-1%

- Reward

- 1

- 1

- Repost

- Share

0xBit :

:

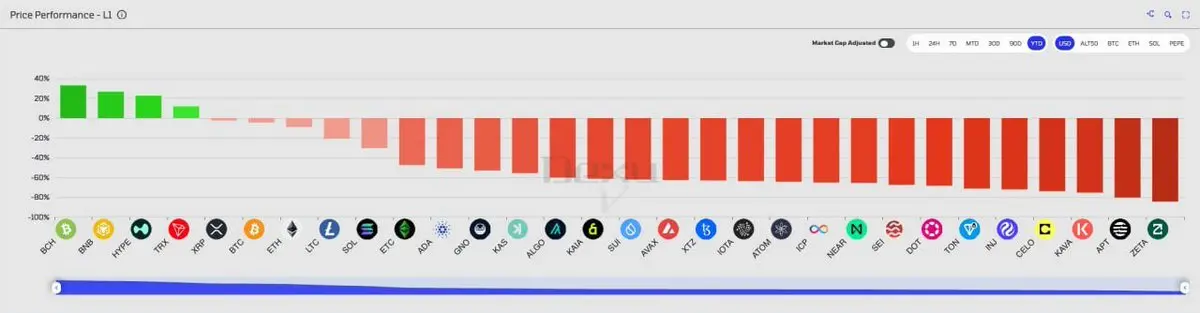

Thanks for letting us know📊 Market Insight:

Crypto Koryo reports that only four L1 tokens are in the green this year — #BCH, #BNB, #HYPE, and #TRX with BCH leading at nearly +40%.

BCH’s outperformance is likely driven by its fully circulating supply (no VC sell pressure), growing ETF speculation, and steady liquidity + controlled volatility.

Crypto Koryo reports that only four L1 tokens are in the green this year — #BCH, #BNB, #HYPE, and #TRX with BCH leading at nearly +40%.

BCH’s outperformance is likely driven by its fully circulating supply (no VC sell pressure), growing ETF speculation, and steady liquidity + controlled volatility.

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: 🇺🇸 Tom Lee's company BitMine has purchased 138,452 $ETH in the last week.

• Total $ETH Holdings: 3,864,951 $ETH (≈ $12.13 BILLION)

• Average buy price: $3,139 per $ETH

DIRECT SIGNAL: There is strong institutional-level conviction in Ethereum - this is not normal buying; it appears to be long term positioning.

• Total $ETH Holdings: 3,864,951 $ETH (≈ $12.13 BILLION)

• Average buy price: $3,139 per $ETH

DIRECT SIGNAL: There is strong institutional-level conviction in Ethereum - this is not normal buying; it appears to be long term positioning.

ETH-0.59%

- Reward

- like

- Comment

- Repost

- Share

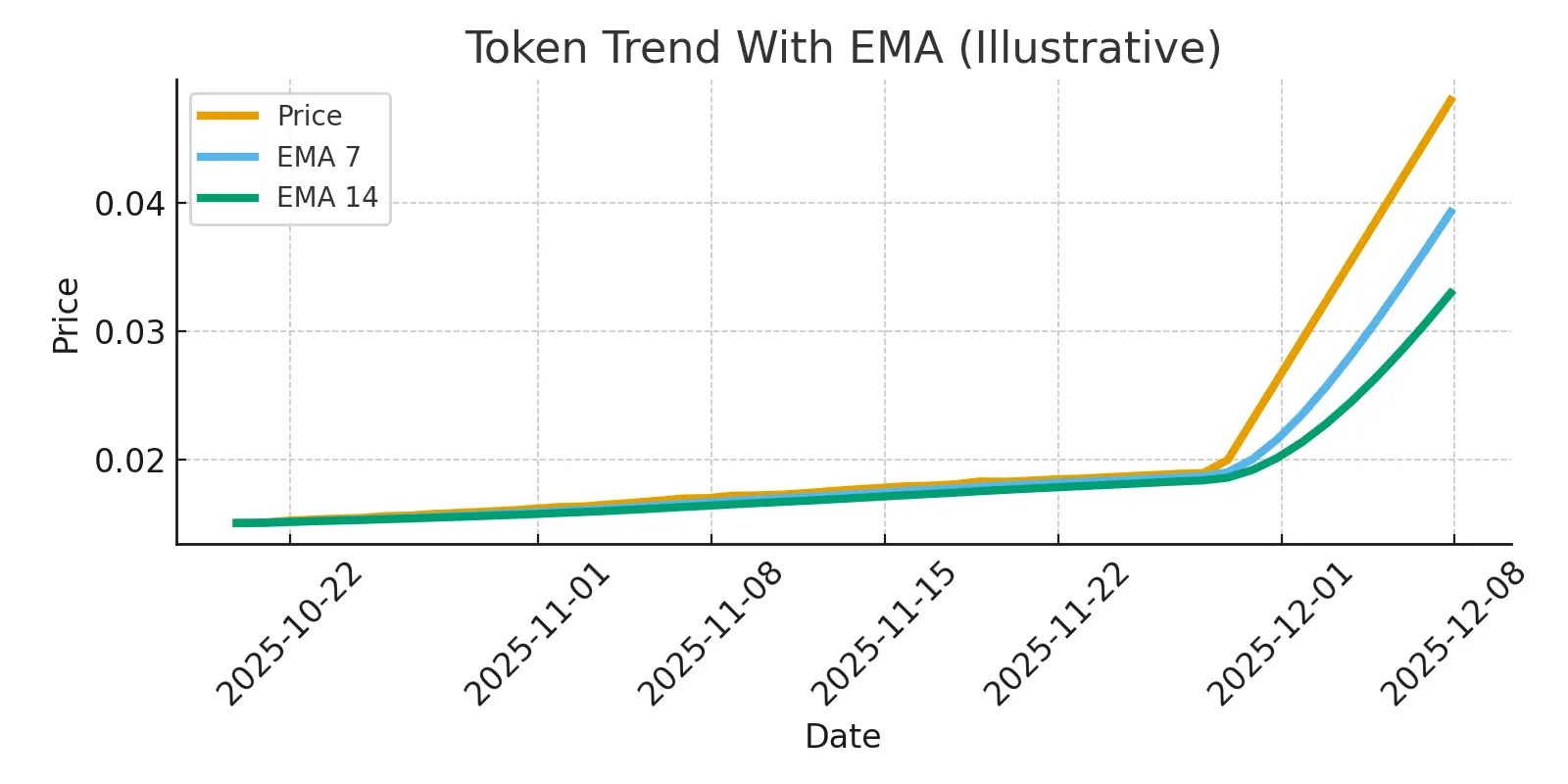

$FHE Market Update on FHE/USDT

FHE just made a huge breakout after staying flat for a long time. The strong 1H candle pushed the price up sharply, showing clear buying pressure. Even after the spike, the chart is still holding above short-term moving averages, which means momentum hasn’t fully cooled off yet.

Short-Term View (1H)

Trend is still bullish as long as price stays above the recent support around the mid-0.02 range.

Momentum indicators show cooling, but buyers are still active.

Mid-Term View

Using simple EMA analysis, the trend is still pointing upward. If the pullback stays contro

FHE just made a huge breakout after staying flat for a long time. The strong 1H candle pushed the price up sharply, showing clear buying pressure. Even after the spike, the chart is still holding above short-term moving averages, which means momentum hasn’t fully cooled off yet.

Short-Term View (1H)

Trend is still bullish as long as price stays above the recent support around the mid-0.02 range.

Momentum indicators show cooling, but buyers are still active.

Mid-Term View

Using simple EMA analysis, the trend is still pointing upward. If the pullback stays contro

FHE-20.01%

- Reward

- like

- 1

- Repost

- Share

BeautifulDay :

:

Watching Closely 🔍Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

- Trending TopicsView More

12.36K Popularity

3.07K Popularity

2.72K Popularity

35K Popularity

92.05K Popularity

- Hot Gate FunView More

- MC:$3.59KHolders:20.00%

- MC:$3.75KHolders:30.59%

- MC:$3.98KHolders:31.53%

- MC:$3.7KHolders:10.96%

- MC:$3.62KHolders:20.00%

- Pin