ElaouziCrypto

No content yet

ElaouziCrypto

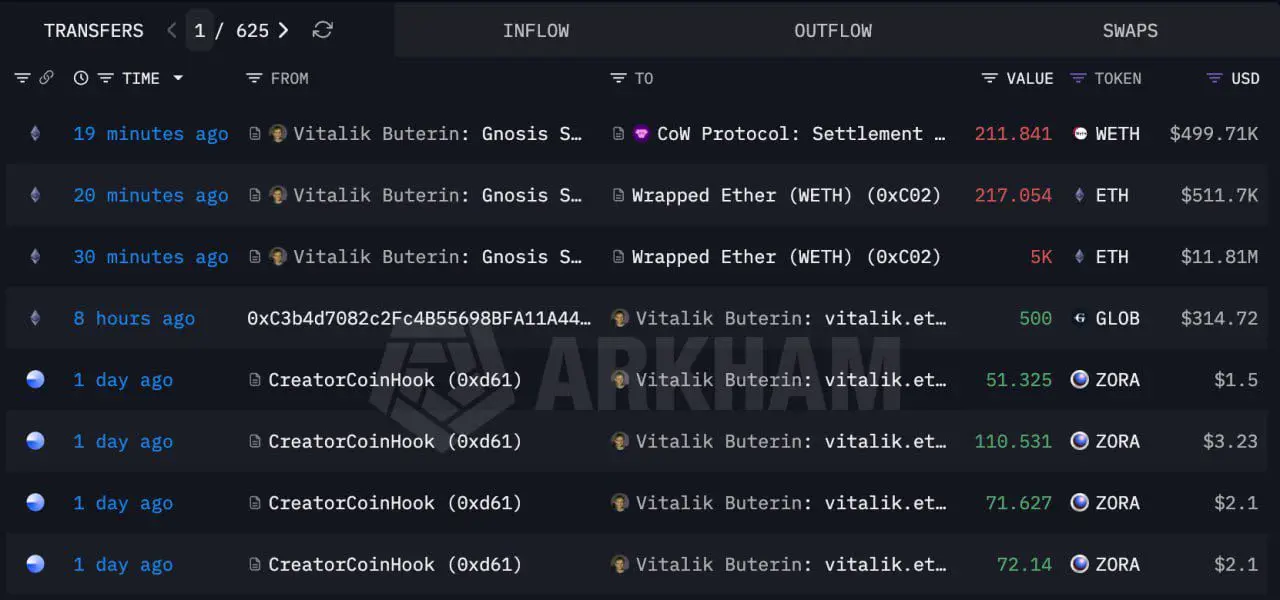

A Smart Move by Vitalik Buterin

Vitalik Buterin's wallet just moved, selling 211.84 ETH for half a million dollars in USDC stablecoin, then immediately transferred the amount to the Kanro platform to support technical initiatives.

Vitalik's moves are always well thought out and aimed at supporting projects that directly serve the tech community.

$USDC

#elaouzi #CryptoMarketPullback

Vitalik Buterin's wallet just moved, selling 211.84 ETH for half a million dollars in USDC stablecoin, then immediately transferred the amount to the Kanro platform to support technical initiatives.

Vitalik's moves are always well thought out and aimed at supporting projects that directly serve the tech community.

$USDC

#elaouzi #CryptoMarketPullback

View Original

- Reward

- 3

- 2

- Repost

- Share

Sniper1h :

:

Hold tight to 💪View More

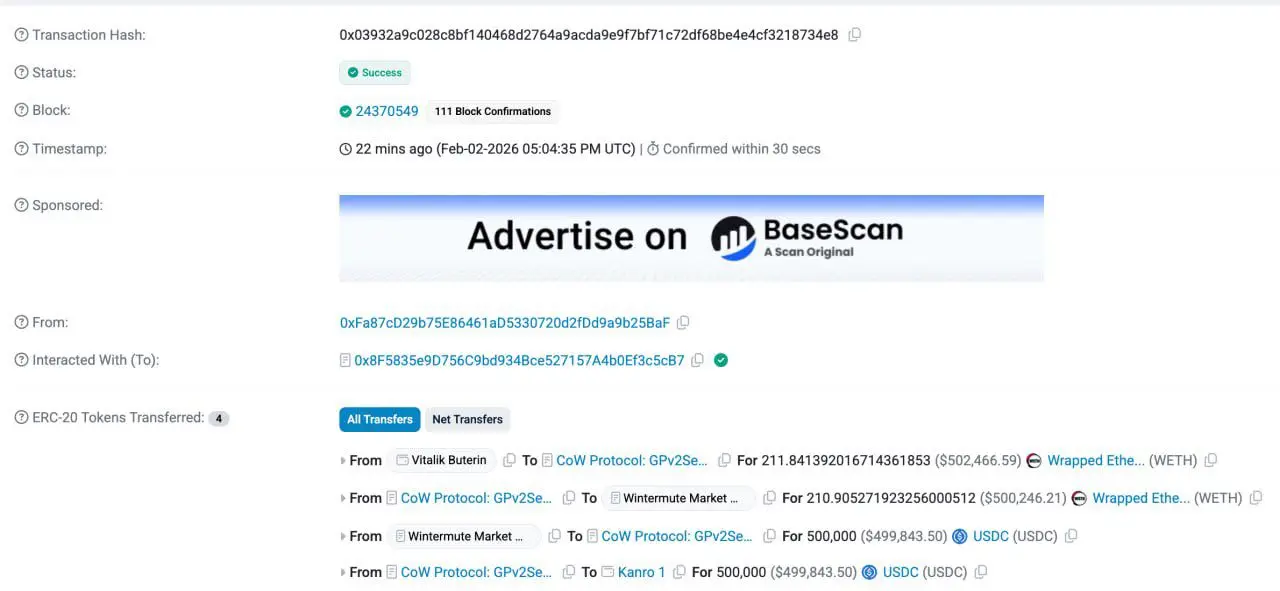

Ethereum whales are moving strongly

The whale known as #BitcoinOG has deposited 100,000 $ETH tokens worth up to $242.7 million into the #Binance platform, and this massive move raises many questions about the next step in the market.

It seems that liquidity has started to flow into platforms in a suspicious manner. Should we expect sharp fluctuations, or is this just a reallocation of major wallets?

$ETH

#eth #elaouzi

The whale known as #BitcoinOG has deposited 100,000 $ETH tokens worth up to $242.7 million into the #Binance platform, and this massive move raises many questions about the next step in the market.

It seems that liquidity has started to flow into platforms in a suspicious manner. Should we expect sharp fluctuations, or is this just a reallocation of major wallets?

$ETH

#eth #elaouzi

ETH-1,71%

- Reward

- like

- Comment

- Repost

- Share

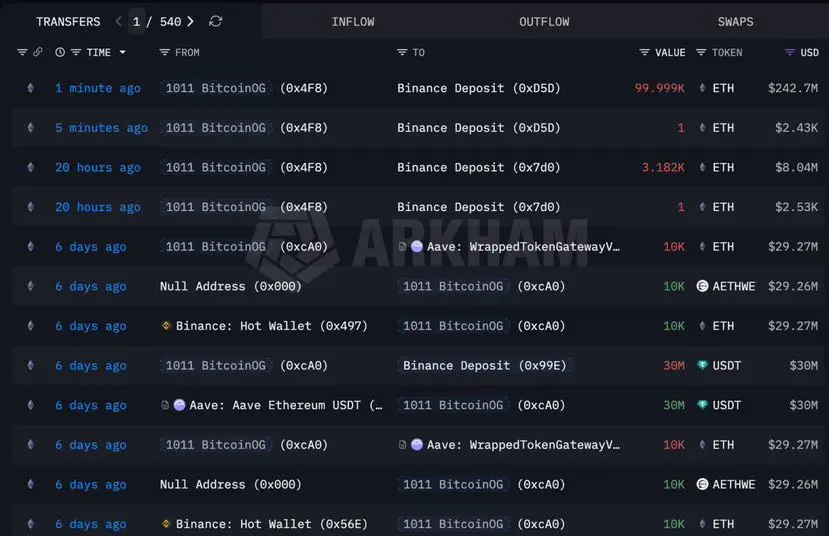

Rocket launch for BULLA on the Binance platform

BULLA achieved remarkable success by reaching $0.128

Registering a 358% increase in spot trading without leverage. As for futures traders with 5x leverage, profits have exceeded 1700%.

We are still at the beginning, as current movements indicate that we are on the verge of a bullish wave in Binance Futures that will be the largest of its kind ever, with market bottom stabilization and increasing momentum.

Behind the scenes of this moment, what you see now is just the beginning of results that will multiply 10 times in the coming period.

#elaouzi

View OriginalBULLA achieved remarkable success by reaching $0.128

Registering a 358% increase in spot trading without leverage. As for futures traders with 5x leverage, profits have exceeded 1700%.

We are still at the beginning, as current movements indicate that we are on the verge of a bullish wave in Binance Futures that will be the largest of its kind ever, with market bottom stabilization and increasing momentum.

Behind the scenes of this moment, what you see now is just the beginning of results that will multiply 10 times in the coming period.

#elaouzi

- Reward

- like

- Comment

- Repost

- Share

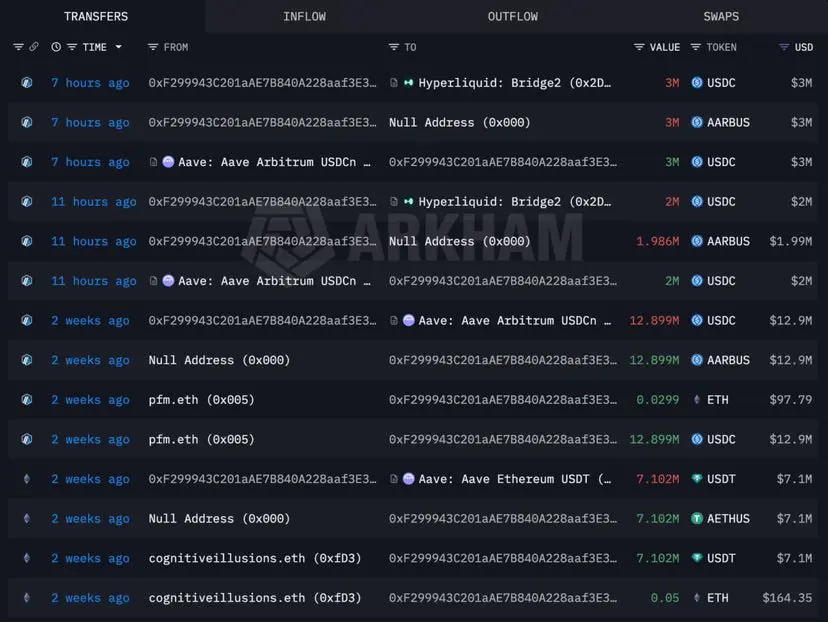

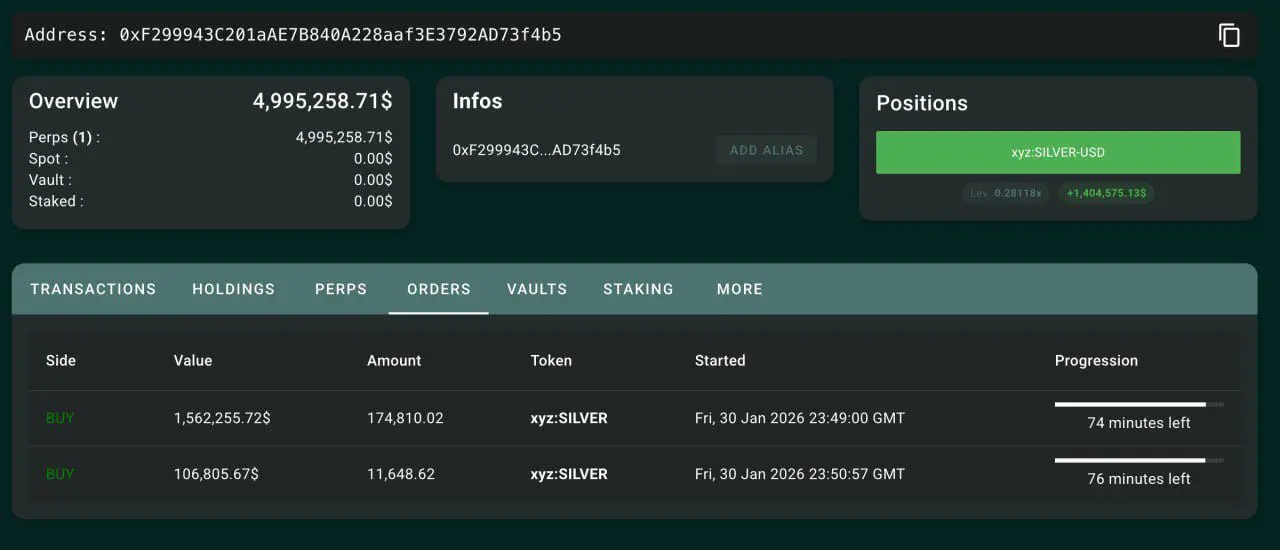

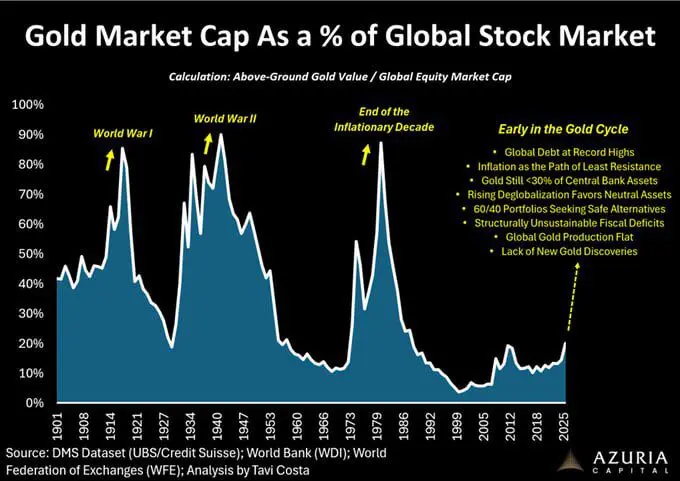

Whale Movements Toward Digital Silver

Recent movements have observed the whale pfm.eth depositing 5 million USD worth of USDC on Hyperliquid platform for long-term investment in the metal silver.

The whale has already opened a buy position worth 1.49 million USD with pending buy orders exceeding 1.6 million USD awaiting execution. These movements reflect strong confidence in the rise of tangible assets within the decentralized trading environment.

Monitoring whale wallets is my favorite way to see where smart liquidity is heading before everyone else, and this is what I always try to share wit

Recent movements have observed the whale pfm.eth depositing 5 million USD worth of USDC on Hyperliquid platform for long-term investment in the metal silver.

The whale has already opened a buy position worth 1.49 million USD with pending buy orders exceeding 1.6 million USD awaiting execution. These movements reflect strong confidence in the rise of tangible assets within the decentralized trading environment.

Monitoring whale wallets is my favorite way to see where smart liquidity is heading before everyone else, and this is what I always try to share wit

HYPE-1,35%

- Reward

- like

- Comment

- Repost

- Share

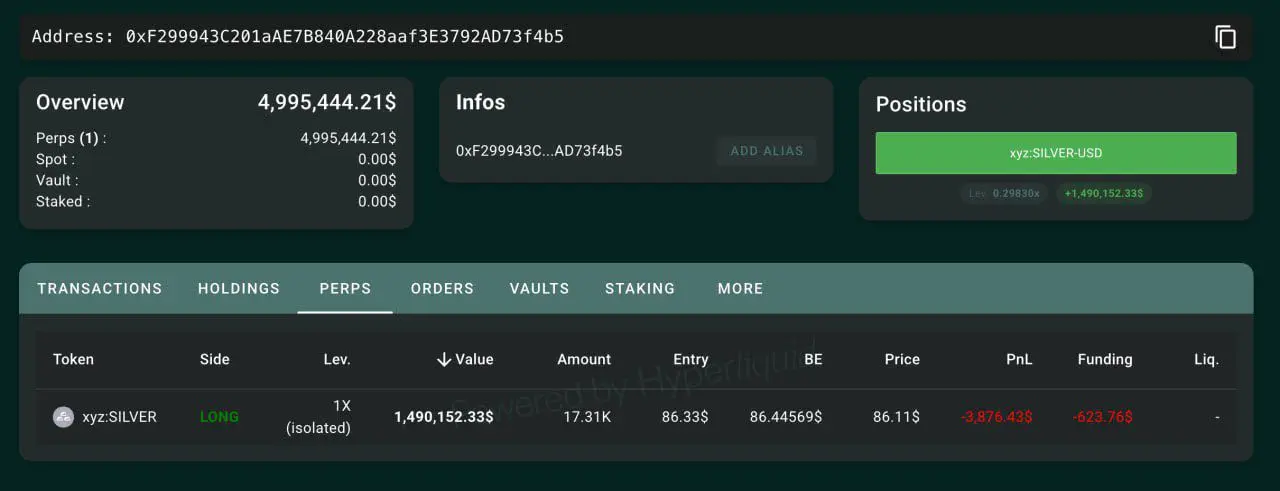

Gold Prepares for New Record Highs

The latest reports from Bank of America (BofA) indicate that gold has begun gaining strong momentum at the start of 2026, with expectations that the ounce will reach $6,000 by spring.

Despite this rise, experts at Crescat (Crescat) believe that the size of the gold "bubble" remains very small compared to the legendary growth it experienced in the 1970s.

The key point here is that the gold-to-market capitalization ratio still remains at historically low levels, approaching 20%, far from the peaks of previous cycles, which means there is still room for signific

The latest reports from Bank of America (BofA) indicate that gold has begun gaining strong momentum at the start of 2026, with expectations that the ounce will reach $6,000 by spring.

Despite this rise, experts at Crescat (Crescat) believe that the size of the gold "bubble" remains very small compared to the legendary growth it experienced in the 1970s.

The key point here is that the gold-to-market capitalization ratio still remains at historically low levels, approaching 20%, far from the peaks of previous cycles, which means there is still room for signific

XAUT1,63%

- Reward

- 2

- 1

- Repost

- Share

GateUser-c82aaf24 :

:

goodYesterday's loss was not the end but the beginning of a new bet

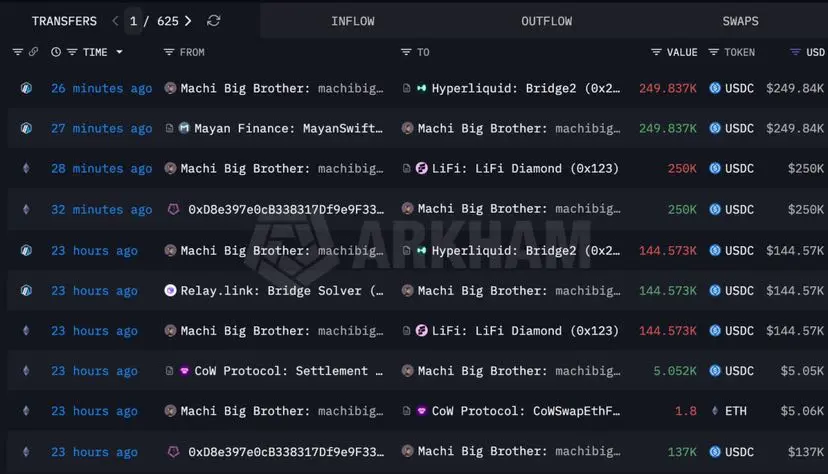

The whale Machi deposited an additional $249,837 into the Hyperliquid platform after losing his previous amount, and the goal is clear: to strengthen his buy positions on ETH and HYPE with determination.

His current investments are distributed as follows:

• 2000 units of ETH worth $5.47 million

• 10889 units of HYPE worth $318,000

I believe that persistence in the market at this moment requires nerves of steel. Do you think he will recover his loss soon, or does the market have more surprises in store?

$HYPE

$ETH

#CryptoMark

View OriginalThe whale Machi deposited an additional $249,837 into the Hyperliquid platform after losing his previous amount, and the goal is clear: to strengthen his buy positions on ETH and HYPE with determination.

His current investments are distributed as follows:

• 2000 units of ETH worth $5.47 million

• 10889 units of HYPE worth $318,000

I believe that persistence in the market at this moment requires nerves of steel. Do you think he will recover his loss soon, or does the market have more surprises in store?

$HYPE

$ETH

#CryptoMark

- Reward

- 2

- Comment

- Repost

- Share

Market whales don't stop moving

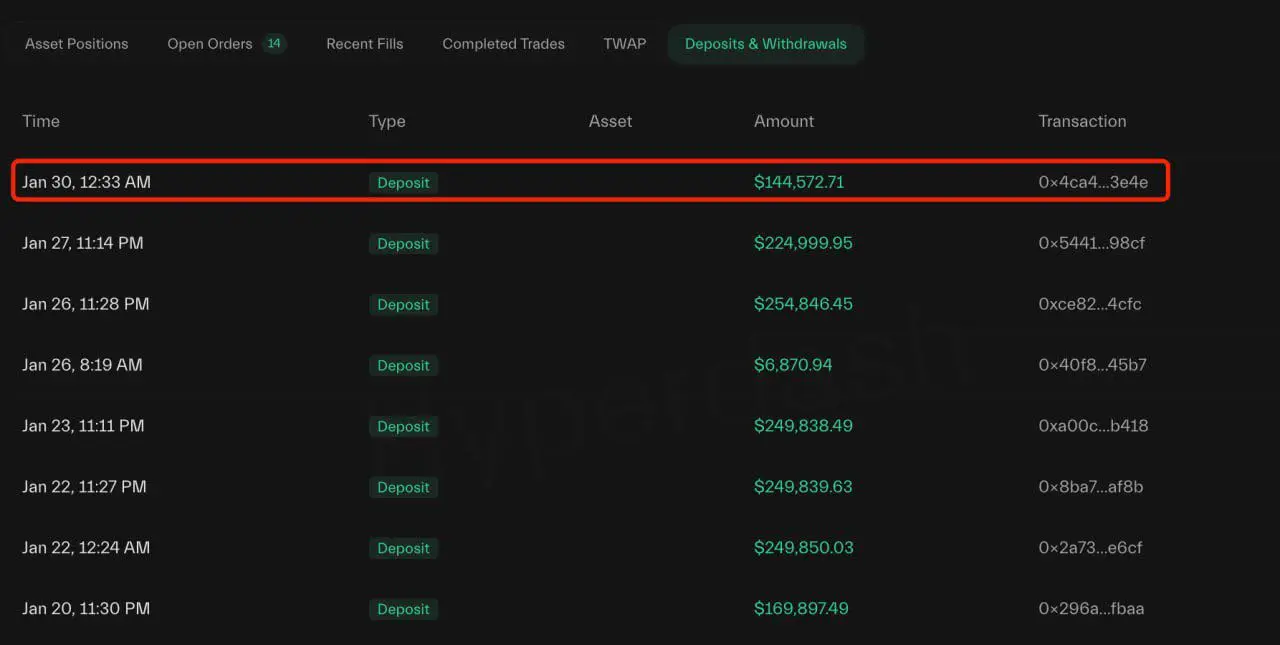

Machi deposited $144,573 in USDC in the Hyperliquid platform to boost his long positions on ETH.

These back-to-back moves reflect great confidence in the current market direction and a desire to seize opportunities before the next rally.

I expect that we will see the results of these moves very soon, as the market does not have mercy on those who wait for a long time.

$ETH

#elaouzi

#MiddleEastTensionsEscalate #CryptoMarketWatch

Machi deposited $144,573 in USDC in the Hyperliquid platform to boost his long positions on ETH.

These back-to-back moves reflect great confidence in the current market direction and a desire to seize opportunities before the next rally.

I expect that we will see the results of these moves very soon, as the market does not have mercy on those who wait for a long time.

$ETH

#elaouzi

#MiddleEastTensionsEscalate #CryptoMarketWatch

ETH-1,71%

- Reward

- 2

- 1

- Repost

- Share

MuhyiddinBridi :

:

Mutafnaqif Qaqqaf L'Ivannlit for the Alpha ExtrusionGolden Opportunities and Exclusive Rewards with Gate

: https://www.gate.com/campaigns/3928?ref=VQVFAF9YUW

Join the Gate.io platform through this special offer and benefit from a welcome bonus package of up to $10,000. This link provides you with exclusive access to discounts of up to 50% on trading fees for life, as well as priority access to new Startup projects and promising coins before they are officially listed. Start your journey in the crypto world with one of the safest and most reliable platforms in the world.

#CryptoMarketWatch

#ContentMiningRevampPublicBeta

#gate

#elaouzi

$GT

: https://www.gate.com/campaigns/3928?ref=VQVFAF9YUW

Join the Gate.io platform through this special offer and benefit from a welcome bonus package of up to $10,000. This link provides you with exclusive access to discounts of up to 50% on trading fees for life, as well as priority access to new Startup projects and promising coins before they are officially listed. Start your journey in the crypto world with one of the safest and most reliable platforms in the world.

#CryptoMarketWatch

#ContentMiningRevampPublicBeta

#gate

#elaouzi

$GT

GT-1,38%

- Reward

- like

- Comment

- Repost

- Share

Crypto whales are heavily betting on digital gold

As gold continues to hit new record levels, whale activity towards gold-backed cryptocurrencies is increasing.

Recent movements tracked show that wallet 0x6Afa spent $5.95 million to purchase 1,137 units of $PAXG in just two days. In a related development, a new wallet 0x0E4F withdrew 800 units of $XAUT worth $4.22 million from the Bybit platform a few hours ago, reflecting a clear trend towards hedging with gold in the digital currency market.

I see that this synchronization between the rise of physical gold and the interest in digital gold

As gold continues to hit new record levels, whale activity towards gold-backed cryptocurrencies is increasing.

Recent movements tracked show that wallet 0x6Afa spent $5.95 million to purchase 1,137 units of $PAXG in just two days. In a related development, a new wallet 0x0E4F withdrew 800 units of $XAUT worth $4.22 million from the Bybit platform a few hours ago, reflecting a clear trend towards hedging with gold in the digital currency market.

I see that this synchronization between the rise of physical gold and the interest in digital gold

XAUT1,63%

- Reward

- like

- Comment

- Repost

- Share

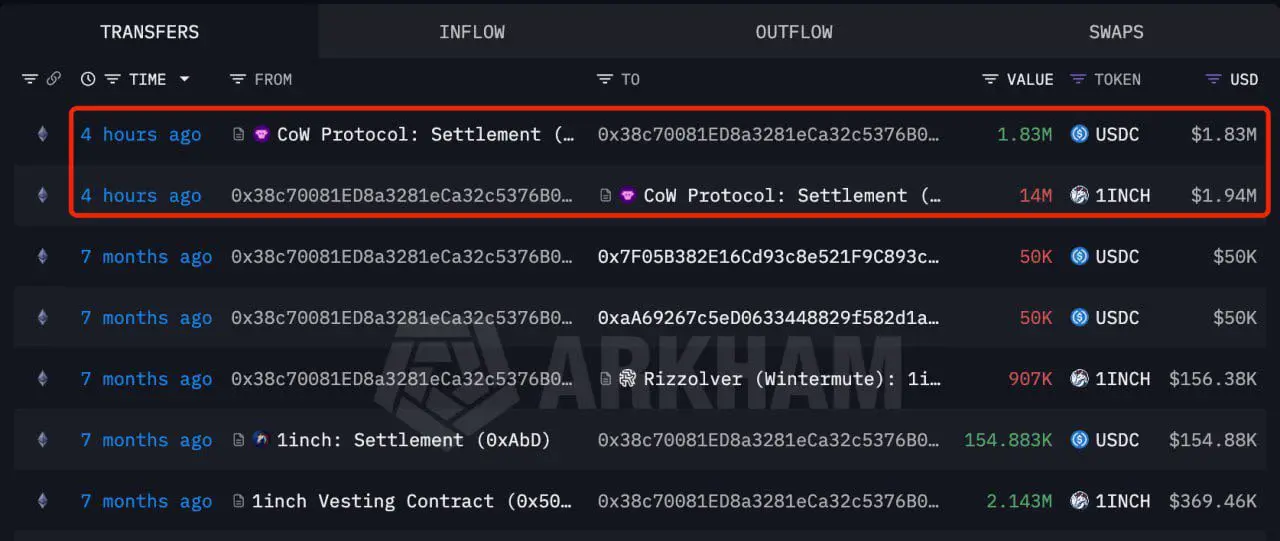

Earthquake in the 1INCH cryptocurrency price

Three major investors caused a strong shake in the market after selling a massive amount of 36.36 million units of 1INCH worth over $5 million.

This sudden move directly led to a price drop of up to 16.7% amid great anticipation from traders.

Honestly, I was expecting a correction but not this strong! Do you think the price will rebound again or will the collapse continue?

$1INCH

#elaouzi #INCH(16,083,075USD)TransferredFromUnknownWalletTo

#CryptoMarketWatch

Three major investors caused a strong shake in the market after selling a massive amount of 36.36 million units of 1INCH worth over $5 million.

This sudden move directly led to a price drop of up to 16.7% amid great anticipation from traders.

Honestly, I was expecting a correction but not this strong! Do you think the price will rebound again or will the collapse continue?

$1INCH

#elaouzi #INCH(16,083,075USD)TransferredFromUnknownWalletTo

#CryptoMarketWatch

1INCH-2,62%

- Reward

- like

- Comment

- Repost

- Share

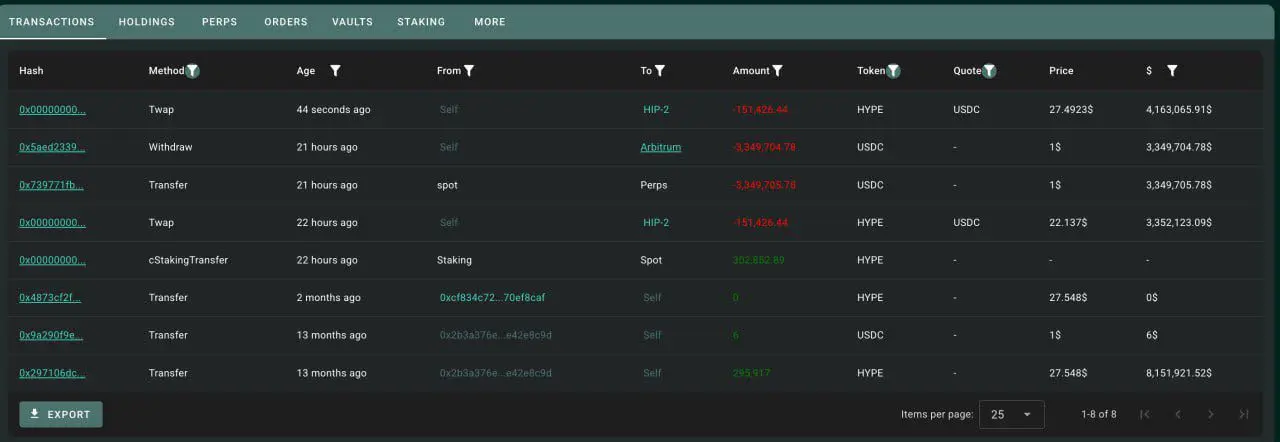

Seizing Opportunities and the Magic of Digital Patience

14 months ago, one whale decided to invest $2.58 million to buy 295,917 of $HYPE at a price of $8.74 and store it entirely.

Today, this whale unlocked the storage and sold the entire position for $7.51 million, making a net profit of $4.92 million.

It is worth noting that at its peak, his profits exceeded $15 million.

This deal clearly reflects how patience and betting on strong projects can turn ordinary numbers into real wealth in the crypto world.

$HYPE

#HYPE #elaouzi

#ContentMiningRevampPublicBeta

14 months ago, one whale decided to invest $2.58 million to buy 295,917 of $HYPE at a price of $8.74 and store it entirely.

Today, this whale unlocked the storage and sold the entire position for $7.51 million, making a net profit of $4.92 million.

It is worth noting that at its peak, his profits exceeded $15 million.

This deal clearly reflects how patience and betting on strong projects can turn ordinary numbers into real wealth in the crypto world.

$HYPE

#HYPE #elaouzi

#ContentMiningRevampPublicBeta

HYPE-1,35%

- Reward

- like

- Comment

- Repost

- Share

Digital Security Gateway to the Exchange

A new era has begun in the crypto world with CertiK announcing its plan to go public with a valuation of up to $2 billion. This step reflects the increasing global demand for protocol security and Web3 risk management. The CEO confirmed that the IPO is a strategic goal positioning the company as the first specialized security entity in blockchain to enter public markets.

Such development gives the crypto market a more institutional character and enhances trust in digital security standards.

#elaouzi

#TrumpWithdrawsEUTariffThreats

View OriginalA new era has begun in the crypto world with CertiK announcing its plan to go public with a valuation of up to $2 billion. This step reflects the increasing global demand for protocol security and Web3 risk management. The CEO confirmed that the IPO is a strategic goal positioning the company as the first specialized security entity in blockchain to enter public markets.

Such development gives the crypto market a more institutional character and enhances trust in digital security standards.

#elaouzi

#TrumpWithdrawsEUTariffThreats

- Reward

- 1

- Comment

- Repost

- Share

A $1 USD Jump to the Big League

Trump's $1 USD stablecoin has surpassed all expectations to become the fifth largest stablecoin worldwide.

With issuance approaching $5 billion, it has succeeded in displacing PayPal's currency, proving that political and economic influence can rapidly reshape the crypto landscape.

This shift positions it as a key player in the future of global digital finance, thanks to increasing confidence in its stability backed by the U.S. Treasury.

$USD1

#elaouzi

#usd1

#trump

Trump's $1 USD stablecoin has surpassed all expectations to become the fifth largest stablecoin worldwide.

With issuance approaching $5 billion, it has succeeded in displacing PayPal's currency, proving that political and economic influence can rapidly reshape the crypto landscape.

This shift positions it as a key player in the future of global digital finance, thanks to increasing confidence in its stability backed by the U.S. Treasury.

$USD1

#elaouzi

#usd1

#trump

USD1-0,02%

- Reward

- 1

- Comment

- Repost

- Share

Ethereum whales wake up again

Whales never stop moving

One of the veteran Bitcoin investors has bought another 22,000 ETH worth over $63 million

These massive moves reflect the big players' confidence in the near future of the market and confirm that opportunities are still available for those who read the scene wisely

I believe these deals are the signal we've been waiting for to know the next market direction. What do you think?

#ETHTrendWatch

$ETH

#elaouzi

Whales never stop moving

One of the veteran Bitcoin investors has bought another 22,000 ETH worth over $63 million

These massive moves reflect the big players' confidence in the near future of the market and confirm that opportunities are still available for those who read the scene wisely

I believe these deals are the signal we've been waiting for to know the next market direction. What do you think?

#ETHTrendWatch

$ETH

#elaouzi

ETH-1,71%

- Reward

- 1

- Comment

- Repost

- Share

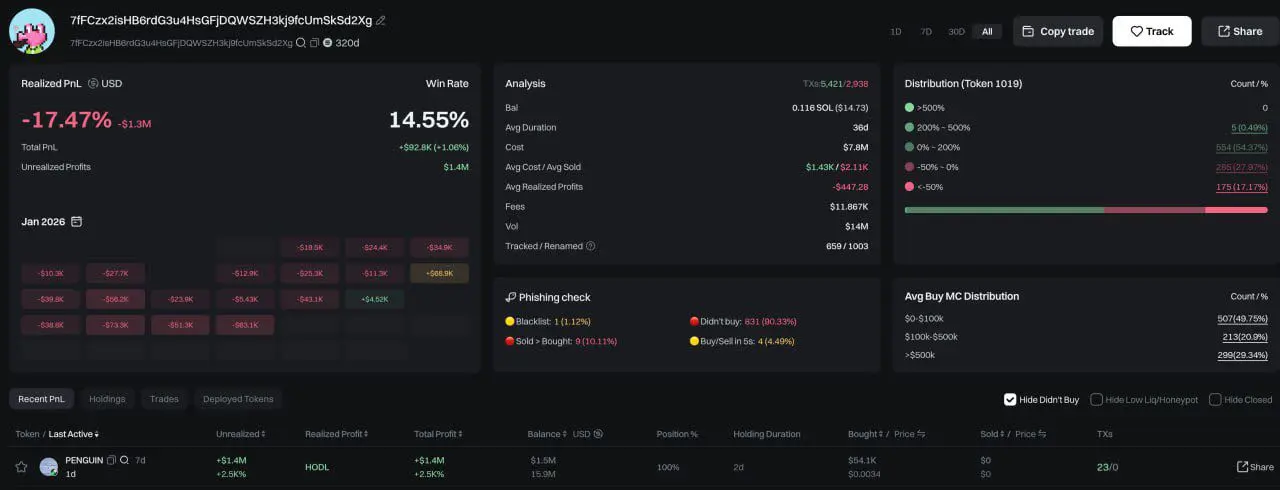

The Storm of Profits Erases Disappointments

Imagine a portfolio that suffered consecutive losses with a win rate of only 14%, but one coin completely changed the game.

The Nietzschean Penguin, known by the symbol $PENGUIN , was the magical force that transformed this trader from a loss to a net profit of $92,000.

This market does not recognize the impossible for those who know how to choose the right moment and make a true breakthrough.

As a portfolio owner, I always believe that one well-planned trade can change the course of your professional life in the crypto world, no matter how rocky the

Imagine a portfolio that suffered consecutive losses with a win rate of only 14%, but one coin completely changed the game.

The Nietzschean Penguin, known by the symbol $PENGUIN , was the magical force that transformed this trader from a loss to a net profit of $92,000.

This market does not recognize the impossible for those who know how to choose the right moment and make a true breakthrough.

As a portfolio owner, I always believe that one well-planned trade can change the course of your professional life in the crypto world, no matter how rocky the

PENGU-6,37%

- Reward

- like

- Comment

- Repost

- Share

Earthquake in the Dollar Throne

The (DXY) dollar index sharply declined at the end of the week, recording its worst performance since mid-2025. Expectations of this decline continue to grow as major investors flee American assets due to escalating tensions between Washington and Europe.

Experts believe that this wave could be the beginning of a long-term downward journey for the greenback.

I think the current economic scene is reshuffling global powers in a way we haven't seen in many years.

$USDC

#TrumpWithdrawsEUTariffThreats

#CryptoMarketWatch

#elaouzi

The (DXY) dollar index sharply declined at the end of the week, recording its worst performance since mid-2025. Expectations of this decline continue to grow as major investors flee American assets due to escalating tensions between Washington and Europe.

Experts believe that this wave could be the beginning of a long-term downward journey for the greenback.

I think the current economic scene is reshuffling global powers in a way we haven't seen in many years.

$USDC

#TrumpWithdrawsEUTariffThreats

#CryptoMarketWatch

#elaouzi

View Original

- Reward

- 3

- 2

- Repost

- Share

GateUser-8f854576 :

:

#GoldandSilverHitNewHighs #GoldandSilverHitNewHighs

#GoldandSilverHitNewHighs

View More

The giant's collapse: GameStop bids farewell to Bitcoin with millions in losses

It seems that GameStop's journey in the crypto market has reached its final stop. The company's official wallet emptied its entire Bitcoin holdings in favor of the Coinbase platform, a clear sign of liquidation.

The story in numbers:

• Purchase at the peak: The company acquired 4,710 BTC at an average price of $107.9K per coin.

• Sale at the bottom: The current price is around $90.8K, indicating a significant loss.

• Heavy toll: The realized losses from this move are estimated at approximately $76 million.

This sud

It seems that GameStop's journey in the crypto market has reached its final stop. The company's official wallet emptied its entire Bitcoin holdings in favor of the Coinbase platform, a clear sign of liquidation.

The story in numbers:

• Purchase at the peak: The company acquired 4,710 BTC at an average price of $107.9K per coin.

• Sale at the bottom: The current price is around $90.8K, indicating a significant loss.

• Heavy toll: The realized losses from this move are estimated at approximately $76 million.

This sud

BTC-1,29%

- Reward

- like

- Comment

- Repost

- Share