Post content & earn content mining yield

placeholder

Adrig_iv

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$SOLRemember that "low" we were tracking the other day during the drop? Solana now has a chance to lock in this bottom signal on the Weekly, and then build off of this B/R combo on the Daily.

SOL2.22%

- Reward

- like

- Comment

- Repost

- Share

SA

StoneAge

Created By@EuropeanFace

Subscription Progress

0.00%

MC:

$0

Create My Token

👀 In every market cycle

Most people are busy with big coins and their sharp fluctuations 📉📈

While some projects move quietly… and reorganize themselves from within ⚙️

🇺🇸 The EGY coin in recent times

Shows remarkable stability and balanced movement 💎

With a clear focus on fundamentals and community building instead of temporary hype 🤝🔥

⏳ This type of project

Often starts quietly…

Then attracts attention at the unexpected moment 🚀✨

📊 Coin Data

🔹 Network: BNB Chain

🔹 Total Supply: 1B EGY

🔹 Status: Gate Fun / Gate Alpha

🔹 Trend: Gradual build before the mome

Most people are busy with big coins and their sharp fluctuations 📉📈

While some projects move quietly… and reorganize themselves from within ⚙️

🇺🇸 The EGY coin in recent times

Shows remarkable stability and balanced movement 💎

With a clear focus on fundamentals and community building instead of temporary hype 🤝🔥

⏳ This type of project

Often starts quietly…

Then attracts attention at the unexpected moment 🚀✨

📊 Coin Data

🔹 Network: BNB Chain

🔹 Total Supply: 1B EGY

🔹 Status: Gate Fun / Gate Alpha

🔹 Trend: Gradual build before the mome

BNB2.21%

MC:$10.49KHolders:3

33.66%

- Reward

- 3

- Comment

- Repost

- Share

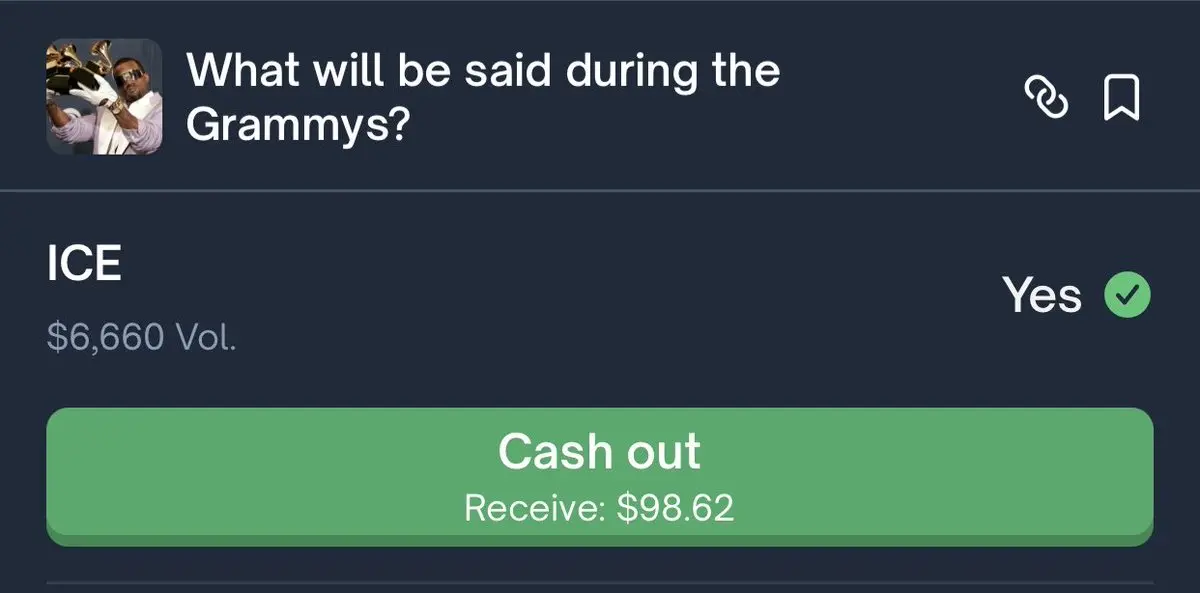

Easiest $100 of my life.

- Reward

- like

- Comment

- Repost

- Share

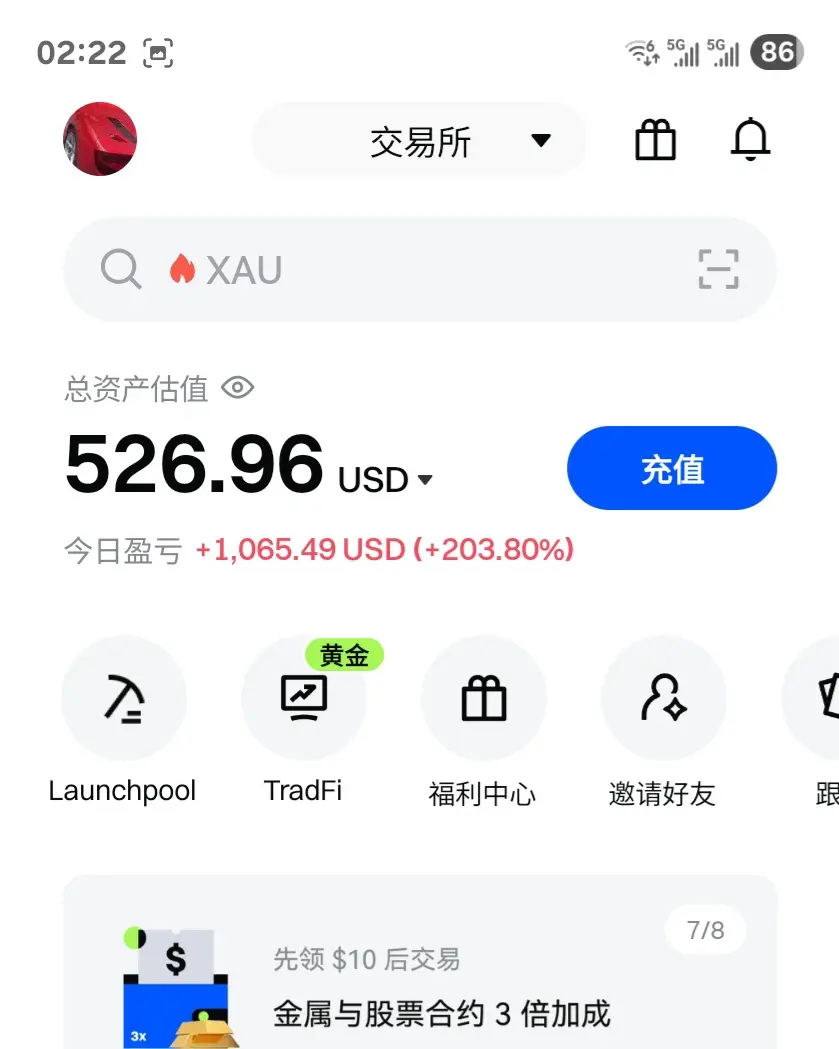

Some U again, yesterday only a little over $300, but in one day it shot up to over $1500, a 5x profit.

Compared to a few months ago, when I was desperately chasing the market every day, doubling my investments daily, then precisely pulling back at night, at the peak hitting 300 to 1500 seven times in 8 days, my mind and body, as well as my account, were all exhausted.

Recently, I suddenly gained some clarity about trading, I feel like I am about to attain enlightenment.

After walking this path for so long, it’s like a drought finally met a sweet rain, and I can finally see a glimmer of s

View OriginalCompared to a few months ago, when I was desperately chasing the market every day, doubling my investments daily, then precisely pulling back at night, at the peak hitting 300 to 1500 seven times in 8 days, my mind and body, as well as my account, were all exhausted.

Recently, I suddenly gained some clarity about trading, I feel like I am about to attain enlightenment.

After walking this path for so long, it’s like a drought finally met a sweet rain, and I can finally see a glimmer of s

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Exclusive Referral Week Phase 9: Earn Up to $300 Cash per Referrer https://www.gate.com/campaigns/3969?ref=UgMXU15Z&ref_type=132&utm_cmp=SlwTM2Wp

- Reward

- 2

- Comment

- Repost

- Share

Understanding Support & Resistance in Crypto

- Reward

- like

- Comment

- Repost

- Share

The Epstein Island and the Nickelodeon logo Always left clues.

View Original

- Reward

- like

- Comment

- Repost

- Share

diaomaobi

叼毛币

Created By@GuXianhu

Subscription Progress

0.00%

MC:

$0

Create My Token

- Reward

- like

- Comment

- Repost

- Share

Guys, what if Saylor lost the private keys to 800,000 $BTCWhat happens next, bull or bear? #crypto

- Reward

- like

- Comment

- Repost

- Share

#WaitOrAct

In the current market environment, the question isn’t bullish or bearish — it’s timing vs patience. Markets are sitting at an inflection point where both action and inaction carry risk.

The Case to WAIT

1. Macro Uncertainty Isn’t Resolved

Liquidity conditions remain tight, and policy signals are still mixed. Acting aggressively before confirmation exposes capital to unnecessary drawdowns.

2. Range-Bound Market Behavior

Price action across major assets suggests consolidation, not expansion. Breakouts without volume confirmation have repeatedly failed.

3. Smart Money Is Observing

On-

In the current market environment, the question isn’t bullish or bearish — it’s timing vs patience. Markets are sitting at an inflection point where both action and inaction carry risk.

The Case to WAIT

1. Macro Uncertainty Isn’t Resolved

Liquidity conditions remain tight, and policy signals are still mixed. Acting aggressively before confirmation exposes capital to unnecessary drawdowns.

2. Range-Bound Market Behavior

Price action across major assets suggests consolidation, not expansion. Breakouts without volume confirmation have repeatedly failed.

3. Smart Money Is Observing

On-

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊$BTCStill executing the plan, avg entry $77.4K,Scaling in this long if we bleed towards 70k, risk defined; despite the dip CVD delta is holding with absorption on the tape, meaning smart money is loading while price hunts liquidity, expecting a pullback then expansion as shorts get forced to cover and invalidation is clear for the longs

- Reward

- like

- Comment

- Repost

- Share

Intraday Trading Strategy (Educational Analysis)

- Reward

- like

- Comment

- Repost

- Share

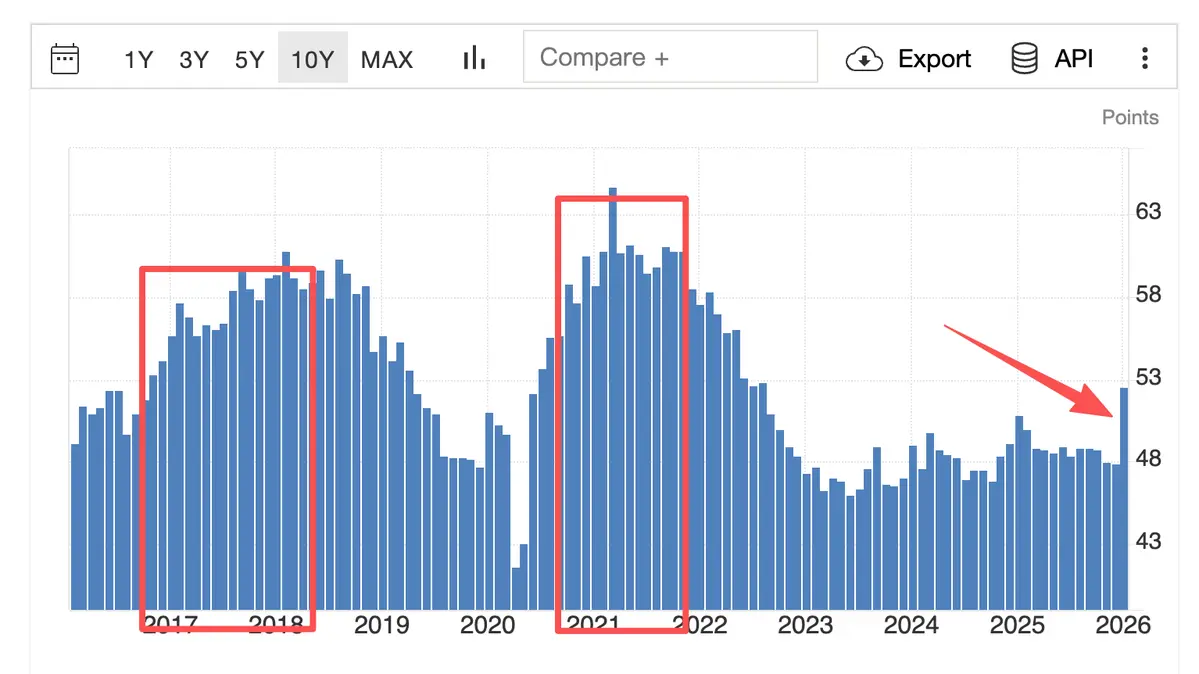

In case you don\'t know, alts szns are high relative to ISM PMI, Look at the char you will know why we don\'t have it for last years from 2022.And it is finally back.

- Reward

- 1

- Comment

- Repost

- Share

Dead cat bounceOnce finished, back to $63 we go $SLV 🩸🩸🩸

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More381.91K Popularity

11.86K Popularity

11.33K Popularity

6.88K Popularity

4.84K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.87KHolders:00.00%

- MC:$2.87KHolders:00.00%

- MC:$2.87KHolders:10.00%

News

View MoreData: 23,100 SOL transferred out from Bullish.com, worth approximately $2.4 million. This transfer indicates a significant movement of assets, reflecting trading activity or portfolio adjustments. Please review the transaction details for security and record-keeping purposes.

7 m

Data: 307.63 BTC transferred from an anonymous address, valued at approximately $23.54 million USD.

37 m

Data: If ETH drops below $2,221, the total long liquidation strength on major CEXs will reach $850 million.

1 h

Bostick: If interest rates are cut, inflation is highly unlikely to drop to 2%. He explained that the current inflation rate is driven by factors that are not easily reversed by monetary policy alone, and that a significant reduction to 2% would require a much more aggressive approach or a change in underlying economic conditions. Therefore, policymakers should be cautious about expecting a quick decline in inflation just through lowering interest rates.

1 h

Bostick: A stable labor market provides the Fed with room to wait

1 h

Pin