According to Wu, Downdetector has monitored that several platforms, including Reddit, Hulu, EA, Max, and Xbox Network, experienced service interruptions today. The Coinbase support team later stated that some users were unable to access Coinbase due to an outage of AWS (Amazon Web Services). The official statement said that the team is currently addressing the issue and that all funds are secure.

View OriginalGateUser-c3b832ee

No content yet

GateUser-c3b832ee

Hyperliquid Founder Discusses the Significance of Perpetual Contracts

At the Token 2049 Singapore conference, Hyperliquid co-founder Jeff Yan discussed the development and value of perpetual contract (Perp) products. He pointed out that perpetual contracts have achieved a groundbreaking breakthrough from 0 to 1, laying an important foundation for the crypto industry. The significant advantage of perpetual contracts as blockchain products is primarily due to two reasons: first, the issue of contract fragmentation with different strike prices and expiration dates can centralize liquidity to en

At the Token 2049 Singapore conference, Hyperliquid co-founder Jeff Yan discussed the development and value of perpetual contract (Perp) products. He pointed out that perpetual contracts have achieved a groundbreaking breakthrough from 0 to 1, laying an important foundation for the crypto industry. The significant advantage of perpetual contracts as blockchain products is primarily due to two reasons: first, the issue of contract fragmentation with different strike prices and expiration dates can centralize liquidity to en

HYPE0.07%

- Reward

- 1

- Comment

- Repost

- Share

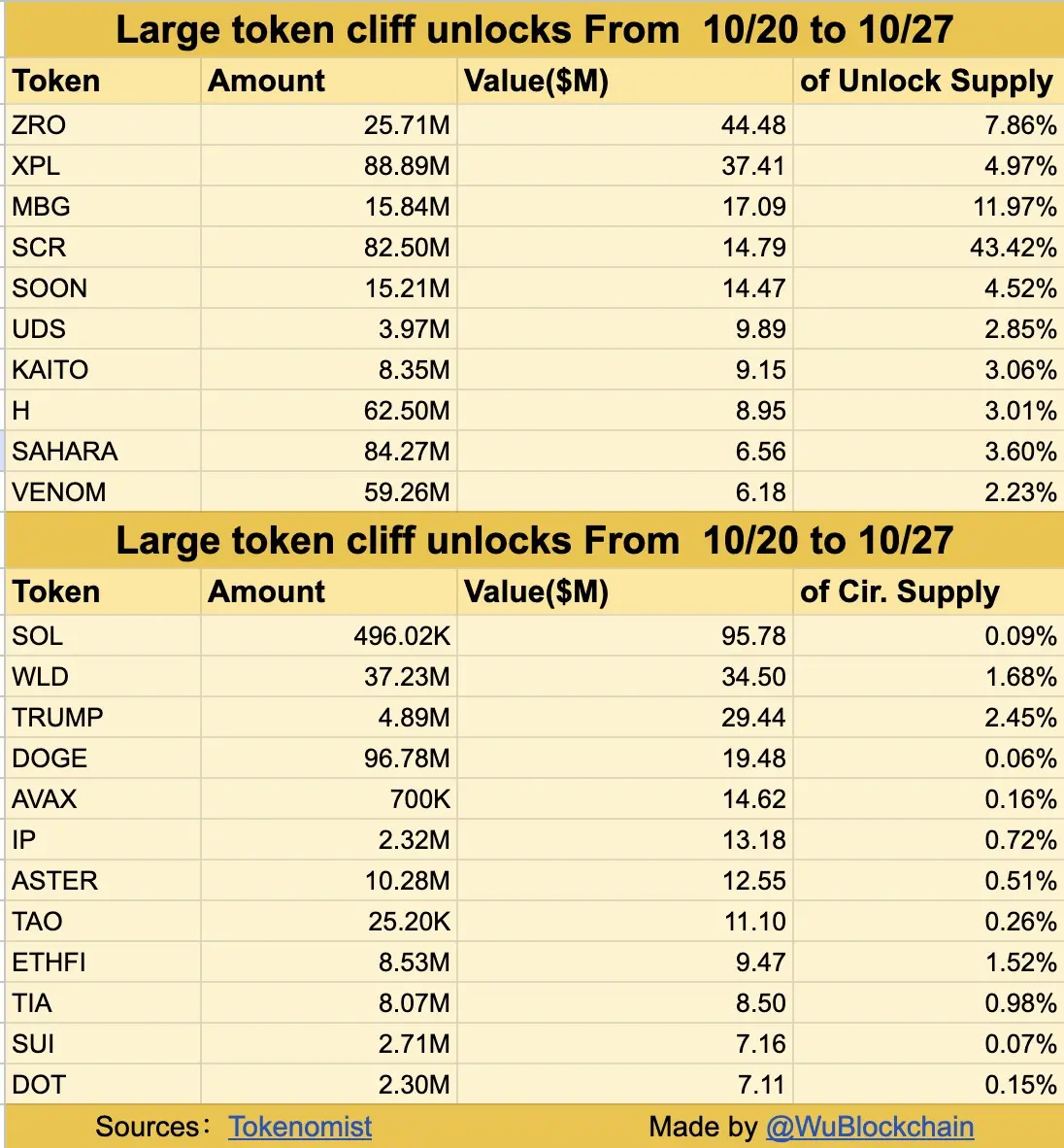

According to Wu, as reported by Tokenomist, in the next 7 days, there will be a single large unlock (amount greater than 5 million USD) for ZRO XPL MBG SCR SOON UDS KAITO H SAHARA VENOM, etc.; in the next 7 days, there will be a linear large unlock (daily unlock amount greater than 1 million USD) for SOL WLD TRUMP DOGE AVAX IP ASTER TAO ETHFI TIA SUI DOT, etc., with a total unlock value exceeding 431 million USD.

View Original

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

According to Wu, data from DeFiLlama shows that the historical cumulative volume of BNB Chain DEX has surpassed 2 trillion USD, with a cumulative volume of 0.558 trillion USD since the beginning of this year. PancakeSwap holds a major market share in the BNB Chain DEX.

View Original- Reward

- 1

- Comment

- Repost

- Share

According to Wu, based on SoSoValue data, during the last trading week (Eastern Time from October 13 to October 17), Bitcoin Spot ETF had a net outflow of 1.23 billion USD, marking the second highest in history, with none of the twelve ETFs seeing a net inflow. The Bitcoin Spot ETF with the highest net outflow last week was the Grayscale ETF GBTC, with a weekly net outflow of 298 million USD, bringing GBTC's total historical net outflow to 24.5 billion USD.

BTC0.75%

- Reward

- 1

- Comment

- Repost

- Share

Wu reported that, according to SoSoValue data, during the last trading week (Eastern Time from October 13 to October 17), the Ethereum Spot ETF had a net outflow of $312 million. The Ethereum Spot ETF with the highest weekly net outflow was the Blackrock ETF ETHA, with a weekly net outflow of $245 million, and the historical total net inflow of ETHA is now $14.24 billion.

ETH-0.39%

- Reward

- 1

- Comment

- Repost

- Share

According to Wu, based on SoSoValue data, during the last trading week (Eastern Time from October 13 to October 17), Bitcoin Spot ETF had a net outflow of 1.23 billion USD, with none of the twelve ETFs experiencing net inflows. The Bitcoin Spot ETF with the highest net outflow last week was Grayscale ETF GBTC, which saw a weekly net outflow of 298 million USD, bringing GBTC's total historical net outflow to 24.5 billion USD.

BTC0.75%

- Reward

- 1

- Comment

- Repost

- Share

According to Wu, based on DeFiLlama data, in the past 24 hours, Lighter's trading volume reached $7.778 billion, becoming another derivatives protocol that surpassed Hyperliquid (approximately $5.069 billion) after Aster. However, Lighter also shows the characteristic of low open interest and high trading volume, with current open interest at $1.414 billion, while Hyperliquid's is $7.59 billion. Previously, Lighter encountered significant downtime issues during the flash crash in the 1011 market.

View Original- Reward

- 1

- Comment

- Repost

- Share

According to Wu, it has been reported that Richard Heart, the suspected founder of HEX, PulseChain, and PulseX, transferred 153,241 ETH (approximately $608 million) from his wallet to a new address in the past 5 hours, as monitored by Lookonchain. Previously, from March 4 to 8, 2024, he purchased 162,937 ETH (approximately $619 million) at an average price of $3,800 through 25 wallets. Additionally, in the past 6 months, he has deposited 9,500 ETH (approximately $37.43 million) into TornadoCash.

ETH-0.39%

- Reward

- 1

- Comment

- Repost

- Share

According to Wu, as reported by the Hong Kong Economic Daily, a Crypto Assets investment company has leased the entire upper floor of the Man Yee Building in Central, covering an area of about 9,000 square feet, with a rent of about 70 HKD per square foot, for business expansion purposes. Recently, the Hong Kong Grade A office market has been active, with three floors of office space in Wong Chuk Hang being rented to DKSH at 20 HKD per square foot, and other companies such as Shanghai Pharmaceuticals and MERCK also settling in Admiralty and Quarry Bay.

View Original- Reward

- 1

- Comment

- Repost

- Share

"Wintermute Founder Discusses 'The Night of October 11th' and Market Predictions" (Author: The Block, Translated by: Odaily) Evgeny Gaevoy, the founder of Wintermute, reviewed the big dump in the crypto market on October 11th in The Block podcast, believing that the event was caused by a combination of multiple leverage and market structure issues, resulting in the largest scale of forced liquidation in history. Gaevoy emphasized that mainstream assets like BTC and ETH showed greater resilience, and market liquidity will further concentrate on leading assets, while alts are temporarily

View Original- Reward

- 1

- Comment

- Repost

- Share

According to Wu, as per data from DeFiLlama, the dark pool HumidiFi has become the largest DEX on Solana, with a volume of 1.1 billion dollars in the past 24 hours, 9.698 billion dollars in the past 7 days, and 34 billion dollars in the past 30 days, all surpassing Meteora, Raydium, and Pump, which were the top DEXs by volume on Solana. The dark pool has no front end and quotes prices through a private method, typically executed by aggregators.

View Original- Reward

- 2

- Comment

- Repost

- Share

According to Wu, Ethereum founder Vitalik Buterin wrote an article introducing the GKR protocol, a family of protocols that enables various proof systems to achieve extremely fast speeds. GKR is the core protocol for realizing rapid proofs such as ZK-EVM and zk-ML, adapting to computations involving "multi-layer low-order processing + extensive repetitive function applications" (such as hash and neural networks), requiring no commitment to intermediate layers, only to input and output, significantly enhancing efficiency. By reducing the computation amount per round of sumcheck (e.g., Gruen'

ETH-0.39%

- Reward

- like

- Comment

- Repost

- Share

According to Bloomberg, the U.S. Department of Homeland Security (DHS) has disclosed that organized crime groups in China are engaging in large-scale money laundering through U.S. gift cards, transferring funds back to China. Investigations show that criminals in the U.S. use stolen gift cards to purchase high-value electronic products, which are then shipped back to China for resale. After making profits, they convert the funds into Crypto Assets and transfer them through Chinese payment platforms. DHS pointed out that related fraud losses have exceeded $1 billion in the past two years, with

View Original- Reward

- like

- Comment

- Repost

- Share

NASDAQ-listed CEA Industries (BNC) announced that it is building the "largest BNB corporate treasury in the world," holding 480,000 BNB with total assets of approximately $663 million. The company positions itself as a BNB ecosystem investment channel for the public market, with its CEO, former Galaxy Digital co-founder David Namdar, stating that BNB is "the most undervalued blue-chip encryption asset." BNC currently has an implied net asset value of approximately $14.59 per share, and its stock price is in the "discount trading" range.

BNB-2.33%

- Reward

- like

- Comment

- Repost

- Share

According to Wu, a U.S. user lost approximately $3.05 million (about 1.2 million XRP) this week due to theft involving the Ellipal hardware wallet, as reported by ZachXBT. The tracking shows that the attacker initiated over 120 Ripple to Tron transfers through Bridgers (formerly SWFT) on October 12, consolidating the funds into an address, which were then completely washed out by October 15, flowing into over-the-counter channels associated with the illegal trading platform Huione in Southeast Asia. Huione has been involved in billions of dollars in fraud and money laundering activities in rec

View Original- Reward

- like

- Comment

- Repost

- Share

According to Wu, MLM monitoring has found that several suspected related wallets hold approximately 12.26 million HYPE, and the trading patterns are highly similar to the public wallet of the well-known encryption figure Technorevenant. If the real-name wallet is included, the peak total holdings amount to approximately 14.66 million HYPE (about 870 million USD), which were subsequently sold off and rotated to Aster. Currently, the related wallets still hold about 9.59 million HYPE (approximately 347 million USD), of which about 2.56 million HYPE have been unlocked, while the rest are in stake

View Original- Reward

- like

- Comment

- Repost

- Share

The article points out that leverage is a tool to improve capital efficiency and should not be viewed as a profit multiplier; blind usage will face the risk of Get Liquidated. At the same time, it is necessary to clearly distinguish between position size and actual risk, and it is recommended to dynamically adjust the betting ratio based on trading quality. The conclusion is: controlling risk and adhering to discipline are key to achieving stable profits. Read more:

View Original- Reward

- like

- Comment

- Repost

- Share

"Deep Tide: Is the crypto world VC facing a life-and-death crossroads?" (Author: Ada) The bull run of 2025 returns, Bitcoin breaks 100,000 USD, but encryption VC is caught in a winter. ABCDE stops fundraising, Primary Market activity drops sharply, VC has transformed from "trend chaser" to "end of the ecosystem": not making money, unable to raise funds, and losing chips to market makers and KOLs, lacking bargaining power. Some are turning to AI investments, Secondary Market, or structured funds for survival, while others are transforming into service providers. New LPs place more importance on

BTC0.75%

- Reward

- like

- Comment

- Repost

- Share