ALPHABrotherHai

Ride with the trend, accompany with profit.

ALPHABrotherHai

Price Trend Analysis

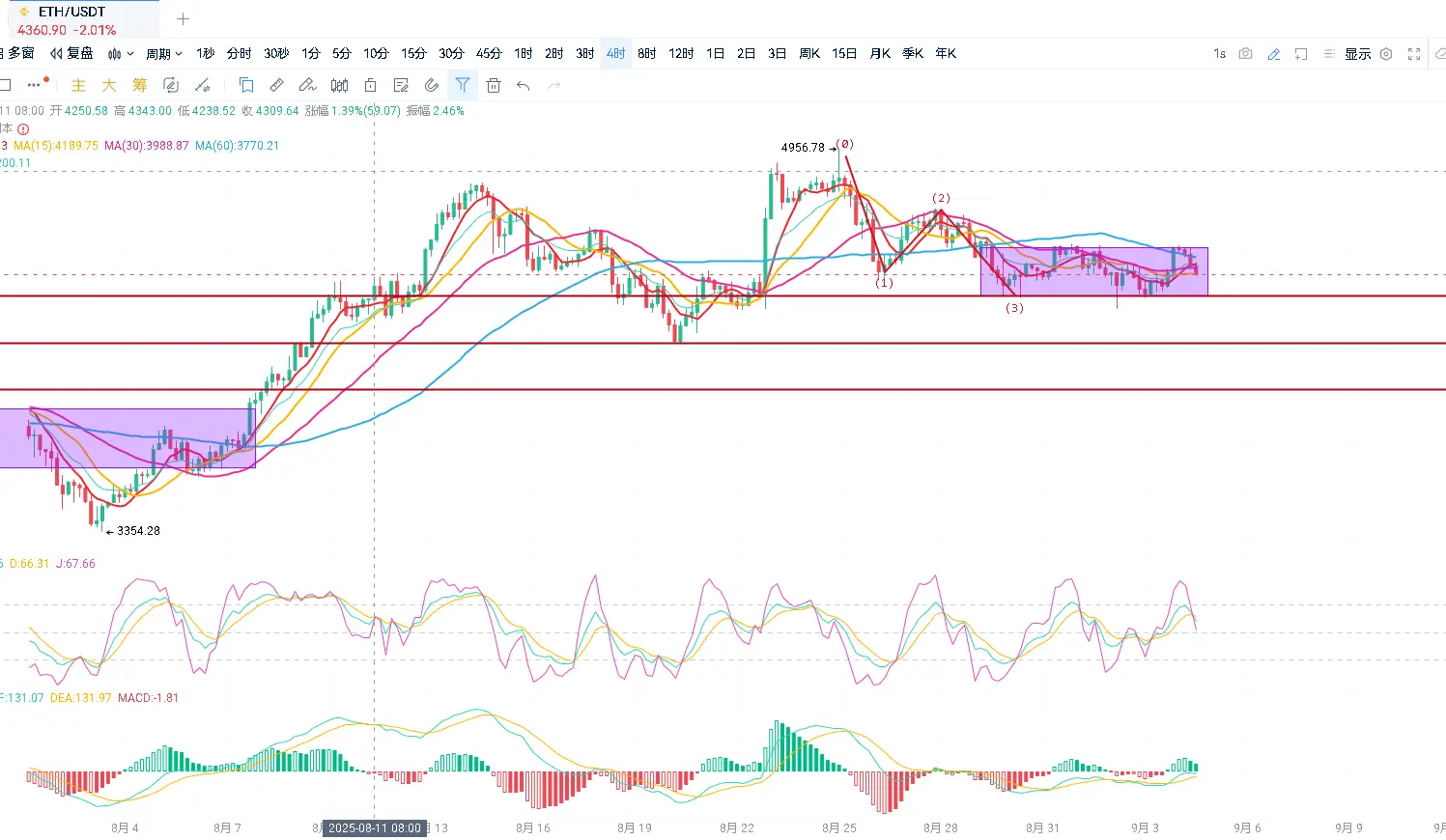

Conclusion: ETH is forming a central consolidation in the 4-hour cycle, waiting for the direction selection in the future market, with a fluctuation range of 4450-4650.

K-line patterns:

1-hour level: Recently oscillating in the 4500-4550 range, with 4557.67 forming a short-term resistance level and 4464 constituting key support. After a long lower shadow (4430.59) appeared at 9 PM on the 16th, a rebound occurred, indicating buyer intervention.

Daily level: After the significant breakout on September 12, there has been a continuous 3-day pullback testing the 4500 integer le

Conclusion: ETH is forming a central consolidation in the 4-hour cycle, waiting for the direction selection in the future market, with a fluctuation range of 4450-4650.

K-line patterns:

1-hour level: Recently oscillating in the 4500-4550 range, with 4557.67 forming a short-term resistance level and 4464 constituting key support. After a long lower shadow (4430.59) appeared at 9 PM on the 16th, a rebound occurred, indicating buyer intervention.

Daily level: After the significant breakout on September 12, there has been a continuous 3-day pullback testing the 4500 integer le

ETH0.85%

- Reward

- 1

- 1

- Repost

- Share

GateUser-fd8e740f :

:

Quick, enter a position! 🚗Price Trend Analysis

Conclusion: ETH is consolidating in a sideways adjustment on the 4-hour timeframe, with a fluctuation range of 4550-4750.

K-line pattern:

A double top pattern has appeared on the 1-hour level (around 4670). The recent high of 4670.28 failed to break the previous high of 4692.36, forming short-term resistance. On the daily level, there have been three consecutive days of long lower shadows (4576-4637), indicating strong buying below 4600, but there is significant selling pressure at the round number of 4700 above.

Technical Indicators:

MACD: The 1-hour level DIF crosses abo

Conclusion: ETH is consolidating in a sideways adjustment on the 4-hour timeframe, with a fluctuation range of 4550-4750.

K-line pattern:

A double top pattern has appeared on the 1-hour level (around 4670). The recent high of 4670.28 failed to break the previous high of 4692.36, forming short-term resistance. On the daily level, there have been three consecutive days of long lower shadows (4576-4637), indicating strong buying below 4600, but there is significant selling pressure at the round number of 4700 above.

Technical Indicators:

MACD: The 1-hour level DIF crosses abo

ETH0.85%

- Reward

- 1

- Comment

- Repost

- Share

Price Trend Analysis

Conclusion: ETH 4-hour cycle trend is upward, focusing on 4650, 4750, 4850 above.

K-line patterns:

Recently, a double top structure has formed at the 1-hour level (4563 and 4551.97), and the current price has fallen below the 4535 support level.

The daily chart shows an upward channel, but the long upper shadow on September 12 indicates strong selling pressure in the 4600 area.

Technical Indicators:

MACD: 1-hour DIF ( 37.52) and DEA ( 30.66) show signs of a death cross, indicating a weakening bullish momentum; the daily MACD ( -17.83) histogram is contracting but remains b

Conclusion: ETH 4-hour cycle trend is upward, focusing on 4650, 4750, 4850 above.

K-line patterns:

Recently, a double top structure has formed at the 1-hour level (4563 and 4551.97), and the current price has fallen below the 4535 support level.

The daily chart shows an upward channel, but the long upper shadow on September 12 indicates strong selling pressure in the 4600 area.

Technical Indicators:

MACD: 1-hour DIF ( 37.52) and DEA ( 30.66) show signs of a death cross, indicating a weakening bullish momentum; the daily MACD ( -17.83) histogram is contracting but remains b

ETH0.85%

- Reward

- 1

- 3

- Repost

- Share

REDOY :

:

HODL Tight 💪View More

Price Trend Analysis

Conclusion: ETH is experiencing an upward oscillation in the hourly cycle, with a fluctuation range of 4300-4500. Within this range, one should sell high and buy low, and follow the trend if the range is broken.

K-line pattern:

Recently, a "double top" pattern has appeared on the 1-hour chart, forming a clear resistance zone in the 4365-4380 area.

The daily chart shows high-level volatility, with strong resistance at the 4500 psychological level.

Technical Indicators:

MACD: The 1-hour level DIF (11.50) has crossed below DEA (7.50), and the red momentum bars are expanding,

Conclusion: ETH is experiencing an upward oscillation in the hourly cycle, with a fluctuation range of 4300-4500. Within this range, one should sell high and buy low, and follow the trend if the range is broken.

K-line pattern:

Recently, a "double top" pattern has appeared on the 1-hour chart, forming a clear resistance zone in the 4365-4380 area.

The daily chart shows high-level volatility, with strong resistance at the 4500 psychological level.

Technical Indicators:

MACD: The 1-hour level DIF (11.50) has crossed below DEA (7.50), and the red momentum bars are expanding,

ETH0.85%

- Reward

- 8

- 2

- Repost

- Share

BuyAnythingAndGetRich. :

:

Just go for it💪View More

- Reward

- like

- Comment

- Repost

- Share

Price Trend Analysis

Conclusion: ETH continues to build a downward center on the 4-hour chart, with a fluctuation range of 4200-4360.

K-line pattern:

1-hour level: Recently formed a double top structure, with highs at 4336.02 and 4330.97. The current price is oscillating in the 4290-4300 range and has not been able to break through the previous highs.

Daily level: After peaking at 4336 on September 7, it fell back, forming a long upper shadow, indicating strong selling pressure above 4300. The low point of 4256 on September 5 and the low point of 4270 on September 7 constitute short-term suppo

Conclusion: ETH continues to build a downward center on the 4-hour chart, with a fluctuation range of 4200-4360.

K-line pattern:

1-hour level: Recently formed a double top structure, with highs at 4336.02 and 4330.97. The current price is oscillating in the 4290-4300 range and has not been able to break through the previous highs.

Daily level: After peaking at 4336 on September 7, it fell back, forming a long upper shadow, indicating strong selling pressure above 4300. The low point of 4256 on September 5 and the low point of 4270 on September 7 constitute short-term suppo

ETH0.85%

Price Trend Analysis

Conclusion: ETH 4-hour cycle continues to build a central area, with a fluctuation range of 4200-4500. Within the range, sell high and buy low; if the range is broken, follow the trend.

K-line patterns:

1-hour level: Recently formed a double bottom structure (4291.02/4295.93), current price has broken through the neckline at 4330 and is pulling back to EMA7 (4326.58).

Daily level: After the long bearish candle from the previous day (4482.05-4265.33), a hammer candle appeared, and yesterday's close confirmed a short-term stop-loss signal.

Technical indicators:

MACD: 1-h

Conclusion: ETH 4-hour cycle continues to build a central area, with a fluctuation range of 4200-4500. Within the range, sell high and buy low; if the range is broken, follow the trend.

K-line patterns:

1-hour level: Recently formed a double bottom structure (4291.02/4295.93), current price has broken through the neckline at 4330 and is pulling back to EMA7 (4326.58).

Daily level: After the long bearish candle from the previous day (4482.05-4265.33), a hammer candle appeared, and yesterday's close confirmed a short-term stop-loss signal.

Technical indicators:

MACD: 1-h

ETH0.85%

- Reward

- 2

- Comment

- Repost

- Share

Price Trend Analysis

Conclusion: ETH is continuing to build a central point in the hourly period, with a range of 4200-4500, and the intraday trend is weak.

K-line patterns:

The 1-hour EMA7 has crossed below EMA30, forming a death cross, indicating a weakening short-term trend. The daily EMA30 (4280) and EMA120 (3439) maintain a bullish arrangement, but the short-term pullback is evident as the key integer support at 4350 was briefly broken before rebounding, showing that there is buying interest at this level.

Technical indicators:

MACD: The 1-hour level DIF (4.66) crosses below DEA (19.59),

Conclusion: ETH is continuing to build a central point in the hourly period, with a range of 4200-4500, and the intraday trend is weak.

K-line patterns:

The 1-hour EMA7 has crossed below EMA30, forming a death cross, indicating a weakening short-term trend. The daily EMA30 (4280) and EMA120 (3439) maintain a bullish arrangement, but the short-term pullback is evident as the key integer support at 4350 was briefly broken before rebounding, showing that there is buying interest at this level.

Technical indicators:

MACD: The 1-hour level DIF (4.66) crosses below DEA (19.59),

ETH0.85%

- Reward

- like

- 1

- Repost

- Share

GateUser-4990f8f3 :

:

Just go for it💪Candlestick Patterns:

1-hour level: A double top pattern has recently formed (4343.46 and 4340.75), and the current price has broken below the neck line at 4313, with a low test of 4291.19. At the 4-hour level, a long lower shadow has appeared (4266.31-4327.93), indicating strong support in the 4250-4270 area.

Daily level: From August 26 to September 2, an ascending wedge (4633-4210) was formed, and currently, it is oscillating at the lower edge of the wedge. The monthly chart shows a shooting star (4491-4210), with significant selling pressure at high positions.

Technical Indicators:

MACD: Th

1-hour level: A double top pattern has recently formed (4343.46 and 4340.75), and the current price has broken below the neck line at 4313, with a low test of 4291.19. At the 4-hour level, a long lower shadow has appeared (4266.31-4327.93), indicating strong support in the 4250-4270 area.

Daily level: From August 26 to September 2, an ascending wedge (4633-4210) was formed, and currently, it is oscillating at the lower edge of the wedge. The monthly chart shows a shooting star (4491-4210), with significant selling pressure at high positions.

Technical Indicators:

MACD: Th

ETH0.85%

- Reward

- 2

- 2

- Repost

- Share

Amarillo :

:

more details 🙂View More

Price Trend Analysis

Conclusion: In the ETH hourly cycle, it is fluctuating upward. Pay attention to the resistance level at 4500 above, which, if not broken, indicates a short position. This was discussed in the morning live broadcast. Today, we are looking for a rebound, and the first target of 4400 has been reached. Next, pay attention to the resistance point at 4500, which is also the second target.

K-line patterns:

The 1-hour level has formed a double bottom (4252.31/4210.61) in the last 24 hours. After breaking through the neckline at 4360 today, it accelerated upward, and the daily line

Conclusion: In the ETH hourly cycle, it is fluctuating upward. Pay attention to the resistance level at 4500 above, which, if not broken, indicates a short position. This was discussed in the morning live broadcast. Today, we are looking for a rebound, and the first target of 4400 has been reached. Next, pay attention to the resistance point at 4500, which is also the second target.

K-line patterns:

The 1-hour level has formed a double bottom (4252.31/4210.61) in the last 24 hours. After breaking through the neckline at 4360 today, it accelerated upward, and the daily line

ETH0.85%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

StrongShieldTradingCompanyPing :

:

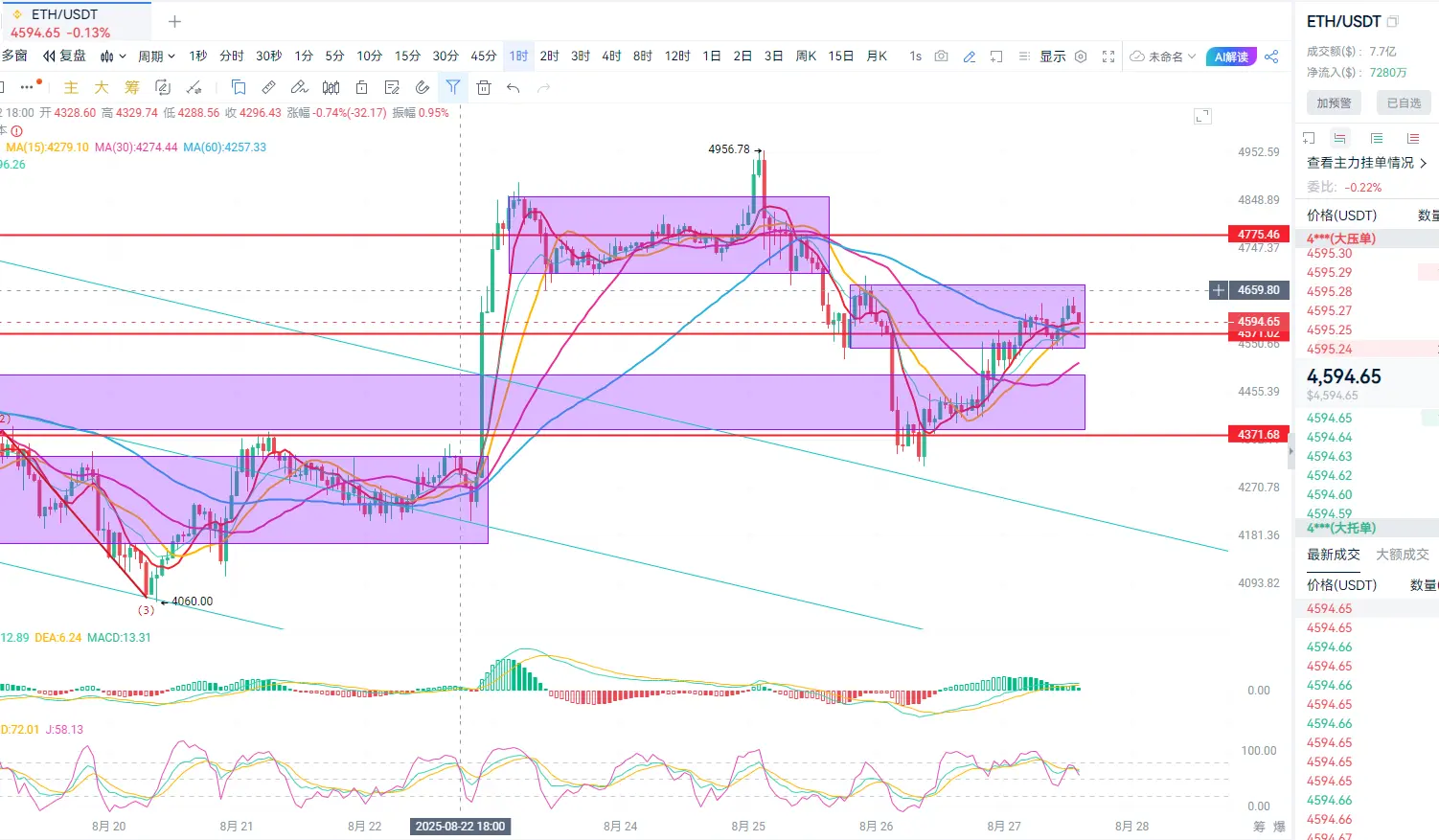

Charge!Price Trend Analysis

Conclusion: ETH is forming a downward center in the 4-hour cycle, with a fluctuation range of 4300-4500. Within this range, sell high and buy low; if the range is broken, follow the trend.

K-line pattern:

Short-term correction is evident. After dropping from the high of 4490 to 4358, it rebounded, forming a V-shaped bottom structure. The key integer level of 4450 has been breached and turned into resistance. The previous high of 4490 constitutes strong pressure.

Technical Indicators:

The MACD continues to show a death cross and move downward, with the histogram expanding,

Conclusion: ETH is forming a downward center in the 4-hour cycle, with a fluctuation range of 4300-4500. Within this range, sell high and buy low; if the range is broken, follow the trend.

K-line pattern:

Short-term correction is evident. After dropping from the high of 4490 to 4358, it rebounded, forming a V-shaped bottom structure. The key integer level of 4450 has been breached and turned into resistance. The previous high of 4490 constitutes strong pressure.

Technical Indicators:

The MACD continues to show a death cross and move downward, with the histogram expanding,

ETH0.85%

- Reward

- 4

- 2

- Repost

- Share

GateUser-5550d7fa :

:

The newbie still doesn't dare to enter, what a missed opportunity ah ah ah ah ah ah ah ah ah ah ah ah ah ah ah ah ah ah ah ah ah.View More

Price Trend Analysis

ETH is continuing to build a central point in the hourly cycle, with a fluctuation range of 4500-4700.

K-line patterns:

The recent hourly chart shows that the price is oscillating around 4560, forming a short-term sideways structure. The previous high of 4588.22 (08/28 13:00) and the low of 4467.63 (08/28 08:00) constitute the current fluctuation range.

The daily chart shows a long lower shadow (lowest at 4481.53 on 08/27, closing at 4506.71), indicating that there is buying support below 4560.

Technical indicators:

MACD: The DIF and DEA on the hourly chart have narrowed a

ETH is continuing to build a central point in the hourly cycle, with a fluctuation range of 4500-4700.

K-line patterns:

The recent hourly chart shows that the price is oscillating around 4560, forming a short-term sideways structure. The previous high of 4588.22 (08/28 13:00) and the low of 4467.63 (08/28 08:00) constitute the current fluctuation range.

The daily chart shows a long lower shadow (lowest at 4481.53 on 08/27, closing at 4506.71), indicating that there is buying support below 4560.

Technical indicators:

MACD: The DIF and DEA on the hourly chart have narrowed a

ETH0.85%

- Reward

- like

- Comment

- Repost

- Share

Price Trend Analysis

Conclusion: ETH is fluctuating in the hourly cycle, with a fluctuation range of 4500-4700 (rounded to the nearest integer).

1. K-line pattern:

1-hour level: The price has formed a short-term double top near 4600 (4643.93 and 4641.77), followed by a pullback to 4588.4, indicating strong selling pressure at the 4600 key level. Daily level: A large bullish candle appeared on August 26 (4310→4632.92), but on August 27, it failed to continue the upward trend, closing with a small bearish candle, forming a short-term stagnation signal.

2. Technical Indicators:

MACD: The 1-hour l

Conclusion: ETH is fluctuating in the hourly cycle, with a fluctuation range of 4500-4700 (rounded to the nearest integer).

1. K-line pattern:

1-hour level: The price has formed a short-term double top near 4600 (4643.93 and 4641.77), followed by a pullback to 4588.4, indicating strong selling pressure at the 4600 key level. Daily level: A large bullish candle appeared on August 26 (4310→4632.92), but on August 27, it failed to continue the upward trend, closing with a small bearish candle, forming a short-term stagnation signal.

2. Technical Indicators:

MACD: The 1-hour l

ETH0.85%

- Reward

- 2

- Comment

- Repost

- Share

Price trend analysis conclusion: ETH staged a closing trend yesterday, history repeats itself, quickly falling in the evening to around 4311, forming a bottom divergence, with the hourly Candlestick showing a head-and-shoulders reversal pattern. There is a rebound demand in the hourly cycle during the day, with the upper resistance levels at 4500 and 4600.

Candlestick pattern:

1-hour level: Recently, a V-shaped Rebound pattern has appeared, quickly rising from the low of 4331 to the high of 4451, forming a short-term bottom structure. At 09:00, a long bullish Candlestick broke through the prev

Candlestick pattern:

1-hour level: Recently, a V-shaped Rebound pattern has appeared, quickly rising from the low of 4331 to the high of 4451, forming a short-term bottom structure. At 09:00, a long bullish Candlestick broke through the prev

ETH0.85%

- Reward

- 2

- Comment

- Repost

- Share

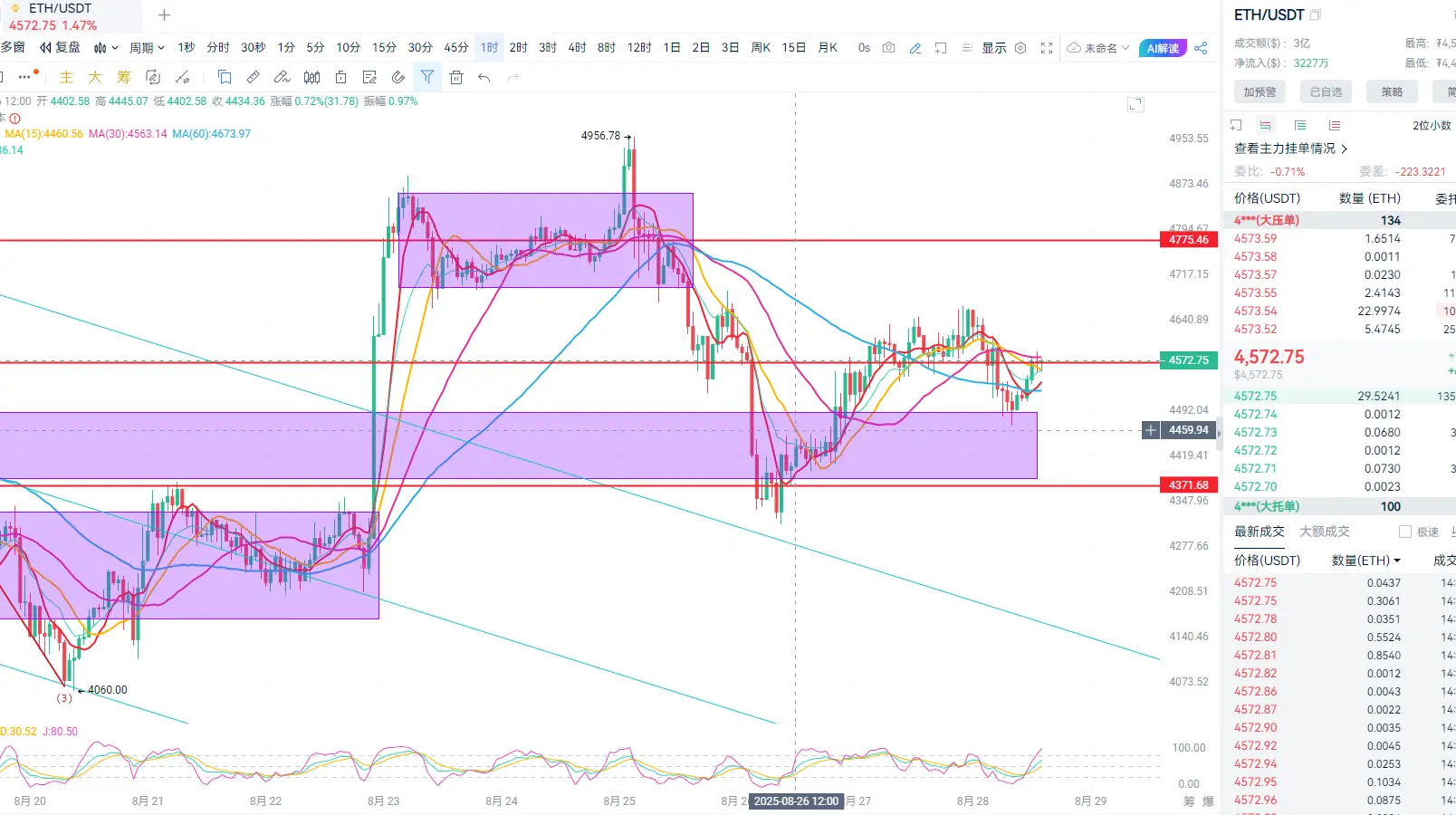

Price Trend Analysis

Conclusion: ETH continues to decline, with support at 4600 and 4500 below.

K-line pattern:

1-hour level: Recently, there have been long upper shadows (such as the high point of 4797.97 at 08:00 on August 25) and long lower shadows (such as the low point of 4656.48 at 14:00 on August 25), indicating fierce competition between bulls and bears. A short-term oscillation box has formed in the 4700-4800 range.

Daily level: A breakout long candle was formed on August 22 (4207→4887), but currently there have been three consecutive days of bearish closes, forming a "Dark Cloud Cove

Conclusion: ETH continues to decline, with support at 4600 and 4500 below.

K-line pattern:

1-hour level: Recently, there have been long upper shadows (such as the high point of 4797.97 at 08:00 on August 25) and long lower shadows (such as the low point of 4656.48 at 14:00 on August 25), indicating fierce competition between bulls and bears. A short-term oscillation box has formed in the 4700-4800 range.

Daily level: A breakout long candle was formed on August 22 (4207→4887), but currently there have been three consecutive days of bearish closes, forming a "Dark Cloud Cove

ETH0.85%

- Reward

- 8

- 4

- Repost

- Share

GateUser-c182469c :

:

Hurry, enter a position! 🚗 Hurry, enter a position! 🚗 Hurry, enter a position! 🚗 Hurry, enter a position! 🚗 Hurry, enter a position! 🚗View More

Price Trend Analysis

Conclusion: ETH continues to decline, focusing on support at 4600 and 4500.

K-line patterns:

1-hour level: Recently, there have been long upper shadows (such as the high point of 4797.97 at 08:00 on August 25) and long lower shadows (such as the low point of 4656.48 at 14:00 on August 25), indicating fierce competition between bulls and bears. A short-term consolidation range has formed between 4700 and 4800.

Daily level: On August 22, a breakout long bullish candle was formed (4207→4887), but currently, there have been three consecutive days of bearish candles, creating a

Conclusion: ETH continues to decline, focusing on support at 4600 and 4500.

K-line patterns:

1-hour level: Recently, there have been long upper shadows (such as the high point of 4797.97 at 08:00 on August 25) and long lower shadows (such as the low point of 4656.48 at 14:00 on August 25), indicating fierce competition between bulls and bears. A short-term consolidation range has formed between 4700 and 4800.

Daily level: On August 22, a breakout long bullish candle was formed (4207→4887), but currently, there have been three consecutive days of bearish candles, creating a

ETH0.85%

- Reward

- 1

- 2

- Repost

- Share

Ybaser :

:

Steadfast HODL💎View More

ETH Hourly Cycle Analysis

Conclusion: ETH continues to build a center, consolidating sideways, and can start at any time.

Price Trend Analysis

K-line pattern:

In the last hour, the K-line was blocked and fell back at the 4300 round number, forming an upper shadow. After a breakout with increased volume at the 4275 resistance level in the previous hour, it failed to continue rising.

The daily chart shows a pattern of three consecutive bearish candles, which is a normal technical pullback following the long bullish candle (+260 points) on August 20, with key support at the previous low of 4220.

View OriginalConclusion: ETH continues to build a center, consolidating sideways, and can start at any time.

Price Trend Analysis

K-line pattern:

In the last hour, the K-line was blocked and fell back at the 4300 round number, forming an upper shadow. After a breakout with increased volume at the 4275 resistance level in the previous hour, it failed to continue rising.

The daily chart shows a pattern of three consecutive bearish candles, which is a normal technical pullback following the long bullish candle (+260 points) on August 20, with key support at the previous low of 4220.

- Reward

- 1

- Comment

- Repost

- Share

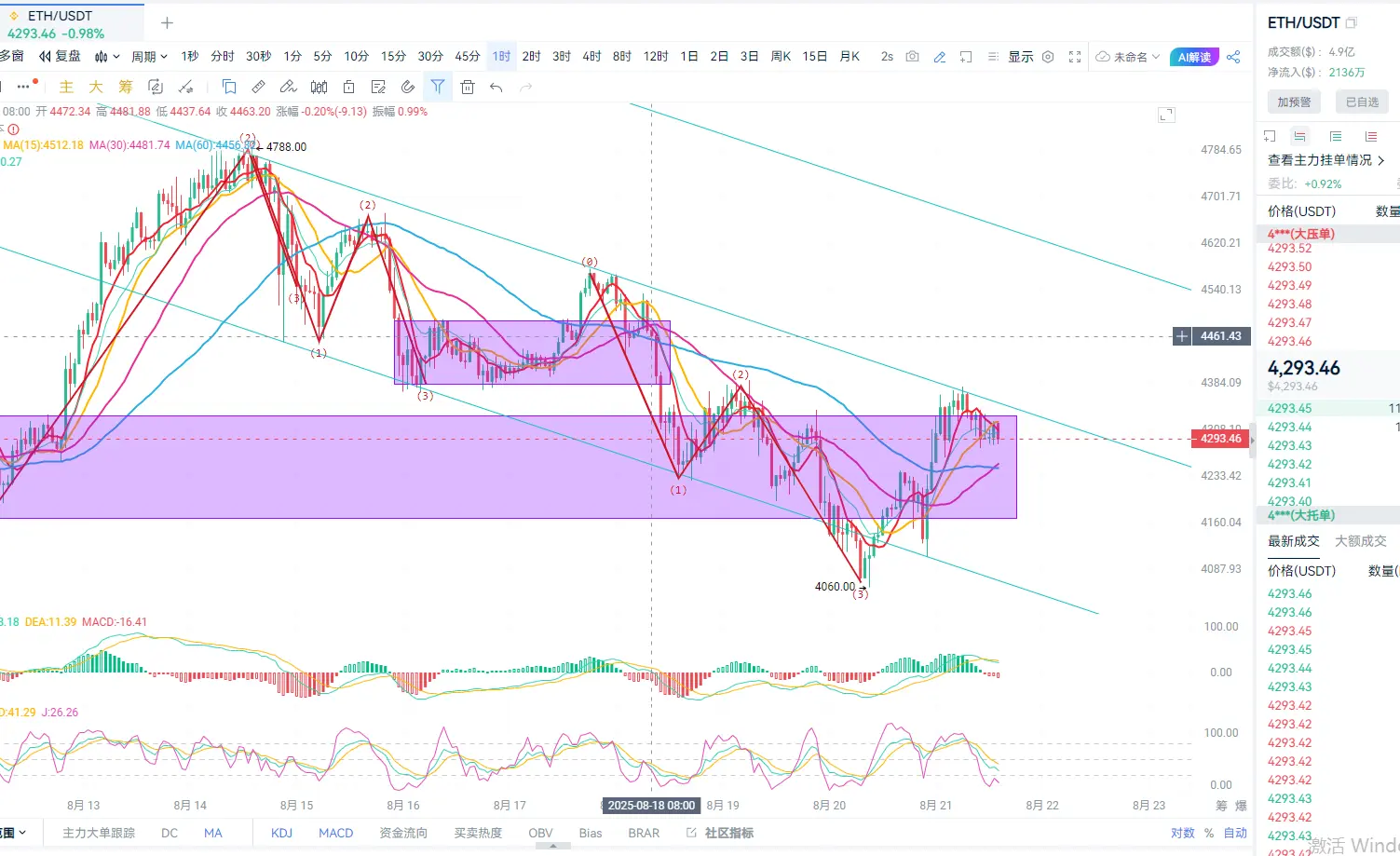

ETH Hourly Trend Analysis

K-line pattern:

Daily level: Recently, the price quickly rebounded from a low of 4056 to a high of 4375 and then retreated, forming a long upper shadow inverted hammer pattern, suggesting strong resistance above 4300. Hourly level: The current price is fluctuating narrowly around 4290, forming a short-term range of 4282-4320.

Technical Indicators:

MACD: 1-hour level DIF ( 23.18) crosses below DEA ( 27.87), histogram turns negative ( -9.38), daily MACD double lines are declining but still above the zero axis. RSI: 1-hour RSI ( 52.02) is flat in the neutral zone, daily

K-line pattern:

Daily level: Recently, the price quickly rebounded from a low of 4056 to a high of 4375 and then retreated, forming a long upper shadow inverted hammer pattern, suggesting strong resistance above 4300. Hourly level: The current price is fluctuating narrowly around 4290, forming a short-term range of 4282-4320.

Technical Indicators:

MACD: 1-hour level DIF ( 23.18) crosses below DEA ( 27.87), histogram turns negative ( -9.38), daily MACD double lines are declining but still above the zero axis. RSI: 1-hour RSI ( 52.02) is flat in the neutral zone, daily

ETH0.85%

- Reward

- 5

- 6

- Repost

- Share

Cho1919 :

:

Hello, ladies and gentlemen. It's nice to meet you. The upcoming US Federal Reserve's Powell will be making an appearance. Volatility is likely to be extremely high. I believe Bitcoin is currently on the verge of cardiac arrest. I encourage everyone to think carefully before investing. Fighting!!!!!View More

Is the ETH hourly cycle building a downward center?

Price Trend Analysis

K-line pattern:

1-hour level: Recently formed a double bottom structure (4060/4067), rebounding to 4188 after breaking through the neckline at 4130, but facing resistance at the 4200 round number.

Daily level: After the large bearish candlestick on August 19 (4355→4067), a long lower shadow appeared, indicating a rebound of bulls after the selling pressure has been released, but the closing price still remained below EMA7 (4278).

Technical Indicators:

MACD: The DIF on the 1-hour level has crossed above the DEA forming a g

Price Trend Analysis

K-line pattern:

1-hour level: Recently formed a double bottom structure (4060/4067), rebounding to 4188 after breaking through the neckline at 4130, but facing resistance at the 4200 round number.

Daily level: After the large bearish candlestick on August 19 (4355→4067), a long lower shadow appeared, indicating a rebound of bulls after the selling pressure has been released, but the closing price still remained below EMA7 (4278).

Technical Indicators:

MACD: The DIF on the 1-hour level has crossed above the DEA forming a g

ETH0.85%

- Reward

- 7

- 8

- Repost

- Share

BrotherSuWillHelpYou :

:

Buckle up and hold on tight, we're about to To da moon 🛫View More