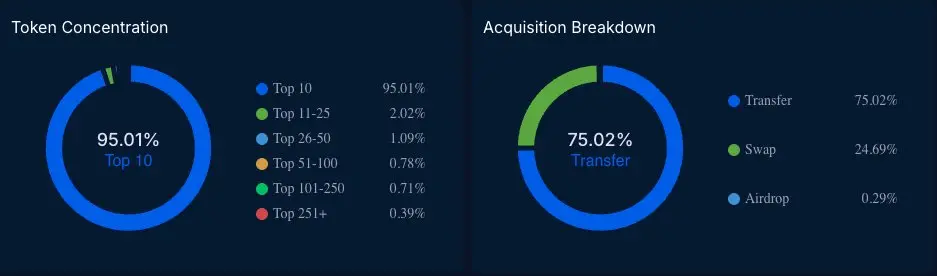

Creditlink's analysis perfectly complements ASTER's narrative.

The platform confirmed that while ASTER's distribution is currently centralized (typical for a startup), its core infrastructure is trustless and decentralized.

This is the blueprint for a serious project.

The platform confirmed that while ASTER's distribution is currently centralized (typical for a startup), its core infrastructure is trustless and decentralized.

This is the blueprint for a serious project.

ASTER7.18%