MavisEvan

Crypto enthusiast since 2015 • Fueling financial freedom through blockchain and DeFi ~ Join Me Now

MavisEvan

Breaking and important. This one matters more than it looks.

Pakistan is officially stepping into the stablecoin conversation. 🇵🇰 According to Reuters, Pakistan has agreed to explore cross-border payments using the USD1 stablecoin with SC Financial Technologies, a firm linked to World Liberty Financial.

I have been watching this shift closely, and this is not just another headline. This is about reducing friction in international payments, cutting settlement time, and lowering dependency on slow legacy rails. If stablecoins are already acting like digital dollars globally, then countries exp

Pakistan is officially stepping into the stablecoin conversation. 🇵🇰 According to Reuters, Pakistan has agreed to explore cross-border payments using the USD1 stablecoin with SC Financial Technologies, a firm linked to World Liberty Financial.

I have been watching this shift closely, and this is not just another headline. This is about reducing friction in international payments, cutting settlement time, and lowering dependency on slow legacy rails. If stablecoins are already acting like digital dollars globally, then countries exp

- Reward

- 1

- Comment

- Repost

- Share

Wall Street Just Went 24/7 With Stablecoins

This is the kind of news that quietly changes the system.

Interactive Brokers, managing more than $770 billion in client assets, is officially launching 24/7 funding using USDC, with plans to roll out Ripple and PayPal stablecoins as early as next week. A traditional brokerage giant is no longer waiting for banking hours. Money is going real time.

This is not crypto adapting to Wall Street.

This is Wall Street adapting to crypto.

Why USDC Is the First Move

By enabling round-the-clock funding with USDC, Interactive Brokers is solving one of the bigges

This is the kind of news that quietly changes the system.

Interactive Brokers, managing more than $770 billion in client assets, is officially launching 24/7 funding using USDC, with plans to roll out Ripple and PayPal stablecoins as early as next week. A traditional brokerage giant is no longer waiting for banking hours. Money is going real time.

This is not crypto adapting to Wall Street.

This is Wall Street adapting to crypto.

Why USDC Is the First Move

By enabling round-the-clock funding with USDC, Interactive Brokers is solving one of the bigges

USDC-0.02%

- Reward

- 4

- 1

- Repost

- Share

Lucky :

:

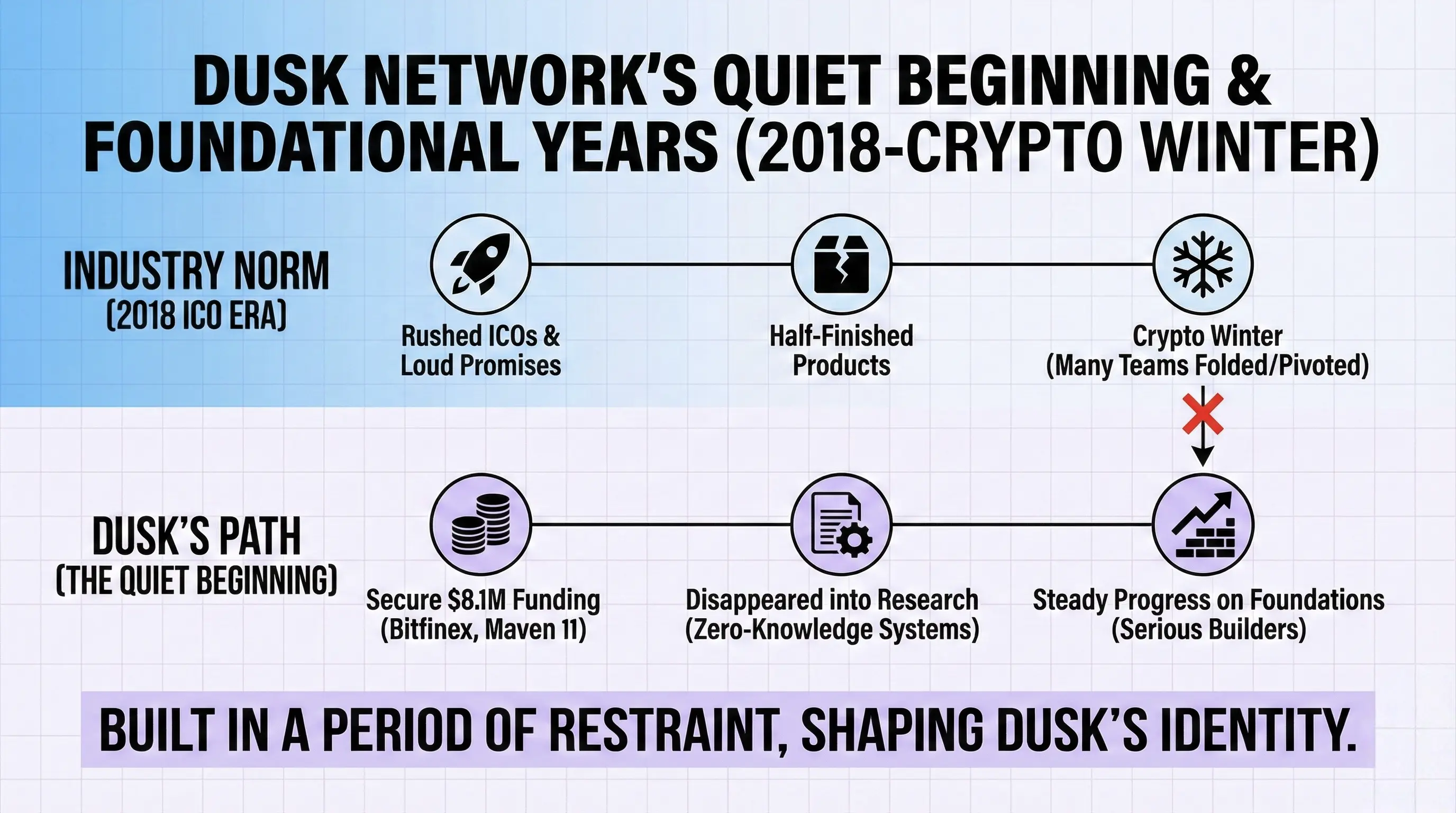

Hold on tight, we're about to take off 🛫The Quiet Beginning That Shaped Dusk

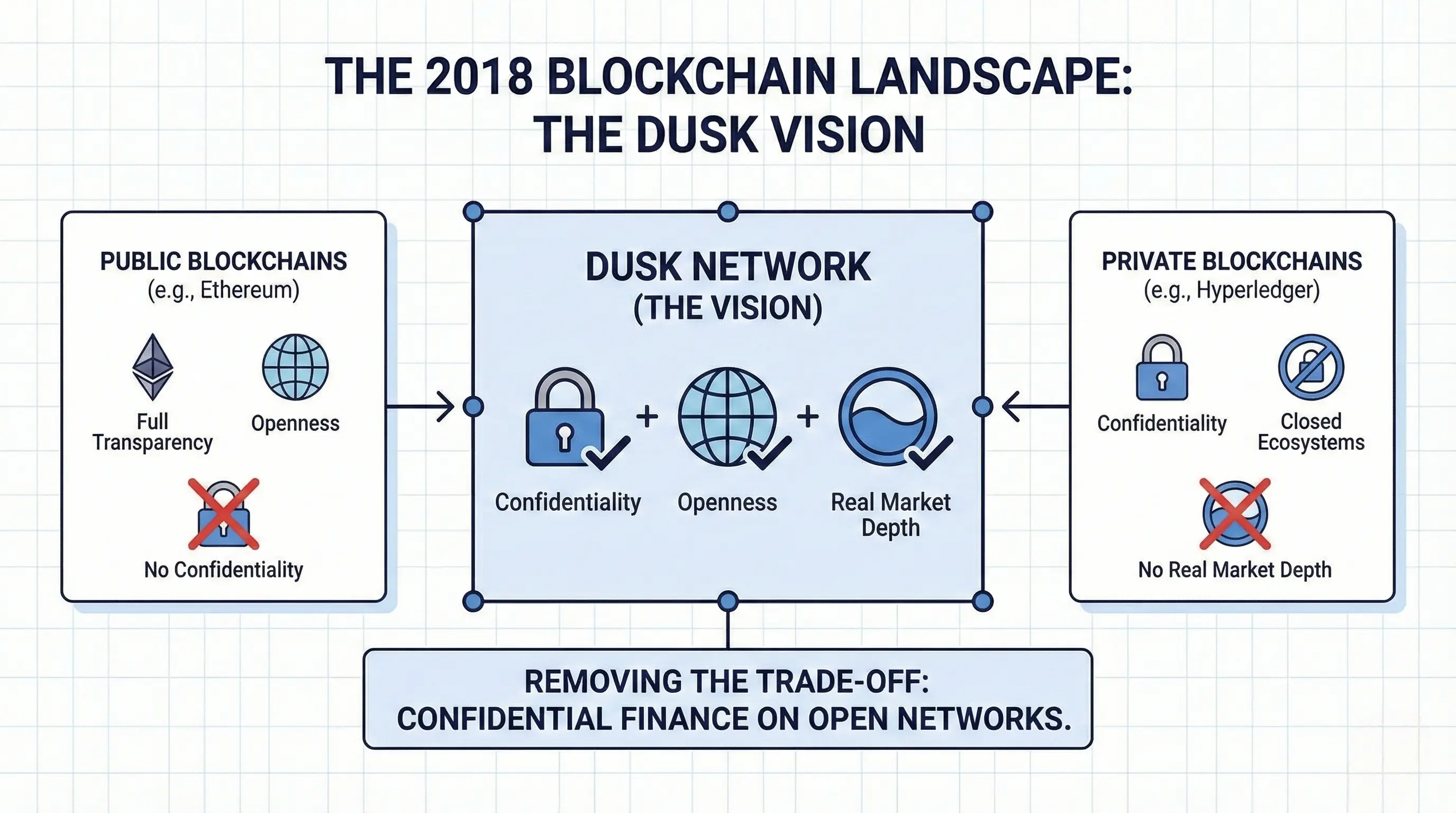

Back in 2018, when most crypto teams were racing to launch tokens and grab attention, a small group took a very different path. Emanuele Francioni, a robotics expert with a deep technical background, joined forces with Fulvio Venturelli, who came from the investment side, and business strategist Jelle Pol. They were not trying to build another general-purpose blockchain. They were trying to fix a problem everyone was ignoring.

Public blockchains like Ethereum were powerful, but they were built on full transparency. That works for simple transfers, but it br

Back in 2018, when most crypto teams were racing to launch tokens and grab attention, a small group took a very different path. Emanuele Francioni, a robotics expert with a deep technical background, joined forces with Fulvio Venturelli, who came from the investment side, and business strategist Jelle Pol. They were not trying to build another general-purpose blockchain. They were trying to fix a problem everyone was ignoring.

Public blockchains like Ethereum were powerful, but they were built on full transparency. That works for simple transfers, but it br

DUSK5.49%

- Reward

- like

- Comment

- Repost

- Share

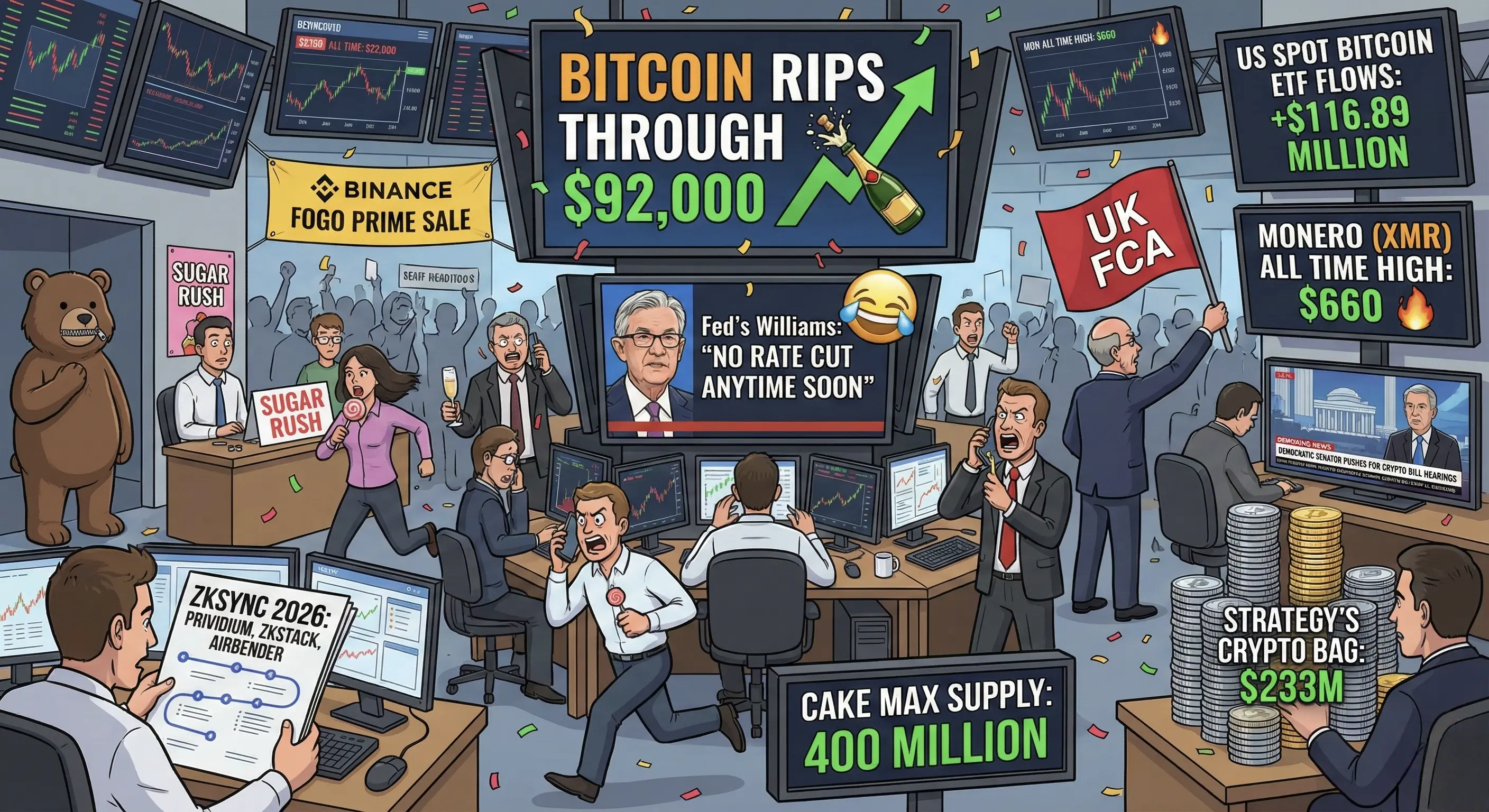

Today feels like the market woke up and chose violence and champagne at the same time 😂🍾 everything is moving, everyone is shouting, and if you blink you miss a breakout.

I’m watching Bitcoin rip through $92,000 like it was made of paper and suddenly all the bears on my timeline have mysteriously gone silent 🤐📈 at the same time Fed’s Williams jumps in saying there is no reason for a rate cut anytime soon, which is hilarious because the market clearly did not get that memo and just keeps running like a kid who stole sugar from the kitchen 🍭🏃♂️

Then you’ve got the UK FCA waving a big red

I’m watching Bitcoin rip through $92,000 like it was made of paper and suddenly all the bears on my timeline have mysteriously gone silent 🤐📈 at the same time Fed’s Williams jumps in saying there is no reason for a rate cut anytime soon, which is hilarious because the market clearly did not get that memo and just keeps running like a kid who stole sugar from the kitchen 🍭🏃♂️

Then you’ve got the UK FCA waving a big red

- Reward

- like

- Comment

- Repost

- Share

I’m telling everyone to grab popcorn because in one hour the CPI number is about to walk onto the stage like the final boss of the week 🤡📊 expected around 2.7% YoY but nobody in this market ever behaves properly so let’s be honest, chaos is loading…

If this thing comes in hotter than 2.7%, say hello to “higher for longer” again, rate cuts start running away like they owe money, dollar flexes its muscles 💪 and risk assets get that awkward red candle haircut 👎 crypto traders start tweeting conspiracy theories, Nasdaq starts sweating, and everyone suddenly remembers what inflation actually me

If this thing comes in hotter than 2.7%, say hello to “higher for longer” again, rate cuts start running away like they owe money, dollar flexes its muscles 💪 and risk assets get that awkward red candle haircut 👎 crypto traders start tweeting conspiracy theories, Nasdaq starts sweating, and everyone suddenly remembers what inflation actually me

- Reward

- like

- Comment

- Repost

- Share

IEEPA Tariff Collapse Could Ignite a $100B Cash Shock Across US Equities

If the court rules on the 14th that IEEPA tariffs are invalid, this is not just a policy headline. It is a direct cash-flow reversal event. Billions that were treated as lost margin suddenly return to balance sheets, and markets reprice that reality fast.

Apple (AAPL) – Margin Recovery Nobody Is Pricing In

For months Apple has been absorbing a silent tax. Citi estimated that keeping 25 percent tariffs would cut FY2026 gross margin by 130 basis points and reduce EPS by $0.66, nearly an 8 percent hit.

If the ruling wipes ou

If the court rules on the 14th that IEEPA tariffs are invalid, this is not just a policy headline. It is a direct cash-flow reversal event. Billions that were treated as lost margin suddenly return to balance sheets, and markets reprice that reality fast.

Apple (AAPL) – Margin Recovery Nobody Is Pricing In

For months Apple has been absorbing a silent tax. Citi estimated that keeping 25 percent tariffs would cut FY2026 gross margin by 130 basis points and reduce EPS by $0.66, nearly an 8 percent hit.

If the ruling wipes ou

- Reward

- 1

- Comment

- Repost

- Share

$1INCH reversed strongly from 0.1758, reclaiming mid-range structure and stabilizing near 0.188–0.189 resistance. Momentum remains bullish as long as it holds above 0.183.

Entry Zone: 0.1870–0.1885

TP1: 0.1915

TP2: 0.1940

TP3: 0.1970

Stop-Loss: 0.1839

If the chart breaks above 0.1911 again, expect a clean continuation.

#JoinGrowthPointsDrawToWiniPhone17 #LINKETFToLaunch #DecemberRateCutForecast

$1INCH

Entry Zone: 0.1870–0.1885

TP1: 0.1915

TP2: 0.1940

TP3: 0.1970

Stop-Loss: 0.1839

If the chart breaks above 0.1911 again, expect a clean continuation.

#JoinGrowthPointsDrawToWiniPhone17 #LINKETFToLaunch #DecemberRateCutForecast

$1INCH

1INCH1.53%

- Reward

- 1

- Comment

- Repost

- Share

$QNT recovered nicely from 92.20 and is forming higher lows on the climb back toward the upper range. Buyers look in control, and a push toward 100+ becomes likely if momentum stays steady.

Entry Zone: 97.60–98.30

TP1: 99.40

TP2: 101.30

TP3: 103.20

Stop-Loss: 96.20

A break through 102.6 would re-open the road toward 105 and above.

#JoinGrowthPointsDrawToWiniPhone17 #LINKETFToLaunch #DecemberRateCutForecast

$QNT

Entry Zone: 97.60–98.30

TP1: 99.40

TP2: 101.30

TP3: 103.20

Stop-Loss: 96.20

A break through 102.6 would re-open the road toward 105 and above.

#JoinGrowthPointsDrawToWiniPhone17 #LINKETFToLaunch #DecemberRateCutForecast

$QNT

QNT2.79%

- Reward

- 1

- Comment

- Repost

- Share

$CROSS broke out cleanly after defending 0.09876. Momentum is strong and bulls have control as long as the breakout level holds.

Entry Zone: 0.1068–0.1078

TP1: 0.1095

TP2: 0.1112

TP3: 0.1130

Stop-Loss: 0.1048

#JoinGrowthPointsDrawToWiniPhone17 #DecemberRateCutForecast #GIGGLEAndPIPPINSurge

$CROSS

Entry Zone: 0.1068–0.1078

TP1: 0.1095

TP2: 0.1112

TP3: 0.1130

Stop-Loss: 0.1048

#JoinGrowthPointsDrawToWiniPhone17 #DecemberRateCutForecast #GIGGLEAndPIPPINSurge

$CROSS

CROSS-2.38%

- Reward

- 1

- Comment

- Repost

- Share

$ZEC just triggered a short liquidation of $14.605K at $471.54, showing that sellers were squeezed as buyers pushed the price up with strong momentum. This kind of move often signals that bulls are gaining control and may try to extend the climb. If ZEC holds above 470.80, the chart can push toward 475.20 and possibly 479.50. A good entry sits near 468–470.80 if the price pulls back and shows support. If ZEC falls under 465.50, the squeeze loses strength and the bullish setup weakens. For now buyers have the advantage, and ZEC can continue upward if volume stays active and the support zone re

ZEC-0.58%

- Reward

- 1

- Comment

- Repost

- Share

$PENGU fired a strong short liquidation of $53.555K at $0.0114, showing that sellers were caught and buyers stepped in with heavy pressure. This kind of squeeze often builds momentum for another move up if support holds. If PENGU stays above 0.0113, the chart can push toward 0.0118 and 0.0122. A good entry sits around 0.0111–0.0113 if the price pulls back and shows strength. If it drops under 0.0109, the bullish setup weakens and the squeeze begins to fade. For now buyers are in control, and PENGU can attempt another upward run if volume remains active and the support zone holds steady.

#Join

#Join

- Reward

- 1

- Comment

- Repost

- Share

$TURBO printed another short liquidation of $5.0239K at $0.00241, showing that sellers were squeezed again as buyers pushed the market higher. This type of move often builds strong upside momentum, especially when liquidations cluster. If TURBO holds above 0.00239, the chart can set up for another climb toward 0.00245 and 0.00250. A good entry sits around 0.00236–0.00239 if the price pulls back and shows support. If it slips under 0.00233, the squeeze weakens and the bullish setup loses strength. For now buyers still have the advantage, and TURBO can push again as long as volume stays active

TURBO0.9%

- Reward

- 1

- Comment

- Repost

- Share

$MON faced a long liquidation of $14.24K at $0.0356, showing strong selling pressure as over-leveraged buyers were shaken out. This move signals short-term weakness, but it can turn into a quick recovery if support holds. If MON stays above 0.0352, the price can attempt a bounce toward 0.0364 and 0.0371. A safer entry sits around 0.0348–0.0352 only if the chart shows signs of holding that level. If MON breaks below 0.0345, the downside can extend and the market becomes risky. For now the key is watching how MON reacts around the liquidation zone, because a solid green candle there can trigger

MON2.38%

- Reward

- 1

- Comment

- Repost

- Share

🔥🇺🇸 Trump just turned the spotlight on the king of AI and the message shook the entire tech world.

Donald Trump shared new quotes from Nvidia’s founder, Jensen Huang, celebrating the launch of Blackwell production, and the tone was unmistakable:

AI was invented in America. Built in America. And now it’s being delivered to the world at full speed. ⚡🌍

Huang revealed that in less than a year, Nvidia has gone from concept to manufacturing its most advanced chips ever — a pace that feels almost unreal. This isn’t just an engineering milestone. It’s a declaration of dominance in the global AI r

Donald Trump shared new quotes from Nvidia’s founder, Jensen Huang, celebrating the launch of Blackwell production, and the tone was unmistakable:

AI was invented in America. Built in America. And now it’s being delivered to the world at full speed. ⚡🌍

Huang revealed that in less than a year, Nvidia has gone from concept to manufacturing its most advanced chips ever — a pace that feels almost unreal. This isn’t just an engineering milestone. It’s a declaration of dominance in the global AI r

- Reward

- 2

- Comment

- Repost

- Share

🔥🌍 A major shift may be unfolding behind closed doors.

According to the Financial Times, U.S. and Russian officials are now drafting a new peace plan for Ukraine, and the gravity of that sentence alone is enough to stop global markets in their tracks. This isn’t rumor or speculation. It’s the first real signal that the world’s two biggest geopolitical forces are testing a path out of a war that has reshaped energy, security, and the global order. ⚡🕊️

If Washington and Moscow are talking, even quietly, it means the chessboard is moving.

For nearly three years, the conflict has driven up defe

According to the Financial Times, U.S. and Russian officials are now drafting a new peace plan for Ukraine, and the gravity of that sentence alone is enough to stop global markets in their tracks. This isn’t rumor or speculation. It’s the first real signal that the world’s two biggest geopolitical forces are testing a path out of a war that has reshaped energy, security, and the global order. ⚡🕊️

If Washington and Moscow are talking, even quietly, it means the chessboard is moving.

For nearly three years, the conflict has driven up defe

- Reward

- 2

- Comment

- Repost

- Share

🔥🇺🇸 The deal-making machine in Washington just roared to life.

President Trump announced that $270 billion worth of agreements are being signed today, involving dozens of major companies across multiple sectors. This isn’t a headline. It’s a shockwave ripping through markets, boardrooms, and global competitors. 💥📈

A quarter-trillion dollars in deals in a single push sends one clear message:

America is throwing its weight back onto the world stage.

Energy. Defense. Tech. Infrastructure. Manufacturing.

Every corner of the economy feels the pull when this much capital starts moving. 🌎⚡

Comp

President Trump announced that $270 billion worth of agreements are being signed today, involving dozens of major companies across multiple sectors. This isn’t a headline. It’s a shockwave ripping through markets, boardrooms, and global competitors. 💥📈

A quarter-trillion dollars in deals in a single push sends one clear message:

America is throwing its weight back onto the world stage.

Energy. Defense. Tech. Infrastructure. Manufacturing.

Every corner of the economy feels the pull when this much capital starts moving. 🌎⚡

Comp

- Reward

- 2

- Comment

- Repost

- Share

🔥⚡ A political storm just broke in Nvidia’s favor and the tech world is buzzing.

The White House is pushing Congress to block a measure that would restrict Nvidia from selling AI chips to China, a rule that would’ve hit not just Nvidia but AMD and other chip giants too. Instead of tightening the reins, the administration is signaling it wants to keep the AI supply chain moving. 🇺🇸💥

And make no mistake this is a massive win for Nvidia.

A company already sitting at the top of the world now gets a green light to continue serving one of the largest tech markets on the planet. 🌍🚀 Investors

The White House is pushing Congress to block a measure that would restrict Nvidia from selling AI chips to China, a rule that would’ve hit not just Nvidia but AMD and other chip giants too. Instead of tightening the reins, the administration is signaling it wants to keep the AI supply chain moving. 🇺🇸💥

And make no mistake this is a massive win for Nvidia.

A company already sitting at the top of the world now gets a green light to continue serving one of the largest tech markets on the planet. 🌍🚀 Investors

AMP0.82%

- Reward

- 2

- Comment

- Repost

- Share

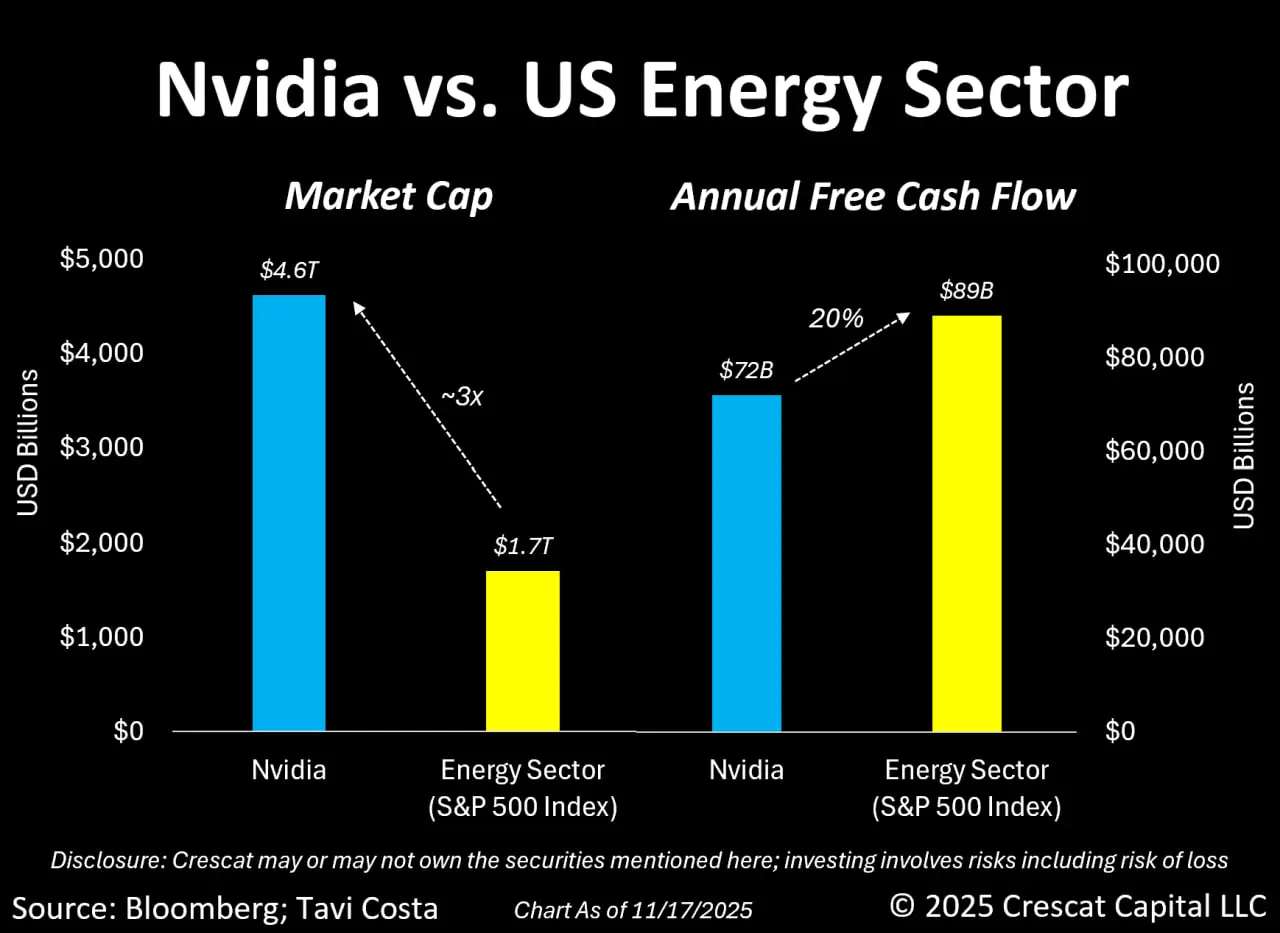

🔥⚡ The market just revealed one of the wildest contrasts in modern finance.

Nvidia has climbed so high, so fast, its valuation now stands at 4.6 trillion dollars… almost three times larger than the entire U.S. energy sector, which sits near 1.7 trillion. 🤯📈

But here’s the twist that hits like a shockwave:

The energy sector actually produces more free cash flow than Nvidia.

Real numbers. Real output. Real infrastructure.

Energy companies generated about $898 billion, while Nvidia came in at $728 billion. ⚡💰

On paper, tech is soaring far above everything else.

Under the surface, the old foun

Nvidia has climbed so high, so fast, its valuation now stands at 4.6 trillion dollars… almost three times larger than the entire U.S. energy sector, which sits near 1.7 trillion. 🤯📈

But here’s the twist that hits like a shockwave:

The energy sector actually produces more free cash flow than Nvidia.

Real numbers. Real output. Real infrastructure.

Energy companies generated about $898 billion, while Nvidia came in at $728 billion. ⚡💰

On paper, tech is soaring far above everything else.

Under the surface, the old foun

- Reward

- 1

- Comment

- Repost

- Share

$XRP is trying to recover after a heavy drop. Buyers stepped in at $2.028, but the trend is still fragile. Watch $2.10 closely. A break above gives strength, a fall below brings pressure. Stay sharp.

#BitcoinPriceWatch #TopGainersInADownMarket #BuyTheDipOrWaitNow?

$XRP

#BitcoinPriceWatch #TopGainersInADownMarket #BuyTheDipOrWaitNow?

$XRP

XRP2.3%

- Reward

- 1

- Comment

- Repost

- Share

🔥 $BNB is trying to climb back after touching $872. Buyers need to hold the $900 zone for the next push. Watch $895 as support. Strong move coming soon.

#TopGainersInADownMarket #AMP #BuyTheDipOrWaitNow?

$BNB

#TopGainersInADownMarket #AMP #BuyTheDipOrWaitNow?

$BNB

BNB1.47%

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More44.94K Popularity

27.81K Popularity

13.31K Popularity

61.49K Popularity

344.99K Popularity

Pin

Strike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889