#BTC Thoughts and Plan Ahead

I still don't think that the cycle top is in, and even if that is the case it would be too dumb to call it here.

Why?

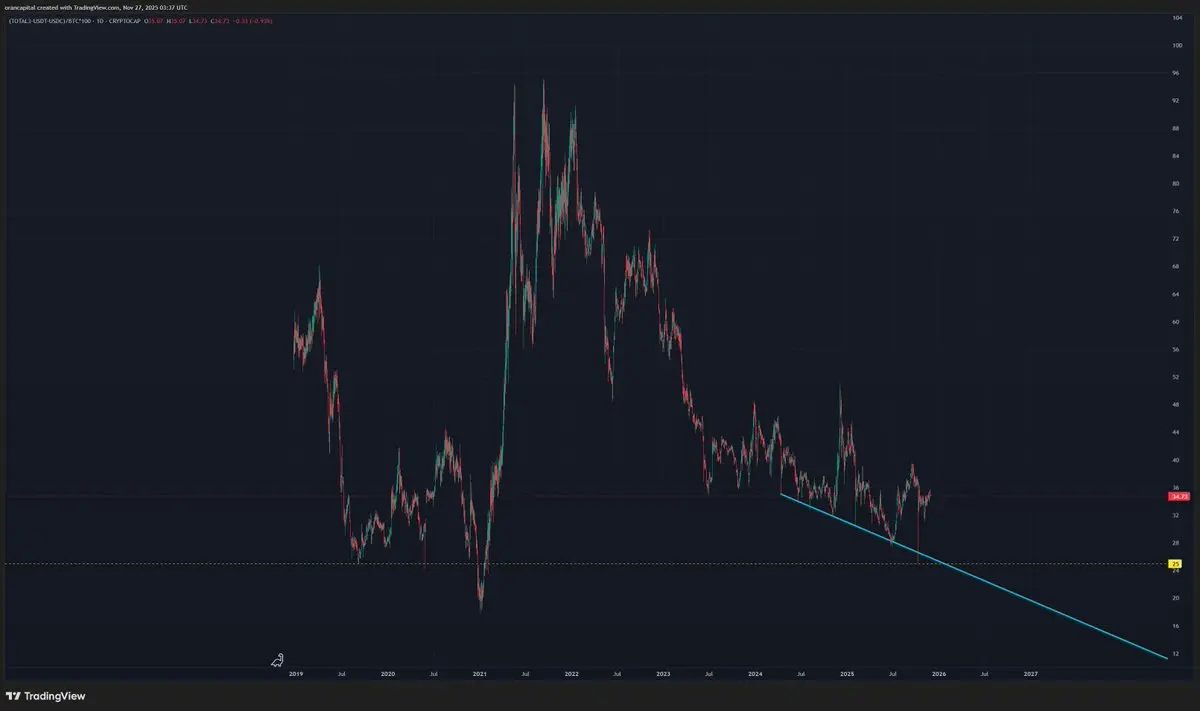

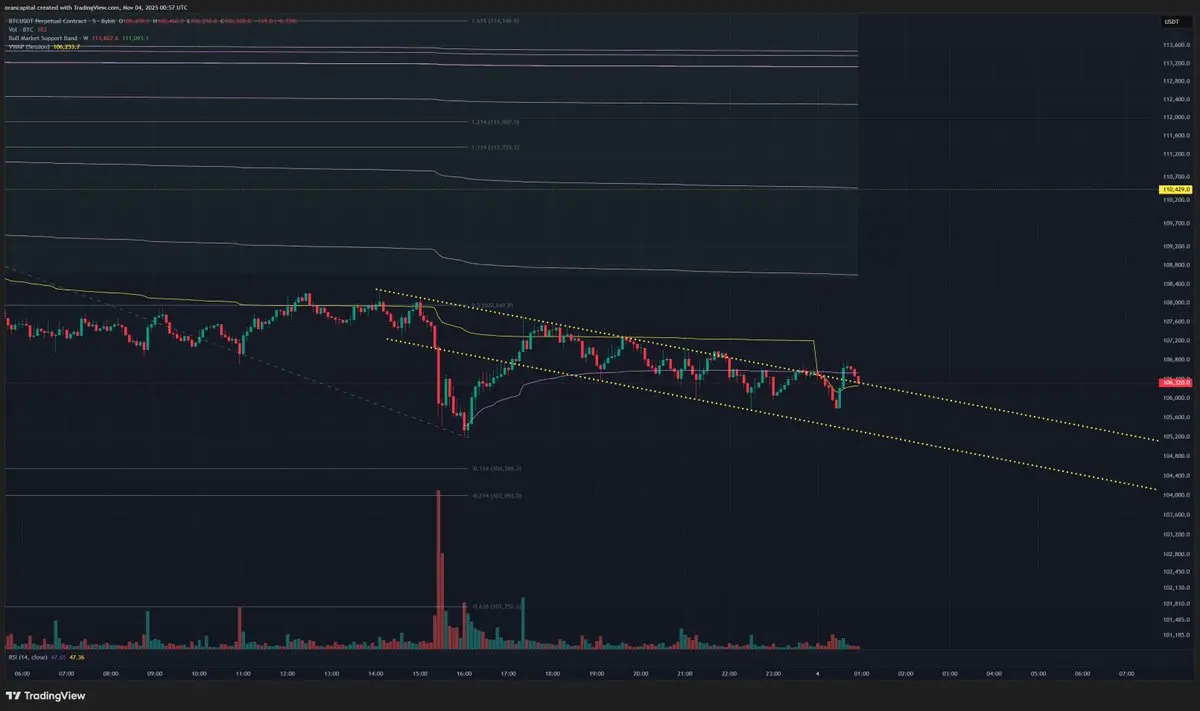

1️⃣ Making the bold call that the top was in at 125k and taking profits would make sense. However, the worst case here is a death cross rally to the 200-day SMA at 110k.

2️⃣ Even though Bitcoin is looking extremely weak here, we have not even confirmed it with 2 weekly closes below the 50 week SMA.

3️⃣ This cycle has been completely different. Bitcoin had a new ATH before the halving. And so far Bitcoin has brought 0% YTD profit in the post-halvi

I still don't think that the cycle top is in, and even if that is the case it would be too dumb to call it here.

Why?

1️⃣ Making the bold call that the top was in at 125k and taking profits would make sense. However, the worst case here is a death cross rally to the 200-day SMA at 110k.

2️⃣ Even though Bitcoin is looking extremely weak here, we have not even confirmed it with 2 weekly closes below the 50 week SMA.

3️⃣ This cycle has been completely different. Bitcoin had a new ATH before the halving. And so far Bitcoin has brought 0% YTD profit in the post-halvi

BTC2.57%